-

Inside Demand Media's "Content Factory"

Here's a question: without checking, who do you think is the largest supplier of videos to YouTube, by a factor of almost 10? If you said Demand Media, which has over 150K individual videos on YouTube that have generated a total of 442 million views to date, you'd be right. Most of the videos are supplied by Demand Media's knowledge-based Expert Village site, and are produced by Demand Studios, the company's content production arm. (For the record, CBS is a distant second supplier to YouTube with almost 16K videos and approximately 327 million total views.)

I learned this and a lot more in a recent and incredibly interesting discussion I had with Steven Kydd, EVP of Demand Studios. In case you've never heard of Demand Media, it's the latest act of former Intermix CEO and

MySpace chairman Richard Rosenblatt (who conceived it as a "thinking person's MySpace" as Steven put it). Since its inception in 2006, the company has raised $355 million, made a string of acquisitions and dramatically built up traffic at its portfolio of web sites.

MySpace chairman Richard Rosenblatt (who conceived it as a "thinking person's MySpace" as Steven put it). Since its inception in 2006, the company has raised $355 million, made a string of acquisitions and dramatically built up traffic at its portfolio of web sites. Most interesting for me though, is how Demand Studios has become a veritable "content factory" (my term), churning out 150K individual videos and 350K articles in 2 1/2 years. How it's done that, and better still, how it is monetizing this mountain of content, is the best example I've seen yet of how to effectively build scale at the intersection of social media, search and broadband video.

At the core of Demand Studios is a network of 10,000 freelance content creators that have passed through a rigorous screening process. Specific content is green-lighted through Demand's analysis of internal data. The potential value of a given piece of content is measured by internal algorithms estimating audience interest, advertiser interest and ability to generate traffic.

Once Demand has decided to produce a piece of content its editors tap into specific producers based on a match of their expertise. The producer follows Demand's guidelines, such as shooting exclusively in HD. But in general, the producer has a relatively free creative hand. If for example, the video involves children's nutrition, the producer can call upon a local health expert to appear (which as Steven notes, experts are often happy to do because the videos help raise their own profiles). Once the video is complete, it is edited for quality and has SEO-optimized metadata created and added.

This process is now refined to the point that 1,000 pieces of content are being created per day (30% video, 70% text), with plans to scale even further. Steven said Demand has paid out over $12M to its producers to date. Each producer's content is tracked over time to see how well it performs and is also peer-rated, allowing the cream of the producer network to rise to the top.

Once complete the content is posted on Demand's sites (e.g. Expert Village, eHow, LiveStrong.com, GolfLink, Trails.com, etc.) and in the case of video, on YouTube as well. As Steven notes, since YouTube has now surpassed Yahoo to be the 2nd largest search site, Demand's knowledge-based videos are a perfect fit for how many people increasingly use YouTube.

The two companies have developed a mutually beneficial relationship. YouTube now drives the majority of Demand's video traffic, and Steven says it is being monetized well through AdSense, overlays and companion ads. Conversely, with Demand now generating 2 million YouTube views per day, it has become an important supplier of quality video to YouTube, helping it bolster its value beyond its UGC roots and build its revenues. As well, YouTube has become a testing ground for new Demand sites, such as a Spanish language version of Expert Village.

Syndication beyond YouTube is a key part of Demand's ongoing success. Through its acquisition of Pluck, a white-label social media platform used by many media brands like USAToday.com, NPR, McGraw-Hill and others, Demand now has an opportunity to also syndicate its content to these publishers, who are increasingly resource-constrained and in need of high-quality third-party suppliers. In short, while Demand's "content factory" has already become a major supplier to YouTube, the world's largest video portal, it is now poised to do the same for lots of other sites as well, further growing its traffic.

There's no question that Demand's strict focus on knowledge-based, Long Tail videos has enabled it to create a unique formula that works well at the intersection of social media, search and broadband video. It's doubtful that all of this could be fully replicated in more creative genres like entertainment. Yet there are elements of Demand's content factory, such as leveraging YouTube's audience base, consistently creating high-quality metadata for SEO and applying rigorous criteria to what content gets produced, that are applicable to all video providers. Given Demand's ambitious plans, I suspect their factory will continue to evolve, providing still further lessons for how to create and monetize content in the broadband era.

What do you think? Post a comment now.

(Note: Steven Kydd will be on a panel I'm moderating at the NABShow on Wed, April 22nd, "How Syndication is Powering the Broadband Video Era." VideoNuze readers can register for complimentary access by using code X104)

Categories: Indie Video

Topics: Demand Media, eHow, GolfLink, LiveStrong.com, MySpace, Trails.com, YouTube

-

March 17th NYC Broadband Video Leadership Evening Coming Soon

We're less than 2 weeks away from VideoNuze's Broadband Video Leadership Evening, on Tuesday, March 17th in New York City. There are over 170 people registered and the event will be an outstanding opportunity to meet industry colleagues and hear from top-tier digital media executives on the front lines of the video revolution.

Lots of great media and technology companies will have people in attendance, including: A&E Television Networks, Atlas Media, Avail Media, Carat, Cisco, Comcast, Conde Nast, Fox, FreeWheel, HBO, Metacafe, NBCU, Ooyala, Panache, Rainbow Networks, Readers Digest, Showtime, Swarmcast, WorldNow, Yahoo and many others. We also have a strong contingent of media coming to cover the event.

We'll start with a "VideoSchmooze" cocktail/networking reception from 6pm - 7:30pm, followed by a panel discussion I'll moderate from 7:30pm - 9pm titled, "Broadband Video '09: Building the Road to Profitability." The panel includes:

- Albert Cheng, EVP, Digital Media, Disney/ABC Television Group

- Greg Clayman, EVP, Digital Distribution & Business Development, MTV Networks

- John Edwards, President and CEO, Move Networks

- Karin Gilford, SVP, Fancast and Online Entertainment, Comcast Interactive Media

- Daina Middleton, SVP, Moxie Interactive, Publicis Groupe

Click here to learn more and register now!

The event will be held at the magnificent Hudson Theater on West 44th Street just off Times Square. NATPE,

VideoNuze's partner since launch, is on board for the event. And I'm extremely grateful to lead sponsor Move Networks and supporting sponsors AnySource Media, ExtendMedia, Horn Group, mPoint and PermissionTV who are making the evening possible.

VideoNuze's partner since launch, is on board for the event. And I'm extremely grateful to lead sponsor Move Networks and supporting sponsors AnySource Media, ExtendMedia, Horn Group, mPoint and PermissionTV who are making the evening possible. I've set up a Facebook group so you can start meeting other attendees and also keep up to date on all the recent broadband news we'll discuss on the panel. I also created a short video with key highlights of the evening (thanks to PermissionTV for production assistance).

Categories: Events

Topics: Broadband Video Leadership Evening

-

Hearst-Argyle Stations Launch "u local" to Include User-Generated Content

Hearst-Argyle Television will use KickApps' social media/video platform to power its stations' new "u local" initiative according to an announcement this morning.

Hearst-Argyle's goal is to allow local residents to discuss news topics important to their community and to upload their own photos and videos. The first u local area was launched in Dec '08 by WMUR in

Manchester, New Hampshire and according to Hearst-Argyle generated tens of thousands of submissions in the first week alone. The other stations in Hearst-Argyle's portfolio will roll out u local in the coming months. For KickApps, the deal follows one with WorldNow, announced last year to drive social media into WorldNow-powered sites.

Manchester, New Hampshire and according to Hearst-Argyle generated tens of thousands of submissions in the first week alone. The other stations in Hearst-Argyle's portfolio will roll out u local in the coming months. For KickApps, the deal follows one with WorldNow, announced last year to drive social media into WorldNow-powered sites. The question begs: can a local TV station become a social media hub for its local residents? In the Facebook-MySpace-Twitter-YouTube age, we seem to be on the cusp of social media saturation. Yet despite all these engagement opportunities, focused local social media initiatives could well find a place. People are extremely passionate about their local communities and the social bonds are very tight. Sharing common experiences, concerns and passions online with local neighbors seems like an updated version of what's been happening over backyard fences since the beginning of time.

The key is execution, not just in the user experience, but in the positioning of what the local broadcaster's brand will stand for. Striving to be a social media hub is a new positioning, and to incent viewer behavior, Hearst-Argyle will need to embrace the capability, heavily promote it and then manage it so it's a safe, well-lit area of its sites.

It's no surprise that local broadcasters have been slammed by the economic downturn. They were already hit hard by free classified services like Craigslist, fragmenting audience behavior, the shift of network programs to online and more recently the decline of the auto industry which is a key advertiser category. Now there are numerous entrants trying to grab their traditional local video advertisers. Not a day goes by without multiple stations announcing cutbacks. In short, local broadcasters need a total reinvention of their business models if they're to survive. u local is not the complete answer, but it is certainly a move in the right direction.

What do you think? Post a comment now.

Categories: Broadcasters, Video Sharing

Topics: Hearst-Argyle, KickApps, WorldNow

-

Clearleap Bridges Broadband Video and Ads to TVs

Summary:

What: Clearleap has introduced a new technology platform for distributing broadband video content directly to TVs and an accompanying ad management system.

For whom: Incumbent service providers (cable/telco) and new over-the-top entrants (device makers, aggregators, etc.), content providers and advertisers

Benefits: For service providers, a flexible, cost-effective system for offering broadband content to their subscribers with minimal technology integration; for content providers a scalable system for distributing content across multiple providers and platforms; for advertisers a new method of targeting on-demand audiences.

More innovation is coming to the ongoing quest to bring broadband content to TVs as Clearleap, an Atlanta-based startup, pulled back the curtain yesterday on its ambitious technology platform. Last fall, CEO/founder Braxton Jarratt gave me a glimpse into what the company was working on and yesterday he explained it more fully.

Clearleap aims to do multiple things with its "clear|flow" and "clear|profit" products. For incumbent video service providers (cable and telco operators) and new "over-the-top" entrants (device makers, aggregators,

etc.), Clearleap enables delivery of broadband and other video to the TV including integrating with existing Video-on-Demand infrastructure when present; for content providers, it improves the process of distributing of content across multiple providers and platforms; and for both service providers and content providers it offers an ad management solution that allows flexible ad insertion and business rules for ads running with Clearleap-delivered video.

etc.), Clearleap enables delivery of broadband and other video to the TV including integrating with existing Video-on-Demand infrastructure when present; for content providers, it improves the process of distributing of content across multiple providers and platforms; and for both service providers and content providers it offers an ad management solution that allows flexible ad insertion and business rules for ads running with Clearleap-delivered video. That's a mouthful, so to break it down a bit, here's my interpretation. First the delivery side. Obviously there's been a lot of discussion, particularly just since CES in January, of new entrants delivering broadband content to TVs, thereby presenting potential alternatives for consumers to "cut the cord" on existing cable and telco providers. One way for incumbent to combat this is for them to offer the best of the web (like TiVo has been doing with TiVoCast for a while now) in one seamless package delivered through the existing set-top box.

To date incumbents haven't pursued this strategy much though. Braxton attributes this intransigence to lack of adequate technology, than to lack of interest. Braxton says Clearleap has a couple of small deployments active and other announcements pending. The key to success is allowing the incumbents to control the process of what content they acquire and to present it in context with other VOD offerings. clear|flow ingests video from content partners into Clearleap's data centers, transcodes it and properly formats it for target devices, adds metadata and business rules and then enables service providers to subscribe to whatever content they want. The video is either served from Clearleap's data centers or pushed to an incumbent's own hosting facility.

On the other side of the coin, another goal of clear|flow is to become the glue that allows content providers who want to distribute across all these emerging platforms to do so with minimal work. Just upload your content, specify business rules and the service providers take it from there. Of course, there's a "chicken and egg" challenge here that content providers will only take an interest when there's sufficient distribution. Braxton recognizes this issue as well and said they've been encouraged by the willingness of certain "friendlies" to get involved, which he hopes will provide validation for others to come on board soon.

Last, but not least, clear|profit allows ad avails to be created and properly divided between the content providers and service providers according to specified rules. Ad management and insertion has of course been the Achilles heel for existing VOD systems, rendering today's VOD a largely revenue-free pursuit for most service providers. Cost-effectively solving the ad insertion process for VOD alone would be a major win.

Clearleap has an ambitious vision and ordinarily I'd say it feels like a lot for any startup to bite off. But Clearleap has a veteran executive team from N2 Broadband, which was a successful VOD software provider prior to its acquisition by Tandberg Television. The Clearleap team knows its way around cable data centers, has strong industry relationships and is benefitting from pressure incumbents feel to broaden their offerings - all no doubt key factors in helping the company raise money.

Still, there's going to be plenty of competition. Others circling this space in one way or another include ActiveVideo Networks, AnySource Media, GridNetworks, Sezmi, TiVo and lots of others who all have their own approaches and systems for connecting content providers with incumbent and new service providers to bring broadband video to TVs. It's going to be an interesting space to watch as there is no shortage of energy aimed at merging broadband with the TV and vice versa.

What do you think? Post a comment now.

Categories: Cable TV Operators, Startups, Telcos

Topics: ActiveVideo Networks, AnySource Media, Clearleap, GridNetworks, SezMi, TiVo

-

Netflix Confirms "South Park" is Coming to Watch Instantly

Netflix confirmed for me that the first 9 seasons of "South Park" are indeed coming to its "Watch Instantly" streaming service. This was mentioned by South Park's Matt Stone in a longer NY Times story yesterday about the program's digital activities. However, since there was no formal announcement yesterday and I couldn't add South Park episodes to my Netflix Watch Instantly I followed up to verify.

A Netflix spokesman told me that a deal has indeed been signed, and that the formal announcement will

follow later this month when the release timeline has been finalized. He did not comment on the Times report that Netflix is paying for the episodes, though I assume this is almost certainly the case.

follow later this month when the release timeline has been finalized. He did not comment on the Times report that Netflix is paying for the episodes, though I assume this is almost certainly the case. Netflix's move demonstrates the beginnings of what I think is real power in its Watch Instantly model, namely the ability to pay to get great content which itself can be a subscriber acquisition and/or retention tool. I expect we'll see a lot more of Netflix cherrypicking programs and or specific networks to build out its Watch Instantly feature. As it does, it will become an increasingly appealing alternative for early adopter cord-cutters.

What do you think? Post a comment now.

Categories: Aggregators, Cable Networks

Topics: Netflix, South Park

-

Metadata Creation Scales Up with EveryZing's New "MediaCloud"

Summary

What: EveryZing is introducing a new metadata creation service called MediaCloud, which can scalably generate metadata for large publishers' video, audo, images and text.

Benefits: High-volume, high-quality metadata creation; avoidance of expensive enterprise software; XML file integration with existing work flow/publishing systems; cohesive multimedia user experiences; more targetable ad inventory

For whom: publishers, ad networks, monitoring services, PR professionals

The process of affordably generating large quantities of high-quality metadata (the information that describes content itself) makes a big leap forward today with EveryZing's announcement of its new "MediaCloud" service.

EveryZing is one of my favorite technology companies focused on video because its products leverage search behavior to drive increased and more specific video views. Regardless of the category (news, sports, entertainment, business) one of the key ways to incent more online video consumption is by returning more accurate results to users when they're seeking something specific. It's not just the improved user experience that counts; it's also that with rich metadata, accompanying ad avails are more targetable, therefore resulting in higher CPMs and/or pay-per-action ads.

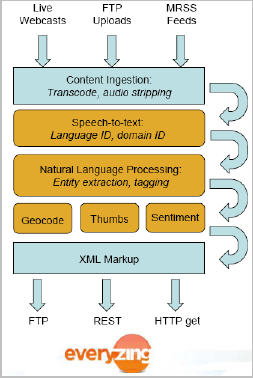

Last Friday, EveryZing's CEO Tom Wilde walked me through MediaCloud and how it fits into the company's portfolio. With MediaCloud, which is offered on a SaaS (software-as-a-service) basis, customers' video is

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.MediaCloud essentially takes what's behind EveryZing's ezSearch and ezSEO products and offers it to customers directly. According to Tom, customers' appreciation for the value of metadata has grown considerably in the last couple of years, therefore making a service like MediaCloud both timely and appealing. Today MediaCloud is geared for more sophisticated publishers who are ready to "graduate" to managing the metadata creation process themselves, but my sense is that eventually this will become a fairly standard part of the work flow for all reasonably-sized video publishers.

There are many exciting uses of MediaCloud's metadata, but two resonate most strongly for me. First is how it enables more universal publishing and multimedia search results for content providers at scale. For example, when you consider how much video is being created by so many different providers (e.g. broadcasters, cable networks, newspapers, magazines, online publishers, brands, etc.), you begin to realize how critical it is that they be able to cohesively deliver all types of assets to users. A scalable way to produce high-quality metadata which pulls related content together and allows each user to consume in the format they prefer is becoming essential.

Second is how contextual ad targeting is enabled at a whole new level. VideoNuze readers know that one of my fixations has been untargeted and/or redundant video ads. Everyone agrees there's much improvement to be made to the video ad value chain. Allowing publishers to expose their videos' metadata to ad networks in particular would provide significantly improved targeting, resulting in better CPMs and making pay-per-action models much more viable.

Net, net, MediaCloud is another important advancement in helping publishers mesh video into their users' behavioral patterns, helping monetize it at a potentially far higher level. No doubt we'll see more SaaS-type video metadata services in the future, but for now MediaCloud is a leader.

What do you think? Post a comment.

Categories: Technology

Topics: EveryZing, MediaCloud

-

Reality Digital Pursues SMBs with New Harmony Social Media Platform

Yesterday, Reality Digital, a player in the white-label social media space, announced "Harmony," a new self-service social media/online video sharing platform targeted to small-to-medium sized businesses. SMBs are getting a lot of love recently as more and more technology providers are realizing there's opportunity to serve them (see post on Jivox and Pixel Fish earlier this week for more).

Cynthia Francis, Reality Digital's CEO/co-founder explained to me that Harmony was borne out of interest that smaller prospects were showing for its Opus platform (which powers such projects as the NFL's "Replay Re-Cutter"). However, with its cost of $50K or more per year, Opus was out of reach for many.

Reality Digital was also seeing a lot of SMBs simply using WordPress and YouTube to cobble together a

community/video presence. So Harmony's goal was to improve on this, enabling SMBs to go beyond template-only social community building and video sharing. Among the differentiators Cynthia sees for Harmony are full drag-and-drop configuration, 100% branding control and self-service advertising in addition to the core community-building and video tools.

community/video presence. So Harmony's goal was to improve on this, enabling SMBs to go beyond template-only social community building and video sharing. Among the differentiators Cynthia sees for Harmony are full drag-and-drop configuration, 100% branding control and self-service advertising in addition to the core community-building and video tools. Most big media companies have now embraced social media to one extent or another. The main challenges with these efforts are keeping the community vibrant, safe and engaging. For resource-constrained SMBs, these issues will take on even greater importance. Still, with video so inexpensive to produce and all businesses striving for customer loyalty, it is appealing to give social media a try. Harmony makes it easy for SMBs to dip their toe in and test to see if it is right for them.

What do you think? Post a comment now.

Categories: Technology

Topics: Reality Digital

-

Seeking Your Feedback

Recently I've received several emails from VideoNuze readers with a common theme: we love the quality of VideoNuze posts, but sometimes they can be quite long - is it possible to provide some sort of summary at the top of each one (with bullet points, a short paragraph, etc.)?

I'm constantly mindful of the length of VideoNuze posts and these are good suggestions. I try to do my best to keep posts as tight as possible, while still trying to be thorough. Some days I can do so in 300 or 400 words. Other days it may take closer to 600 or 700.

Regardless, I'm sensitive that readers have a lot on their plates and so finding ways to make VideoNuze content more accessible and usable is super-important to me. I'm wide open to suggestions for how to do so. If you have thoughts or suggestions, please leave a comment or just drop me an email at wrichmondATvideonuze.com.

I look forward to hearing from you!

Categories: Miscellaneous