-

SF Chronicle Provides Video Compilation of Clinton Campaign

Last Thursday I remarked on a really professional documentary video that the NY Times produced which offered a retrospective on Hillary Clinton's candidacy. The Times promoted it on page one, which I thought was pretty significant evidence of how newspapers are capitalizing on broadband video's news opportunities.

I just noticed another great example of a newspaper's involvement with video. Check out what the SF Chronicle posted on its SFGate.com site last Friday. Rather than producing their own documentary video,

they culled about a dozen videos (mainly from YouTube) that were turning points in the campaign.

they culled about a dozen videos (mainly from YouTube) that were turning points in the campaign. The accompanying article makes great points about how important broadband video is becoming in the political process. It also notes that video's uncontrolled and unscripted nature are important differences that candidates need to understand and embrace. The article is spot on and well-worth a read.

Categories: Newspapers

Topics: San Francisco Chronicle, SFGate

-

Understanding TakeTV/Fanfare's Demise

Late last week came news that SanDisk has discontinued its TakeTV device and companion Fanfare content aggregation web site, which were unveiled last October. TakeTV was an inexpensive USB PC-TV connector that allowed users to grab video from Fanfare, for easy playback on their TVs.

I gave TakeTV and Fanfare a moderately positive review and thought that as a low-end product it could gain some traction. I thought of it as having "stocking stuffer" appeal - a relatively cheap gadget that would find its market. I've done a little asking around to try to understand what happened.

From what I've gathered, it sounds like SanDisk ultimately recognized the reality that TakeTV was really

peripheral to their core focus of marketing memory products. Too much customer education would be required to move this product, especially in the face of quasi-competitors like AppleTV, Vudu, Xbox and others. In addition, minimums from Hollywood to gain top-notch content has continued to raise the bar for startup devices like these to succeed.

peripheral to their core focus of marketing memory products. Too much customer education would be required to move this product, especially in the face of quasi-competitors like AppleTV, Vudu, Xbox and others. In addition, minimums from Hollywood to gain top-notch content has continued to raise the bar for startup devices like these to succeed. Yet, my bet is that we haven't seen the last of SanDisk's involvement in the broadband video market. Like hard-drives, processors and PCs themselves, memory products rely on ever-larger applications to drive the consumer purchase cycle. For SanDisk, video has to be right at the top of their list in terms of the apps that will create demand for its increasingly capacious storage products. So stay on the lookout for SanDisk to resurface somewhere in the video landscape.

Categories: Devices, Technology

Topics: SanDisk

-

Entriq-DayPort Deal Broadens Product Offerings

Though I've been predicting a wave of consolidation among broadband vendors for a while, deals in the space have only been sporadic. I think that's been due to investors continuing to fund independent companies and a sufficient amount of business to go around for most everyone.

One deal that did close in the last few months was Entriq's acquisition of DayPort. I recently had a briefing with Guy Tennant, Entriq's COO and Cory Factor, DayPort's former CEO and now CTO of the combined entity to understand their joint strategy and a recently-expanded deal with Inergize Digital Media.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs. By acquiring DayPort, which supports advertising, Entriq expands its capabilities, allowing it to serve customers regardless of business model choice. This would also include hybrid pay/ad-supported models, which I continue to hear more and more about. The combined company is focusing on verticals like broadcasting (where DayPort always had a presence), independent producers and long-form content, particularly sports. Syndication is another key focus of the combined companies, mirroring the trend that I've written about in the past.

The recently-expanded deal with Inergize builds on a prior relationship DayPort had with the company. Inergize itself provides online solutions to broadcasters and Entriq has now integrated its combined capabilities more deeply with Inergize to serve the market. The two companies are also trying to deeply tie in to existing broadcast work-flow and production operations. One joint customer Guy and Cory cited was Newport Television, which recently acquired the Clear Channel TV stations which as deployed the Inergize/Entriq products.

Entriq-DayPort is competing in the very crowded broadband video content management/publishing space, which I've described previously. Yet by combining, the two companies have certainly strengthened their hand. As the market continues to evolve, they'll be fighting for their share.

Categories: Broadcasters, Deals & Financings, Technology

Topics: DayPort, Entriq, Inergize Digital Media

-

The NewsMarket Finds a Profitable Corner of the Broadband Video Market

While much attention in the broadband video industry has been focused on consumer-oriented companies, The NewsMarket is showing that there are other profitable niches for those with deep domain knowledge and creative business models. When I was in NYC last week I caught up with Romina Rosado, its Global Head of Marketing over lunch to learn more.

The NewsMarket's fundamental insight was recognizing that broadband would be a great platform for news video to be disseminated and that broadband's growth would eventually change both the roles of public relations/corporate communications professionals and the media's coverage of news.

On the one hand, PR people would need to offer up more video assets to augment their traditional text and images-based materials. And on the other hand, as consumer penetration of broadband increased, the news media would need improved access to video assets to help them cover stories online in a way that met changing consumer expectations. As its name implies, The NewsMarket's vision was to serve these two worlds, helping marry PR and news reporting to broadband in an efficient, cost-effective manner.

But executing on this vision has been turbulent. Founded in the dot com heyday, The NewsMarket clung to life in the early 2000's waiting for the market to stabilize and catch up. The good news is that not only has this happened, but The NewsMarket is now using its core competencies and relationships to expand its services.

The way The NewsMarket works is that companies, government agencies and other providers pay a fee to upload and have their videos (e.g. product demos, executive interviews, etc.) hosted at a secure site, where pre-approved media outlets are then able to download and edit. There are now 17,000 media outlets in 193 countries accessing video. Broadband's progress is evident, as Romina explained that a year ago NewsMarket videos were used in the same proportion by traditional broadcasters and online news outlets. Now the latter account for 80% of usage, including many newspaper sites as heavy users.

About a year ago The NewsMarket addressed bloggers by making a portion of its total videos available in a product called VideoCafe. But in response to the blurring demarcations of media and bloggers' displeasure at the limited quantity, The NewsMarket is shifting course to give bloggers access to the full library. It's also adding lots of HD video as sources are increasing their video quality.The NewsMarket has also expanded its portfolio by providing white label "broadcast newsroom" services for others' sites. About 70 customers have signed up for this. Microsoft is one example (not login needed). The NewsMarket has taken the next logical step by introducing its BrandTV product, whereby brands and others can set up their own channels in custom environments. YouTube is an obvious alternative for companies considering a quick and cheap alternative. But its unmanaged environment poses obvious issues, particularly for the growing list of companies getting more serious about using video to deliver their messages.

The NewsMarket's lessons are not only to be persistent in the face of adversity, but also to be creative in thinking about what kinds of macro changes broadband forces and how inventive business models can take advantage of them.

Categories: Aggregators

Topics: The NewsMarket

-

Fox's "Remote-Free TV" Seems to Fall Short

Two-and-a-half weeks ago, in "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks" I asserted that Fox's decision to cut in half the number of ads it will include in two new programs was influenced by the limited ads shown in networks' broadband initiatives.

By giving "RFTV" a try, Fox was catching on to the idea that fewer commercial interruptions improves the

viewer experience. I pointed out that the challenge RFTV posed is that cutting ad time in half means that Fox would have to double the CPMs it charged just to remain whole. Could Fox do that?

viewer experience. I pointed out that the challenge RFTV posed is that cutting ad time in half means that Fox would have to double the CPMs it charged just to remain whole. Could Fox do that?Yesterday's piece in Adweek provided at least a preliminary answer: No. Adweek, quoting unnamed media agency sources, reported that Fox is getting only a 35-40% premium for the "RFTV" ad inventory. If my math is right that would imply that Fox is grossing 30-33% less total ad revenue than it would have under its traditional ad model.

Broadcast networks, having moved much of their programming online, have engendered new viewer expectations for fewer ads. The early results from Fox's "RFTV" initiative may indeed be evidence that these new expectations are at odds with sustaining broadcasters' traditional margins and profits.

Categories: Advertising, Broadcasters

Topics: FOX

-

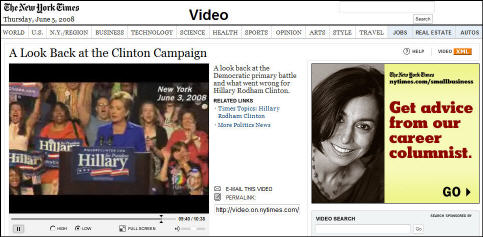

New York Times Highlights Clinton Video on Page One

Catching a train to NYC this morning to moderate at the Advertising 2.0 conference, I picked up a New York Times, something I rarely do anymore, having moved to the online version a long time ago. In a sign of the times (no pun) there on page one, under a huge picture of Barack Obama the caption identified him outside the Capitol yesterday, and continued, "A video looks at his party's long and grueling primary battle: nytimes.com/politics."

It's pretty cool to think that this is where things have progressed to: a major newspaper prominently highlighting a video it has fully produced as part of its news coverage. Talk about a blurring of the lines between different media segments. Going online I found the video, shot in documentary style with narration to be every bit as professional as something one would find on the networks.

My only gripe is that the video is woefully under-monetized. No pre-roll, post-roll or mid-rolls in a 10+ minute video. And even the accompanying display ad is a house ad for the Times's career columnist. If the Times is going to invest in creating great video, it should at least make money at it! Hopefully next time...Categories: Newspapers

Topics: NYTimes.com

-

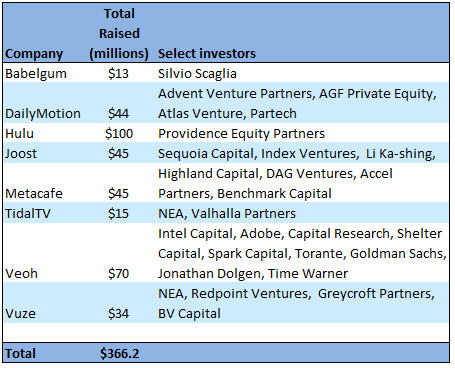

Video Aggregators Have Raised $366+ Million to Date

With this week's news that Veoh has garnered another $30 million in financing, by my count the total amount raised by the top broadband video aggregators now exceeds $366 million. The breakdown is below, according to publicly available data I've pulled together.

While definitions of who should be included in this category are admittedly fuzzy, I consider broadband aggregators to be companies that are providing a broad-based destination site that focuses mainly on professionally-created video. Often these sites include broadcast network and cable TV programming, but they don't have to. I'm sure plenty of readers have their own definitions and that I've overlooked some, so feel free to post a comment to add others to the list.

Savvy investors seem to have an enormous appetite for these kinds of companies. Veoh, with 28 million monthly unique visitors, and others have demonstrated their ability to attract lots of eyeballs. Yet all of these companies are solely reliant on advertising, and that of course makes begs the question how well these companies can convert their traffic to real revenue and therefore become profitable, sustainable businesses?

Since all of these companies are private it is hard to assess their momentum. Yet in a recent panel I moderated at Streaming Media East, Mike Henry, SVP of Ad Sales for Veoh explained the range of current challenges. Chief among them is getting traditional TV media buyers to clearly understand the broadband medium, how to buy into it and how to measure its performance. These are crucial matters since the biggest source of broadband ad dollars will no doubt come from brands shifting their TV spending to broadband.

Of course, to the extent that these companies can continue raising big money, they're buying themselves more runway. Complicating matters is that all of these sites live in the long shadow of YouTube, which alone still accounts for around 40% of all video views per month. Then there are big players like Yahoo, MSN and AOL and recent entrants like Adobe which are vying for their share of the video pie. But at some point these companies will have to show they can make money and survive.

With all these crosscurrents, it will be interesting to see how these companies' stories unfold.

Categories: Advertising, Aggregators, Deals & Financings

-

Revisiting The Long Tail and Broadband Video

Way back in the dark ages of March, 2005, I wrote a newsletter entitled, "The Long Tail of Video is About to Get Longer - What Role Will Cable Play?" I thought of it yesterday when I read an article in Multichannel News "Cable Bests Broadcast - Basic Networks Steamroll Into Summer with Lion's Share of Audience." I continue to believe that cable TV provides a lot of lessons for those thinking about broadband video's future.

First, a quick refresher on the idea of The Long Tail. In October, 2004, Chris Anderson, editor of Wired

magazine, wrote an article which later turned into a book, asserting that once physical limitations (e.g. manufacturing, distribution, inventory, etc.) are removed - thereby allowing all products with niche appeal to be readily available to consumers - it turns out that the aggregate sales of these niche products are greater than the few "mass" products which were always available in traditional distribution channels. When this effect is plotted on an XY graph, the line depicting the tiny sales per niche unit extends indefinitely, forming a "long tail."

magazine, wrote an article which later turned into a book, asserting that once physical limitations (e.g. manufacturing, distribution, inventory, etc.) are removed - thereby allowing all products with niche appeal to be readily available to consumers - it turns out that the aggregate sales of these niche products are greater than the few "mass" products which were always available in traditional distribution channels. When this effect is plotted on an XY graph, the line depicting the tiny sales per niche unit extends indefinitely, forming a "long tail."The Long Tail was an important contribution in understanding how the world of digital economics works. Anderson cited multiple examples where the Long Tail was evident (e.g. Amazon, Rhapsody, etc.). In my March '05 piece I explained that the Long Tail concept was familiar to anyone in the cable TV business: the traditional "head" content was the broadcasters, the long tail was the constellation of niche-oriented cable TV channels.

When I wrote the piece, as a group, basic cable TV's total audience had just nudged past the collective audience of the broadcasters for the first time (i.e. The Long Tail effect was becoming evident). While each cable channel's audience was small relative to each broadcaster's, cable's total audience was now greater. It had taken 30+ years for cable audience to reach this point.

Flash forward 3+ years to the Multichannel article revealing that in May sweeps period, cable's audience share had surged to 60%, compared with 40% for the broadcasters. And it's interesting to note that a key part of cable's May win is due to cable co-opting traditional broadcast programming: in May TNT's airing of NBA playoff games accounted for 12 of the month's top 20 most-watched programs.

What does all this have to do with broadband video? As I explained back in '05, in reality, broadband distribution is essentially extending the long tail of programming. Broadband allows startups and established players (including cable and broadcast networks!) to utilize newly available broadband infrastructure to reach their audiences. The result is a massive proliferation of new programming and new viewer behaviors, further fragmenting audiences to ever-smaller niches.

Today's cable channels will eventually be seen as the "mid-tail" with broadband as the hyper-niche long tail. Given their own first-hand experience of the last 30 years, cable operators, cable networks and broadcast networks should all have a pretty clear view of the challenges and opportunities that broadband creates. How well they respond will determine who will be the winners and losers of the next 30 years.

Categories: Broadcasters, Cable Networks, Cable TV Operators

Topics: The Long Tail