-

Cable's Emmy Nominations Illustrate Cord-Cutting's Challenge

Last week when the primetime Emmy award nominees were announced, cable programs turned in another strong performance, garnering 272 of the 487 nominations. The Emmys and other awards illustrate one of the key challenges for would-be cord-cutters: outside of per-program download options (e.g. iTunes) that will persist, in the coming TV Everywhere world, virtually none of cable's award-winning programming will be accessible online unless you subscribe to a cable/satellite/telco service provider. This is a critical fact in understanding how the broadband video world is going to unfold.

One of the reasons TV Everywhere is so compelling is that it offers cable networks an on-ramp to online distribution while preserving their existing - and increasingly valuable - dual revenue (monthly affiliate fees and advertising) business model. As more content executives are concluding that advertising alone will not be sufficient for profitable long-form program distribution online, the payments cable networks receive from cable/satellite/telco providers is more valuable than ever. TV Everywhere's online access will inevitably lead to heavier viewership and enhanced loyalty.

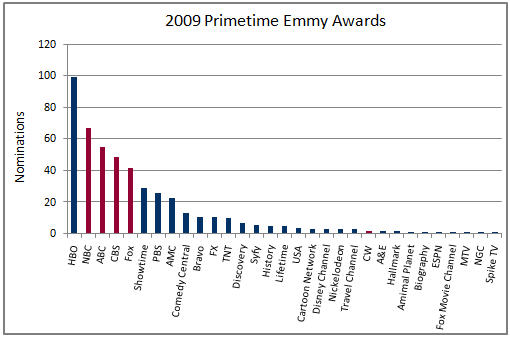

The Emmy nominations show the expanding breadth of cable's quality. As the below chart depicts, this year 26 different cable networks' programs were nominated, with HBO, the perennial leader picking up 99 nominations (it should be noted that last week HBO signed on to Comcast's On Demand Online technical trial, further entrenching HBO in the cable world, therefore dimming the notion that HBO will ever be available outside the traditional premium subscription model).

Cable's strength is even better understood by looking at the major Emmy award categories. For example, in the outstanding drama series category, cable got 5 of 7 nominations (AMC-2, FX, HBO, Showtime). In the outstanding children's program category, cable got all 3 nominations (Disney Channel-2 and Nickelodeon). In the outstanding reality program series category, cable got 5 of 6 nominations (A&E, Bravo, Discovery-2, NGC). Even in outstanding comedy series, cable got 3 of 7 nominations (HBO-2, Showtime).

When TV Everywhere gets fully rolled out, cable networks will have little-to-no incentive to make much of their programming available to non-paying video subscribers. That means that the Hulus of the world will have to content themselves with a catalog of broadcast programs, older movies and made-for-broadband series. As broadcast's Emmy nominations show, that still means there's plenty of popular content to drive online audience. But until Hulu figures out a subscription model, it (and its content suppliers) will be economically disadvantaged to cable both on-air and online. This is no small issue given each TV program episode now costs $2-3 million to produce.

Meanwhile, consumers will make their own video choices. If they choose to cut the cord they won't have subscription-based online access to programs like Entourage, Weeds, MythBusters, Hannah Montana, Mad Men or Dexter, not to mention top-shelf sports from ESPN, TNT and others. For some people eager to cut the cord, that will be just fine. But I'm betting that for the majority of viewers that would be unacceptable and they'll continue to choose to subscribe. TV Everywhere can use cable programs' popularity to blunt cord-cutting before it ever takes off and cement cable's appeal in the broadband era.

What do you think? Post a comment now.

Categories: Broadcasters, Cable Networks, Cable TV Operators

Topics: Comcast, HBO, TV Everywhere

-

VideoNuze Report Podcast #22 - June 26, 2009

Below is the 22nd edition of the VideoNuze Report podcast, for June 26, 2009.

This week Daisy and I discuss the TV Everywhere and OnDemand Online initiative that Comcast and Time Warner unveiled this week. As I wrote in this post on Wednesday, the companies are beginning a trial in July for 5,000 Comcast subscribers, who will gain online access to a selection of TNT and TBS programs. The primary purpose of the trial is to test security of the content. The companies anticipate that other cable networks will join the trial too, and that other video service providers will begin their own trials in the near future.

In the podcast we explore further why granting cable subscribers online access is an important step forward in the evolution of the broadband video medium, and what it means to the overall ecosystem. There are a lot of unknowns about how TV Everywhere/OnDemand Online will work; Time Warner's and Comcast's CEO were candid about that. For now they released a set of "principles" to guide their pursuits. There will be much more to come on this story.

Click here to listen to the podcast (15 minutes, 27 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Cable Networks, Cable TV Operators, Podcasts

Topics: Comcast, Podcast, Time Warner, TV Everywhere

-

4 Industry News Items Worth Noting

Looking back over the past week's news, there are at least 4 industry items worth noting. Here are brief thoughts on each:

Time Warner starts to acknowledge execution realities of "TV Everywhere" - I was intrigued to read this piece in Multichannel News covering comments that Time Warner Cable COO Landel Hobbs made about its TV Everywhere's plans being slowed by "business rules." Though I love TV Everywhere's vision, I've been skeptical of it because it's overly ambitious from technical and business standpoints. This was the first time I've seen anyone from TW begin to acknowledge these realities (though Hobbs insists "the hard part is not the technology"). I fully expect we'll see further tempered comments from TW executives in the months to come as it realizes how hard TV Everywhere is to execute.

VOD and broadband video vie for ad dollars - I've been saying for a while that broadband can be viewed as another video-on-demand platform, which inevitably means that it's in competition with VOD initiatives from cable operators. For both content providers and advertisers, a key driver of their decision to put resources into one or the other of the two platforms is monetization. And with VOD advertising still such a hairball, broadband has gained a decisive advantage. As a result, I wasn't surprised to read in this B&C article that ad professionals are imploring cable operators to get on the stick and improve VOD's ad insertion processes. Cablevision took an important step in this direction, announcing this week 24 hour ad insertion. Still, much more needs to be done if VOD is going to effectively compete with broadband video for ad dollars.Cisco sees an exabyte future - Cisco released an updated version of its "Visual Networking Index" which I most recently wrote about in February. Once again, Cisco sees video as the big driver of IP traffic growth, accounting for 91% of global consumer IP traffic by 2013. The fastest growing category is "Internet video to the TV" (basically the convergence play), while the biggest chunk of video usage will still be "Internet video to the PC" (today's primary model). Speaking to Cisco market intelligence people recently, it's clear that from CEO John Chambers on down, the company believes that video is THE growth engine in the years to come.

iPhone's new video capabilities - Daisy reviews this in her podcast comments today. It's hard to underestimate the impact of the iPhone on the mobile video market, and the forthcoming iPhone 3G S's video capabilities (adaptive live streaming, video capture/edit and direct video downloads for rental or own) mean the iPhone will continue to raise the mobile video bar even as new smartphone competitors emerge. Nielsen has a good profile of iPhone users here. It notes that 37% of iPhone users watch video on their phone, which 6 times more likely than regular mobile subscribers.

Categories: Advertising, Cable TV Operators, Mobile Video, Video On Demand, Worth Noting

Topics: Apple, Cablevision, Cisco, iPhone, Time Warner Cable, TV Everywhere

Posts for 'TV Everywhere'

Previous |