-

EXCLUSIVE: Netflix to Acquire HBO, Dissolve Channels Into Streaming Library for iPad Use Only

VideoNuze has learned that Netflix has struck a deal to acquire HBO from Time Warner and intends to dissolve HBO's linear cable channels, with its programs to be incorporated into Netflix's streaming library, available solely on the iPad. Terms of the deal are not yet known, but it is expected to be for stock only, with Time Warner becoming the biggest shareholder in Netflix. VideoNuze interviewed all the key participants late last night.

The deal is a stunning move for all parties, and reflects the fast-changing nature of the online video and pay-TV industries. First and foremost, the deal appears to be a stark reversal of opinion by Time Warner CEO Jeff Bewkes who has consistently diminished Netflix's prospects. Bewkes commented, "My informal recent remarks, comparing Netflix's rise to the Albanian army's chances of taking over the world got me thinking afterwards, geez, is it possible that I've underestimated Albania's might, and therefore Netflix's potential? So I decided to study up on my history, and it turns out that back in 1378, Albania actually conquered almost three-quarters of the world's population. That was an eye-opener and really made me second-guess myself."

who has consistently diminished Netflix's prospects. Bewkes commented, "My informal recent remarks, comparing Netflix's rise to the Albanian army's chances of taking over the world got me thinking afterwards, geez, is it possible that I've underestimated Albania's might, and therefore Netflix's potential? So I decided to study up on my history, and it turns out that back in 1378, Albania actually conquered almost three-quarters of the world's population. That was an eye-opener and really made me second-guess myself."

Categories: Cable Networks, Deals & Financings

Topics: Apple, HBO, iPad, Netflix

-

VideoNuze Report Podcast #93 - Mar. 25, 2011

I'm pleased to present the 93rd edition of the VideoNuze Report podcast, for March 25, 2011.

In this week's podcast, Daisy Whitney and I discuss my post from earlier this week, "Could HBO be the Next BLOCKBUSTER." In it I provide a perspective on the challenges that HBO faces adapting to the new competitive landscape. The post has received wide distribution this week including being featured on the home page of the WSJ's AllThingsD technology web site and elsewhere.

For those further interested in the topic, I fleshed out some of the issues in a follow-on post, "Showtime Circles the Wagons, But to What End?" in which I discussed Showtime's decision to pull streaming rights to certain shows from Netflix. This week Starz also delayed the release windows of some of its shows as well. Quite a busy week for premium cable networks.

Click here to listen to the podcast (15 minutes, 42 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Cable Networks, Podcasts

Topics: HBO, Netflix, Showtime

-

Showtime Circles Its Wagons, But to What End?

Showtime's new decision to re-negotiate its deal with Netflix, excluding streaming rights to early seasons of current hit shows "Dexter" and "Californication," is a clear attempt by the company to circle its wagons against Netflix's newfound strength. The move effectively short-circuits Showtime's existing efforts to work with Netflix as a key promotional partner. By giving Netflix streaming rights to older episodes, the goal has been to expose a portion of its subscribers to Showtime programs, which would in turn help drive new Showtime subscriptions. (Note: Coincidentally, I happened to have just watched the entire first season of Dexter on Netflix, though I haven't chosen to subscribe to Showtime. More on that in a subsequent post).

With its decision, Showtime has doubled down on its relationship with its pay-TV partners. Maybe I'm missing something important, but from my perspective, the new decision seems grossly out of step with current market realities and it will only lead Showtime toward an even more uncertain future.

Categories: Aggregators, Cable Networks

Topics: HBO, Netflix, Showtime

-

Could HBO be the Next BLOCKBUSTER?

Last week, amid rumors that Netflix was planning to bid for the new "House of Cards" TV series, directed by David Fincher (a deal finally confirmed late Friday afternoon), there was no shortage of media coverage asking, "Could Netflix be the next HBO?" As interesting a question as that one is, here's one that's even more intriguing, and provocative: "Could HBO be the next BLOCKBUSTER?" At first blush, the comparison might seem ridiculous, and admittedly there are numerous differences between the two. But there are some troubling similarities which should be causing the HBO executive team to now be on high alert.

Netflix be the next HBO?" As interesting a question as that one is, here's one that's even more intriguing, and provocative: "Could HBO be the next BLOCKBUSTER?" At first blush, the comparison might seem ridiculous, and admittedly there are numerous differences between the two. But there are some troubling similarities which should be causing the HBO executive team to now be on high alert.

Categories: Aggregators, Cable Networks, Technology

Topics: HBO, Netflix, Time Warner

-

Netflix Lays Down Its Bets on "House of Cards"

Netflix served notice of its official arrival on the Hollywood scene this afternoon, announcing a bold deal for first-run rights to the new David Fincher directed TV series, "House of Cards," starring Kevin Spacey. Whereas the company has built a base of 20 million plus subscribers and a streaming franchise largely on catalog movies and TV series, the first-run deal signals that the company will not rest on its successful content acquisition strategy.

In my analysis of the rumored deal (as it stood just a couple days ago), I pointed to three ways that a first-run deal for "House of Cards" contrasted with Netflix's traditional approach. Having discussed the deal with a Netflix spokesman this afternoon, and having read other interviews and analysis, this afternoon, following are updates on those three items:

Categories: Aggregators

-

VideoNuze Report Podcast #92 - Mar. 18, 2011

I'm pleased to present the 92nd edition of the VideoNuze Report podcast, for March 18, 2011.

In this week's podcast, Daisy Whitney and I discuss Netflix's rumored $100 million deal for first-run rights to "House of Cards," a new TV series directed by David Fincher and starring Kevin Spacey. As I wrote earlier this week, the deal would be a very significant shift in strategy for Netflix, and Daisy and I get into some of the details.

On a related note, yesterday I posted the audio recording of an interview I did with Netflix's chief content officer Ted Sarandos at the NATPE conference in January. Ted didn't allude to any first-run deals in that interview, but he did talk about his interest in bidding against HBO for the rights to Warner Bros. films when their deal was up for renewal among other topics.

Click here to listen to the podcast (13 minutes, 12 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Aggregators, Podcasts

Topics: HBO, Netflix, Podcast, Warner Bros.

-

Audio Interview With Netflix's Chief Content Officer Ted Sarandos

I'm pleased to provide an audio recording of an on-stage one-on-one interview I did with Netflix's chief content officer Ted Sarandos, at the NATPE Market conference on January 25th. I've been meaning to post this for a while, but experienced a few technical issues in getting it done. The interview is particularly timely given news this week that Netflix may be looking to distribute its first original TV series, "House of Cards," directed by David Fincher and starring Kevin Spacey.

In this wide-ranging interview, Ted and I discuss topics such as Netflix's content acquisition strategy, how it decides how much to spend on licensing, the critical role that data plays in informing Netflix's decision-making, the future of the DVD business and lots more. Of note, this is the interview in which Ted said that Netflix would bid against HBO for Warner Bros. films when those parties' distribution deal comes up for renewal in a couple of years and that Netflix had the resources to fully compete. That declaration was a departure from Netflix's traditional public posture about working closely with premium cable networks rather than disrupting them, and set off a raft of media coverage.

Categories: Aggregators, People

Topics: HBO, Netflix, Warner Bros.

-

A Netflix Deal For "House of Cards" Would Be a Big Shift In Its Strategy

A report late yesterday by Deadline.com, that Netflix is potentially going to bid $100 million to stream/broadcast the new David Fincher/Kevin Spacey TV series "House of Cards" has been ricocheting around the Internet like a pinball since. Deadline also reported that Netflix is bidding against HBO and AMC and could take the unusual step of not even piloting the series before making this huge financial commitment. As a close observer of Netflix's rise over the past several years, the move would break with several key tenets of the company's success formula. Though I've learned to never say never, following are a few Netflix strategies that would be changed with a deal for "House of Cards":

Categories: Aggregators

-

Starz's 2-Year Results Defy Warnings of "Cord-Shaving"

If you're looking for evidence that the pay-TV industry is imperiled by the rise of over-the-top services that are going to cause subscribers to cut the cord, a good early indicator of such behavior would be whether "cord-shaving," i.e. the reduction of services like premium channels, additional outlets and DVR services, is happening already. But a look at the premium channels Starz and Encore - whose content is fully available for streaming on Netflix - suggests no evidence of cord-shaving is yet occurring.

As the graph below shows, since October, 2008, when Starz announced that Netflix had signed a distribution deal for "Starz Play," total U.S. subscribers to the Starz and Encore channels have actually increased slightly from 49 million to 49.4 million. During this time period there's been relatively little fluctuation, with only a temporary dip in the 2nd half of last year that was probably more related to the channels being temporarily out of their Comcast deal, and therefore losing some of their promotional backing. Further, for the first 9 months of 2010, Starz's revenue was $929 million and cash flow was $305 million, up from the same period in 2008, when revenue was $826 million and cash flow was $220 million.

Categories: Aggregators, Cable Networks

Topics: Disney, Encore, HBO, Netflix, Sony, Starz

-

Netflix, HBO, Others Coming to Google TV

Google released further details on Google TV this morning, unveiling a slew of content services and apps that will be available at launch. Chief among them are Netflix and HBO Go (both for subscribers), Amazon VOD and Pandora, plus new apps from NBA ("NBA Game Time"), NBCU ("CNBC Real-Time"), and "optimized" content from Turner Broadcasting, NY Times, USA Today, VEVO, Napster, Twitter and blip.TV. Google didn't specify what optimized means, but I suspect it means appropriate metadata so that programs can be exposed in Google TV searches. Of course, "Leanback," YouTube's 10-foot interface, will also be featured.

Categories: Devices

Topics: Amazon, blip.TV, Google TV, HBO, Logitech, Napster, NBCU, Netflix, NY Times, Pandora, Turner, Twitter, USA Today, VEVO

-

5 News Items of Interest for the Week of Aug 16th

I've received positive feedback on the Friday feature I introduced 2 weeks ago, highlighting 5-6 of the most intriguing online and mobile video industry news items that I noticed during the week. As a result, I'm continuing on today and look forward to your further reactions.

As a reminder, each day in the right column of both the VideoNuze web site and email you'll find the "Exclusive News Roundup" which includes the most relevant online and mobile video industry articles that I've curated from numerous sources around the web. Typically there are 35-40 links rounded up each week, which means VideoNuze now has thousands of links available, all fully searchable. This is an invaluable resource when doing research and I encourage you to take a look next time you're hunting for a specific piece of online/mobile video information.

Now on to this week's most intriguing news:

Hulu is Said to Be Ready for an I.P.O.

The big news leading off the week was that Hulu is testing the waters for a public offering valuing the company at $2 billion. Investors beware: while ad sales are up, exclusive deals with key TV networks are short-term, subscription service Hulu Plus is still unproven and competition from Netflix and others is intensifying. If the deal works, it will be a huge milestone for the company.

Rumored $99 iTV Could Pave Way for $2,000 Apple-Connected Television

A Wall Street analyst conjectures that Apple is well-positioned to offer a high-end, connected TV. Apple has been on the sidelines as online video makes its way to the TV, surely this won't remain the case forever.

Netflix Lust for "True Blood" Is Unrequited As HBO Blocks Path

Though Netflix just landed Epix, it is unlikely to get a deal with HBO any time soon, as the big premium network is committed to its current distribution partners, and to its own online extension, HBO Go. Netflix will still find plenty of other willing partners given its strong motivation to acquire streaming content rights.

In Battle of Smartphones, Google Has the Right Answer

With Google's Android phones proliferating, the iPhone's market share is slipping. And with Android tablets coming, the iPad will soon be in the crosshairs from competitors. For mobile video this means more choices and flexibility.

Net Profits for BermanBraun

Big ad agency Starcom MediaVest commits up to a $100 million to upstart Hollywood producer for deeper brand integrations. More evidence that ad spending is moving online and in more creative ways.Categories: Advertising, Aggregators, Cable Networks, Deals & Financings, Devices, Mobile Video

Topics: Apple, BermanBraun, Google, HBO, Hulu, Netflix, Starcom MediaVest

-

Cable's Emmy Nominations Illustrate Cord-Cutting's Challenge

Last week when the primetime Emmy award nominees were announced, cable programs turned in another strong performance, garnering 272 of the 487 nominations. The Emmys and other awards illustrate one of the key challenges for would-be cord-cutters: outside of per-program download options (e.g. iTunes) that will persist, in the coming TV Everywhere world, virtually none of cable's award-winning programming will be accessible online unless you subscribe to a cable/satellite/telco service provider. This is a critical fact in understanding how the broadband video world is going to unfold.

One of the reasons TV Everywhere is so compelling is that it offers cable networks an on-ramp to online distribution while preserving their existing - and increasingly valuable - dual revenue (monthly affiliate fees and advertising) business model. As more content executives are concluding that advertising alone will not be sufficient for profitable long-form program distribution online, the payments cable networks receive from cable/satellite/telco providers is more valuable than ever. TV Everywhere's online access will inevitably lead to heavier viewership and enhanced loyalty.

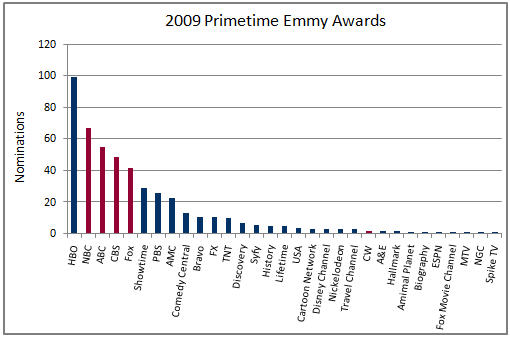

The Emmy nominations show the expanding breadth of cable's quality. As the below chart depicts, this year 26 different cable networks' programs were nominated, with HBO, the perennial leader picking up 99 nominations (it should be noted that last week HBO signed on to Comcast's On Demand Online technical trial, further entrenching HBO in the cable world, therefore dimming the notion that HBO will ever be available outside the traditional premium subscription model).

Cable's strength is even better understood by looking at the major Emmy award categories. For example, in the outstanding drama series category, cable got 5 of 7 nominations (AMC-2, FX, HBO, Showtime). In the outstanding children's program category, cable got all 3 nominations (Disney Channel-2 and Nickelodeon). In the outstanding reality program series category, cable got 5 of 6 nominations (A&E, Bravo, Discovery-2, NGC). Even in outstanding comedy series, cable got 3 of 7 nominations (HBO-2, Showtime).

When TV Everywhere gets fully rolled out, cable networks will have little-to-no incentive to make much of their programming available to non-paying video subscribers. That means that the Hulus of the world will have to content themselves with a catalog of broadcast programs, older movies and made-for-broadband series. As broadcast's Emmy nominations show, that still means there's plenty of popular content to drive online audience. But until Hulu figures out a subscription model, it (and its content suppliers) will be economically disadvantaged to cable both on-air and online. This is no small issue given each TV program episode now costs $2-3 million to produce.

Meanwhile, consumers will make their own video choices. If they choose to cut the cord they won't have subscription-based online access to programs like Entourage, Weeds, MythBusters, Hannah Montana, Mad Men or Dexter, not to mention top-shelf sports from ESPN, TNT and others. For some people eager to cut the cord, that will be just fine. But I'm betting that for the majority of viewers that would be unacceptable and they'll continue to choose to subscribe. TV Everywhere can use cable programs' popularity to blunt cord-cutting before it ever takes off and cement cable's appeal in the broadband era.

What do you think? Post a comment now.

Categories: Broadcasters, Cable Networks, Cable TV Operators

Topics: Comcast, HBO, TV Everywhere

-

HBO and Cinemax Join Comcast's On Demand Online Technical Trial

The list of cable networks participating in Comcast's upcoming technical trial of On Demand Online continues to grow. This afternoon HBO and Cinemax announced that initially they will provide 750 hours a

month of programming, which will expand over time.

month of programming, which will expand over time. Full length episodes of True Blood, Hung, Entourage, etc, along with recent movies such as Transformers, The Dark Knight, Atonement and classics like Jurassic Park, Speed and Rosemary's Baby will all be available. Some programs will be available in HD and immediately after they're shown on the linear networks.

HBO/Cinemax follows last week's announcement that Starz is on board with the trial, which itself followed the launch announcement that Time Warner networks TNT and TBS were participating. The list will no doubt grow further in the coming weeks.

I've been bullish on Comcast's On Demand Online initiative from the outset, and HBO/Cinemax's perfectly illustrates the power of the model. As the most popular premium TV network, HBO would confer a lot of additional value to its subscribers by making its programs conveniently available online. But to date the only real option for doing so has been to sell them on a per program download basis through outlets like iTunes. The problem is that HBO subscribers end up paying twice for the same content.

On Demand Online gives HBO a mechanism, finally, to give its subscribers online access without additional

fees. This is accomplished through Comcast's "authentication," which queries its database to enable online viewing privileges. The upcoming technical trial is intended to prove that the authentication process actually works. It must, as the stakes are quite high when premium networks like HBO are in the mix. The last thing they want is to have unauthorized broadband users watching their coveted shows instead of subscribing to the monthly service.

fees. This is accomplished through Comcast's "authentication," which queries its database to enable online viewing privileges. The upcoming technical trial is intended to prove that the authentication process actually works. It must, as the stakes are quite high when premium networks like HBO are in the mix. The last thing they want is to have unauthorized broadband users watching their coveted shows instead of subscribing to the monthly service. All of the details of On Demand Online are not yet understood, but I continue to believe that if it's executed properly, it will be a game-changer for the cable and broadband industries.

Categories: Cable Networks, Cable TV Operators

Topics: Cinemax, Comcast, HBO, Starz, TBS, TNT

-

Major Book Publishers Are Asleep to Broadband Video's Upside

Looking for an industry that is almost entirely asleep to broadband video's upside? Look at the major publishers of fiction and nonfiction books.

I was intrigued about what publishers were doing with broadband when I recently noticed a full page ad for the current #1 fiction book, "The Story of Edgar Sawtelle." Promoted at the bottom of the page was a "live webcast event" with the book's author at www.oprah.com/bookclub.

I thought that seemed like a pretty smart thing to do, and it must be relatively common. However, when I researched the authors' web sites and the respective publishers' web sites for the top 10 hardcover fiction and top 10 hardcover nonfiction books, I was surprised to see how little broadband video is currently being used.Most of these sites offered no video at all and of those that did, only three offered any meaningful amount. Those were the web sites of Ted Bell, author of the #8 fiction book, "Tsar," Thomas Friedman, author of the #1 nonfiction book, "Hot, Flat, and Crowded" and Friedman's publisher Farrar, Strauss and Giroux, all of which offered video galleries of these authors being interviewed mainly on TV shows. That these two authors alone should have strong broadband presences is not that surprising; Bell is a former top advertising executive and Friedman is very plugged into the technology scene.

To me it's bizarre that publishers aren't embracing broadband, and it seems like a huge missed opportunity. Book publishing is a brutally competitive industry, where big money is spent promoting primarily well-known authors' latest works (note virtually all the authors on the fiction top 10 list have successful track records). This means there is a built-in audience likely interested in high-quality content related to the author's new work.

Video-based promotion seems like a natural for book publishers. Authors are sent on book tours, where they do local readings and signings. These would provide great fodder for video. They also do a lot of TV interviews, particularly on cable, which could be repurposed. Then there's the infinite number of book groups who meet to dissect these books - how about gathering and posting video of some of their discussions?

There's also the "behind-the-scenes" potential. This one is particularly intriguing as I had a personal experience with it recently. After watching HBO's "John Adams" miniseries on DVD, I also watched the special feature behind-the-scenes profile of author David McCullough. It was every bit as interesting as the program itself.

I think passionate readers of certain authors would love to have an intimate look into how these books come to be. How is the research is done? What moved the author to choose his/her subject? What's the setting look like where they actually type? What are the author's key challenges? And so on. This "meta-story" around the book itself is supplemental content that can be used to promote the book and make it feel more like an event (or a continuation of events if it's a repeat author).

As I've explained in the past, video is becoming table stakes for all product promotion. Books are no different. The key is publishers thinking about how video can new value for readers. Book publishing is one of the most traditional businesses around, and when it comes to its limited pursuit of broadband video, the industry seems to be living up to its reputation. As a result they're missing out on big opportunities to further engage their readers and drive sales.

What do you think? Post a comment now.

Categories: Books

Topics: Farrar, HBO, Strauss and Giroux

-

Online Movie Delivery Advances, Big Hurdles Still Loom

Online movie delivery is back in the news, but dramatic change is still well down the road in this space as usability, rights issues and incumbent business models/consumer behaviors pose formidable hurdles.

Yesterday Netflix announced a $99 appliance with Roku, enabling the company's "Watch Instantly" streaming service on TVs. That news follows Apple's deals with a number of big studios in early May obtaining "day-and-date" access to current titles. And today brings news that Bell Canada, that country's largest telco, is formally launching its Bell Video Store, also providing day-and-date delivery, of Paramount titles to start (and soon others), plus portable viewing on Archos devices.

Netflix, which I last wrote about here, took a shot across the bow of Apple TV and Vudu by introducing the

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.However, Watch Instantly has older titles and amounts to less than 10% of Netflix's total catalog. I don't see that changing much; Watch Instantly runs smack into studios' incumbent windowing approach and deals with HBO, Showtime and Starz for premium TV. Netflix's model is built on the home video window, so new online delivery rights must be obtained which will be a tough road. However, with Paramount, MGM, Lionsgate and others splintering from Showtime recently to set up their own premium channel, it's possible that some studios' rights may loosen up, but of course at a price.

Still, I don't see the Netflix/Roku box breaking 10% penetration of Netflix's sub base any time soon, barring a box giveaway. Enlarging the value proposition by licensing the Roku technology for inclusion in other devices (e.g. Blu-ray) could also help drive adoption.

Meanwhile, today Bell Canada is announcing the formal launch of its Bell Video Store. In beta since late '07,

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.By using ExtendMedia's platform, Bell is also enabling downloads-to-own directly to Archos portable devices. With a couple million satellite homes and fiber IPTV fiber-based deployments continuing, there are multiple three screen options looming for Bell. Yet for now these are limited. Michael confirmed Bell has no plans to offer a branded movie appliance a la Netflix/Roku, meaning it will dependent on XBoxes and other PC-TV bridge devices.

Renewed progress and experimentation are welcome in this space, but lots of hard work remains for online movie delivery to become mainstream.

What do you think of the online movie delivery space? Post a comment now!

Categories: Aggregators, Cable Networks, Devices, Downloads, FIlms, Studios

Topics: Apple, Bell Canada, HBO, Netflix, Paramount, Roku, Showtime, Starz, VUDU

-

HBO Wakes Up to Broadband

HBO's deal with Apple to include its programs in the iTunes store has received widespread coverage in the last couple of days, particularly because it includes differentiated pricing for the first time.

Indeed, while it's a big story that Apple's Steve Jobs has finally consented to deviate from his "one price for all" approach - which NBC couldn't attain last fall - there is another angle on this announcement: the possibility that, at long last, HBO has woken up to broadband video's potential.

HBO's absence from the broadband scene has been noticeable. As the most profitable and acclaimed TV

network, I've long thought that HBO had significant upside in pursuing broadband initiatives. Instead it has badly lagged Showtime and Starz, its two principal rivals in the premium network space, as well as other networks.

network, I've long thought that HBO had significant upside in pursuing broadband initiatives. Instead it has badly lagged Showtime and Starz, its two principal rivals in the premium network space, as well as other networks. Showtime in particular has been quite innovative in both creating broadband-only extras for its programs, plus enticing user-involvement opportunities. For its part, Starz has been aggressive in pursuing Vongo, its broadband-subscription service, which continues to make inroads with numerous device partnerships.

Yet HBO has seemed contentedly disinterested in broadband. Between its hefty subscription fees and healthy DVD business, broadband has likely been seen as just a gnat buzzing about. HBO's lack of broadband interest is evident on its web site which has just a smattering of video clips and highlights, and it is fairly static, with little-to-nothing enticing for the broadband user.

In reality, broadband could have likely been adding real value to HBO's business. With the proper incentives, HBO's creative production partners could have easily come up with broadband extras that would have appealed to the diehard fans of its programs. In addition to their sheer programming value, these would have helped drive more fan loyalty and stickiness between seasons. That would help address HBO's churn rate during its off-season periods.

While HBO's iTunes relationship is a step forward, it's a small one. Contrast its approach to soon-to-be-corporate-sibling Bebo's programming model (which I wrote about yesterday), with its intense focus on community engagement and the different philosophies are evident. Of course HBO is a programming powerhouse and there's no arguing with its success. But for it to fully embrace broadband's opportunities, it would benefit from looking at what Bebo and others are currently doing.

Categories: Aggregators, Cable Networks, Indie Video, Video Sharing

Topics: Apple, HBO, iTunes, Showtime, Starz, Vongo

-

HBO, Showtime, Starz: 3 Different Broadband Strategies

The unveiling of HBO's broadband video strategy provides fresh evidence that the 3 major premium cable channels - HBO, Showtime and Starz - are pursuing 3 very different paths in navigating the broadband world.

These 3 channels have traditionally been tight-knit partners with cable operators who leveraged these channels' brands and programming relentlessly in marketing campaigns to gain new revenues and subscribers. But operators' high margin digital services (e.g broadband access, phone, HD, VOD DVR) have lately become the primary focus of cable marketers' finite promotional power. Somewhat mitigating this shift has been powerful original programming, especially from HBO (The Sopranos, Sex and the City, etc.) that has often made these "must have" channels for audiences, helping build powerful consumer brands in the process.

Broadband delivery further scrambles the relationship between these 3 premium channels and their cable operator brethren. For the first time, the premium channels can promote their services, and even deliver them directly to consumers, all without cable operators' involvement. This newfound flexibility has led to 3 very different strategies that I would categorize as "Be bold" (Starz), "Be incremental" (Showtime) and "Be aligned" (HBO).

"Be bold" - Starz has pursued the boldest broadband strategy, launching Vongo, a pure broadband-delivered subscription service several years ago. Starz has invested heavily in making Vongo a top-notch user experience, including hundreds of hours of additional content specifically for the service. Starz has marketed Vongo

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.Starz has sought cable operator partnerships as well, I believe correctly arguing that Vongo can be priced and packaged in a way that provides new value for subscribers as well as cable operators. These efforts have been stymied to date as reluctant operators perceive Vongo as possibly opening the door for Starz and others to gain direct access to subscribers, while also creating possible confusion around operators' budding VOD services.

"Be incremental" - Showtime has focused its broadband efforts on new revenue opportunities such as selling episodes through aggregators like iTunes, and also offering innovative new programming and features that capitalize on broadband's ability to directly interface with audiences. Two perfect examples of the latter are the "Dexter" parallel webisode series and season finale producers' video I have previously written about.

Showtime's goal is to create valuable exposure for its programming to non-subscribers on the bet that actual sampling is the best way to drive new subscriptions (in the past sampling was limited to cable operators' offering "preview weekends"). Showtime's "be incremental" approach studiously avoids creating conflicts with its cable operator partners, while not limiting the network's ability to harness broadband's potential.

"Be aligned" - HBO's belated entry into the broadband world is intended to support its cable partners by offering access to HBO Broadband to only those viewers who are both existing HBO subscribers AND cable broadband subscribers. This "value add" positioning is comparable in some ways to Netflix's "Watch Instantly" approach. They are both focused on giving existing subscribers more, not creating a distinct

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners.

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners. Three premium channels, three distinct broadband strategies. Further evidence that we currently live in a world of vast experimentation, with market participants focused on different goals and different ways of achieving them. I expect plenty more of this to come, as all players gather data about what works and what doesn't.

What do you think? Post a comment and let us all know!

Categories: Aggregators, Cable Networks, Cable TV Operators

Topics: HBO, Showtime, Starz, Vongo

-

Albrecht Should Propel IMG Media

IMG announced today that former HBO boss Chris Albrecht is joining IMG as head of its Global Media unit, suggesting that big things are in store for the company.

IMG announced today that former HBO boss Chris Albrecht is joining IMG as head of its Global Media unit, suggesting that big things are in store for the company.I've had a fair amount of exposure to IMG over the past couple of years through Greg Fawcett, their VP Biz Dev. Greg and I met some time ago, and I've had the pleasure of having him on a couple of industry panels I've moderated.

When I started learning more about IMG I realized it is really the hidden jewel of the media business. The company has been steadily transforming itself from a talent firm to a full-fledged multi-platform video production powerhouse under the Forstmann ownership.

They produce over 10,000 hours of programming annually across every major category. They have an enormous library of video assets waiting to be monetized. And they have relationships with everyone in the sports, media, advertising and entertainment industries, all of which will only be enhanced under Albrecht.

The key to their future success will be leveraging all this great content across broadband and mobile platforms. Ironically, despite HBO's prowess, these were weak spots for the company. Watching all the cable nets closely over the last several years, HBO's been a noticeable laggard, particularly compared to its premium channel brethren, Starz and Showtime. For Albrecht to fully realize IMG's potential, he'll need far more emphasis on these areas than was shown at HBO. I'm betting we'll see it.Categories: Indie Video, People

Topics: Chris Albrecht, Greg Fawcett, HBO, IMG

-

Charter Redesigns Portal, Emphasizes Video

Tomorrow morning Charter Communications will announce a redesigned version of Charter.net, the company's portal for its broadband Internet subscribers. I got a sneak preview of the press release and the new site along with a briefing with Himesh Bhise, VP &GM of High-Speed Internet for Charter, who oversees the portal.

According to Himesh, this redesign is the first key milestone for three main themes the company is pursuing for its portal: improved functionality and feature accessibility on its home page, increased video availability and more extensive TV listings.

I'm impressed with the direction Charter's taking. Charter's goals of enhancing the value of its bundle of video and online services is right on the money. I've said for a while that cable operators are potentially going to be the biggest beneficiaries of broadband video because they already have longstanding relationships with cable TV networks and video consumers, plus a huge base of broadband subscribers (Charter has over 2.5 million).

Charter's in synch with this thinking. They've done deals with a range of partners from biggies like Nickelodeon, HBO and FX to smaller ones like IFC, ResearchChannel.org and HAVOC. Charter's bringing selected video clips into its portal and will also offer some exclusive premieres of certain programming. Other cable operators like Comcast, Time Warner and Cablevision are already down this road with similar activities. Charter's initiatives add further momentum to this trend.

While I'm a fan of these moves, I would love to see the cable guys step up their broadband video activities even further. For example, Himesh and I engaged in an interested mini-debate about the definition and value of "exclusive" broadband programming. To me there's an terrific opportunity for cable operators to negotiate and obtain the broadband rights, at least for a defined window, for certain programs exclusively for their Internet subscribers. This would mean their subscribers get video they just can't get elsewhere. (Btw, that's kind of the way the cable TV world used to work until Congress stepped in with the "program access rules" in the '92 Cable Act).

Some kind of exclusive broadband programming would differentiate cable's portals from the Joosts and other next-gen broadband aggregators coming into the market. I think it's inevitable we're going to see some jousting for these kinds of rights, especially as things get more competitive.

Categories: Cable Networks, Cable TV Operators, Partnerships

Topics: Charter, FX, HBO, IFC, Nickelodeon

Posts for 'HBO'

Previous |