-

Netflix Confirms "South Park" is Coming to Watch Instantly

Netflix confirmed for me that the first 9 seasons of "South Park" are indeed coming to its "Watch Instantly" streaming service. This was mentioned by South Park's Matt Stone in a longer NY Times story yesterday about the program's digital activities. However, since there was no formal announcement yesterday and I couldn't add South Park episodes to my Netflix Watch Instantly I followed up to verify.

A Netflix spokesman told me that a deal has indeed been signed, and that the formal announcement will

follow later this month when the release timeline has been finalized. He did not comment on the Times report that Netflix is paying for the episodes, though I assume this is almost certainly the case.

follow later this month when the release timeline has been finalized. He did not comment on the Times report that Netflix is paying for the episodes, though I assume this is almost certainly the case. Netflix's move demonstrates the beginnings of what I think is real power in its Watch Instantly model, namely the ability to pay to get great content which itself can be a subscriber acquisition and/or retention tool. I expect we'll see a lot more of Netflix cherrypicking programs and or specific networks to build out its Watch Instantly feature. As it does, it will become an increasingly appealing alternative for early adopter cord-cutters.

What do you think? Post a comment now.

Categories: Aggregators, Cable Networks

Topics: Netflix, South Park

-

Metadata Creation Scales Up with EveryZing's New "MediaCloud"

Summary

What: EveryZing is introducing a new metadata creation service called MediaCloud, which can scalably generate metadata for large publishers' video, audo, images and text.

Benefits: High-volume, high-quality metadata creation; avoidance of expensive enterprise software; XML file integration with existing work flow/publishing systems; cohesive multimedia user experiences; more targetable ad inventory

For whom: publishers, ad networks, monitoring services, PR professionals

The process of affordably generating large quantities of high-quality metadata (the information that describes content itself) makes a big leap forward today with EveryZing's announcement of its new "MediaCloud" service.

EveryZing is one of my favorite technology companies focused on video because its products leverage search behavior to drive increased and more specific video views. Regardless of the category (news, sports, entertainment, business) one of the key ways to incent more online video consumption is by returning more accurate results to users when they're seeking something specific. It's not just the improved user experience that counts; it's also that with rich metadata, accompanying ad avails are more targetable, therefore resulting in higher CPMs and/or pay-per-action ads.

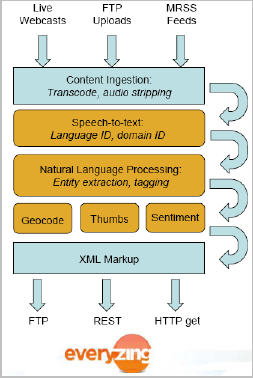

Last Friday, EveryZing's CEO Tom Wilde walked me through MediaCloud and how it fits into the company's portfolio. With MediaCloud, which is offered on a SaaS (software-as-a-service) basis, customers' video is

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.MediaCloud essentially takes what's behind EveryZing's ezSearch and ezSEO products and offers it to customers directly. According to Tom, customers' appreciation for the value of metadata has grown considerably in the last couple of years, therefore making a service like MediaCloud both timely and appealing. Today MediaCloud is geared for more sophisticated publishers who are ready to "graduate" to managing the metadata creation process themselves, but my sense is that eventually this will become a fairly standard part of the work flow for all reasonably-sized video publishers.

There are many exciting uses of MediaCloud's metadata, but two resonate most strongly for me. First is how it enables more universal publishing and multimedia search results for content providers at scale. For example, when you consider how much video is being created by so many different providers (e.g. broadcasters, cable networks, newspapers, magazines, online publishers, brands, etc.), you begin to realize how critical it is that they be able to cohesively deliver all types of assets to users. A scalable way to produce high-quality metadata which pulls related content together and allows each user to consume in the format they prefer is becoming essential.

Second is how contextual ad targeting is enabled at a whole new level. VideoNuze readers know that one of my fixations has been untargeted and/or redundant video ads. Everyone agrees there's much improvement to be made to the video ad value chain. Allowing publishers to expose their videos' metadata to ad networks in particular would provide significantly improved targeting, resulting in better CPMs and making pay-per-action models much more viable.

Net, net, MediaCloud is another important advancement in helping publishers mesh video into their users' behavioral patterns, helping monetize it at a potentially far higher level. No doubt we'll see more SaaS-type video metadata services in the future, but for now MediaCloud is a leader.

What do you think? Post a comment.

Categories: Technology

Topics: EveryZing, MediaCloud

-

Reality Digital Pursues SMBs with New Harmony Social Media Platform

Yesterday, Reality Digital, a player in the white-label social media space, announced "Harmony," a new self-service social media/online video sharing platform targeted to small-to-medium sized businesses. SMBs are getting a lot of love recently as more and more technology providers are realizing there's opportunity to serve them (see post on Jivox and Pixel Fish earlier this week for more).

Cynthia Francis, Reality Digital's CEO/co-founder explained to me that Harmony was borne out of interest that smaller prospects were showing for its Opus platform (which powers such projects as the NFL's "Replay Re-Cutter"). However, with its cost of $50K or more per year, Opus was out of reach for many.

Reality Digital was also seeing a lot of SMBs simply using WordPress and YouTube to cobble together a

community/video presence. So Harmony's goal was to improve on this, enabling SMBs to go beyond template-only social community building and video sharing. Among the differentiators Cynthia sees for Harmony are full drag-and-drop configuration, 100% branding control and self-service advertising in addition to the core community-building and video tools.

community/video presence. So Harmony's goal was to improve on this, enabling SMBs to go beyond template-only social community building and video sharing. Among the differentiators Cynthia sees for Harmony are full drag-and-drop configuration, 100% branding control and self-service advertising in addition to the core community-building and video tools. Most big media companies have now embraced social media to one extent or another. The main challenges with these efforts are keeping the community vibrant, safe and engaging. For resource-constrained SMBs, these issues will take on even greater importance. Still, with video so inexpensive to produce and all businesses striving for customer loyalty, it is appealing to give social media a try. Harmony makes it easy for SMBs to dip their toe in and test to see if it is right for them.

What do you think? Post a comment now.

Categories: Technology

Topics: Reality Digital

-

Seeking Your Feedback

Recently I've received several emails from VideoNuze readers with a common theme: we love the quality of VideoNuze posts, but sometimes they can be quite long - is it possible to provide some sort of summary at the top of each one (with bullet points, a short paragraph, etc.)?

I'm constantly mindful of the length of VideoNuze posts and these are good suggestions. I try to do my best to keep posts as tight as possible, while still trying to be thorough. Some days I can do so in 300 or 400 words. Other days it may take closer to 600 or 700.

Regardless, I'm sensitive that readers have a lot on their plates and so finding ways to make VideoNuze content more accessible and usable is super-important to me. I'm wide open to suggestions for how to do so. If you have thoughts or suggestions, please leave a comment or just drop me an email at wrichmondATvideonuze.com.

I look forward to hearing from you!

Categories: Miscellaneous

-

VideoNuze Report Podcast #8 - Feb 27, 2009

Below is the 8th edition of the VideoNuze Report podcast, for Feb. 20, 2009.

This week Daisy Whitney and I discuss the recently-revealed plans by Comcast and Time Warner to offer their subscribers online access to cable TV programming. I wrote about this at length this week in "The Cable Industry Closes Ranks - Part 2."

We also discuss Daisy's article "IAB Reaches for Web Video Ad Standards" in which she describes industry efforts to drive common ad standards primarily for long-form programming. The article explains the confusion that currently reigns in the market and why it's so critical that this be addressed.

Click here to listen to the podcast (13 minutes, 5 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts

-

Updates to VideoNuze's March 17th Broadband Video Leadership Evening

We're now just 2 1/2 weeks away from VideoNuze's Broadband Video Leadership Evening, on Tuesday, March 17th in New York City. There are 160+ people registered and the event will be a premier opportunity to meet industry colleagues and learn from top-tier digital media executives on the front lines of the video revolution.

We'll start with a "VideoSchmooze" cocktail/networking reception from 6pm - 7:30pm, followed by a panel

discussion I'll moderate from 7:30pm - 9pm titled, "Broadband Video '09: Building the Road to Profitability." The panel includes:

discussion I'll moderate from 7:30pm - 9pm titled, "Broadband Video '09: Building the Road to Profitability." The panel includes:- Albert Cheng, EVP, Digital Media, Disney/ABC Television Group

- Greg Clayman, EVP, Digital Distribution & Business Development, MTV Networks

- John Edwards, President and CEO, Move Networks (new)

- Karin Gilford, SVP, Fancast and Online Entertainment, Comcast Interactive Media

- Daina Middleton, SVP, Moxie Interactive, Publicis Groupe (new)

Click here to learn more and register now!

There is so much happening in the broadband video world these days that we'll have lots to discuss. We'll certainly dig into the implications of Hulu's recent decision to pull its content from Boxee and TV.com, Comcast and Time Warner Cable's intent to bring cable TV programs online for their subscribers and Nielsen and comScore's recent data around video viewership trends. It's going to be an exciting and insightful panel for sure!

The event will be held at the Hudson Theater on West 44th Street just off Times Square. NATPE, VideoNuze's partner since launch, is on board for the event. And I'm extremely grateful to lead sponsor Move Networks and supporting sponsors ExtendMedia, Horn Group, mPoint and PermissionTV who are making the evening possible.

I've set up a Facebook group so you can start meeting other attendees and also keep up to date on all the recent broadband news we'll discuss on the panel. I also created a short video with key highlights of the evening (thanks to PermissionTV for production assistance).

Categories: Events

-

New Research from TDG Sheds Light on Consumers' Three Screen Intentions

This past Tuesday I highlighted some of Nielsen's recent data which showed, among other things, significant online and mobile video usage by younger age groups. In that post I noted that marketers need to pay close attention to these trends to ensure their products and services meet these users' needs and expectations.

New research from The Diffusion Group (a long-time VideoNuze partner) provides a window into how users think about accessing video across multiple screens, and who the providers might be. TDG has recently completed a survey of 2,000 adults (18 or above) which tested interest in two-screen and three-screen services along with content and features. TDG has graciously provided a sample of the slides for complimentary download by VideoNuze. You can download the slides here.

TDG defined a three-screen service as "a single video service which feeds all your household TVs, PCs and mobile devices, for a single monthly fee, from a single service provider, and with relatively equal content, variety and quality of service for all three devices."

TDG found that almost 25% of those surveyed responded positively to such a package. Whereas video marketers would have traditionally considered heavy TV viewership (25 hours/week and above) to be the most important criterion for driving more video services adoption, these so-called "three-screen intenders" don't exhibit heavier TV viewership than non-intenders (though they're slightly higher in moderate viewership, 11-25 hours/week).

Rather, the behavior that distinguishes three-screen intenders is how much online viewing they're doing. The intenders are far higher consumers of online video in general, and of online TV programs in particular. In other words, their behaviors are already self-selecting them as the targets for a three-screen service offering. That of course makes it much easier for marketers to find and target them.

All of this certainly supports Comcast's and Time Warner Cable's recently revealed plans to offer their video subscribers online access to programs. Better news still for these companies is that TDG found that cable operators were the top choice by intenders as the preferred three-screen provider. Cable was chosen by 31.7% of intenders, almost double the amount that selected satellite operators. Translation: there is a sizable group of consumers interested in three-screen services and cable appears to be in the prime position to capitalize on this.

Of course, the next question then is whether cable operators should charge for these services or imitate Netflix's example with Watch Instantly by including them as a value add to existing digital services. In my opinion, at least some of the online viewing capability should be included for no extra charge. That would go a long way toward establishing loyalty, and position cable for even greater competitive gains.

Click here to download the complimentary slides.

What do you think? Post a comment now.

Categories: Cable TV Operators

Topics: Comcast, The Diffusion Group, Time Warner Cable

-

Local Video Ad Space is Bustling with Innovation

The ad business in general may be in the doldrums due to the economic downturn, but one space that's bustling with innovation is online video ads for local, small-to-medium (SMB) sized businesses.

Local advertising has of course been around since the beginning of time. And even the idea of allowing local SMBs to create video ads is not a new concept; cable operators' local ad divisions have been doing this for years. What's relatively new in the local ad space are companies that allow a far higher degree of self-service video ad creation and campaign management by the client, online placements of their ads, and much improved analytics and ROI measurement capabilities vs. traditional cable TV.

For some local merchants, engaging in this process will be overwhelming and they'll stick with the tried and true local options like newspaper, radio and yellow page listings. But I believe that for many others, who recognize that their customers are increasingly going online to find local merchants and understand that a video packs far higher emotional punch than a text ad, this new alternative will be highly compelling.

There are multiple fairly well-funded players covering the local SMB video ad space, each with their own particular points of differentiation. They include Spot Runner, Spot Mixer, Jivox, Mixpo, PixelFish and others. Some like Spot Runner don't limit themselves to online distribution only, they're targeting TV as well. But the basics are relatively similar: a low-cost, often self-service ad creation process, a pretty well-defined way of targeting the intended audience through locally-oriented sites, and fairly flexible campaign/spending options. A persistent goal is to make it incredibly easy and cost-effective for local SMBs, who have most likely never done anything like this, to get up and running quickly.

To get a better feel for this all works and how SMBs are benefitting, I recently spoke with both Jim Gustke, VP of Worldwide Marketing at Jivox and Stephen Condon, VP of Marketing at PixelFish. Jivox, which raised

$10.5 million last summer, reported that it doubled its customer base in Q4 '08. Jim said a real differentiator for the company is its publishing network of 800 premium sites and 65 million monthly unique visitors. This allows it to offer advertisers improved targeting and analytics vs. competitors who can only promise placements on affiliated sites. Jivox video ads auto-play in a 300x250 window on the publisher's site with audio off until initiated by the user. Better still for the advertiser, Jivox only charges for ads when 100% of the video has been viewed, thereby providing a pay-for-performance value proposition as well.

$10.5 million last summer, reported that it doubled its customer base in Q4 '08. Jim said a real differentiator for the company is its publishing network of 800 premium sites and 65 million monthly unique visitors. This allows it to offer advertisers improved targeting and analytics vs. competitors who can only promise placements on affiliated sites. Jivox video ads auto-play in a 300x250 window on the publisher's site with audio off until initiated by the user. Better still for the advertiser, Jivox only charges for ads when 100% of the video has been viewed, thereby providing a pay-for-performance value proposition as well.Jim said the most popular local categories include cosmetic surgeons, dentists, contractors, hospitality and legal. Demonstrating how active the category is, most of Jivox's new business has come through search. New advertisers pay as little as $250 to get started.

Meanwhile, Stephen explained that PixelFish employs a more customized and channel-centric approach, getting 80% of its business through partners like YellowBook, Google TV and others who are interfacing

directly with the SMBs. That means PixelFish overlaps a bit with TurnHere and other video production networks. When one of its partners generates an order, PixelFish taps into its network of videographers to shoot specific footage which is then centrally edited and produced for the client. Through online editing tools recently acquired from EyeSpot, the advertiser can make changes to the ad himself and continue to make updates to it as offers change.

directly with the SMBs. That means PixelFish overlaps a bit with TurnHere and other video production networks. When one of its partners generates an order, PixelFish taps into its network of videographers to shoot specific footage which is then centrally edited and produced for the client. Through online editing tools recently acquired from EyeSpot, the advertiser can make changes to the ad himself and continue to make updates to it as offers change."Democratization" is a much-overused word, but here I think it really does apply. Even with local cable advertising, the cost of producing and running a TV ad has been prohibitive for many local merchants. These new companies are changing that, making video advertising accessible and affordable for the first time for broad swaths of local SMBs. Incumbents like local cable, newspapers and radio need to prepare themselves as the power of broadband and search-based marketing disrupt their status quo. I'm expecting this new crop of companies is going to drive a lot of change in this space.

What do you think? Post a comment now.

Categories: Advertising

Topics: Jivox, Mixpo, PixelFish, Spot Mixer, Spot Runner