-

Hulu Desktop Induces More Head-Scratching About Role of Screens

Yesterday Hulu announced Hulu Labs - "a place to try out experimental projects from Hulu and share your feedback while they're still in development." Four current projects are listed, "Hulu Desktop," "Video Panel Designer," "Recommendations" and "Time-Based Browsing."

Hulu Desktop, a browser-less app for surfing videos with a Windows Media Center or Apple remote

controls moves Hulu yet another step closer to the proverbial "10 foot" or TV-like experience. Yet as Peter Kafka at AllThingsD rightly notes, Hulu continues to draw a seemingly arbitrary distinction between screens. It's fine with the Hulu folks to use Desktop to watch on a large monitor connected to your computer. But if you want to watch on an actual TV (via Boxeee, for example) that's a no-no.

controls moves Hulu yet another step closer to the proverbial "10 foot" or TV-like experience. Yet as Peter Kafka at AllThingsD rightly notes, Hulu continues to draw a seemingly arbitrary distinction between screens. It's fine with the Hulu folks to use Desktop to watch on a large monitor connected to your computer. But if you want to watch on an actual TV (via Boxeee, for example) that's a no-no. So even as Hulu admiringly pushes the bounds to improve its users' experiences, it is going to continue to find itself in wrapped around the axle trying to explain itself. What would change all this and make Hulu's owners agnostic to whether you watch Hulu's programs on PCs or TVs? Simple: Hulu demonstrating it can generate ad revenue at parity (or better) with traditional on-air delivery. Once it can do that, then these distinctions will melt away. Problem is, despite Jeff Zucker asserting that Hulu is ahead of plan, the reality is that Hulu is nowhere close to achieving parity (nor has it shared a roadmap for doing so).

Until this happens, things like Hulu Desktop are neat, but will only cause more head-scratching among Hulu's tech-savvy early-adopter audiences.

What do you think? Post a comment now.

Categories: Aggregators

Topics: Hulu

-

Common Craft Shows that Video Entrepreneurship is Alive and Well

Far, far from the world of big media, where broadband delivery is causing multi-billion dollar tectonic plate shifts, there is a Seattle-based husband-and-wife team who are demonstrating that video is truly a wide open playing field for entrepreneurs with clever new ideas and the pluck to pursue them. Big media's broadband pursuits provide ample grist for my daily VideoNuze posts, but periodic detours describing entrepreneurial companies like Common Craft show how fundamentally empowering broadband video has become.

I discovered Common Craft last week when I noticed a prompt at the top of Twitter.com for a video explaining "Twitter in Plain English." I clicked and found myself watching a short video with simple paper cutouts acting out how Twitter works, along with a voice-over providing simple but detailed narration. It perfectly explained what Twitter is about in 2 1/2 minutes.

Intrigued, I followed the producer's link to CommonCraft.com and found an entire library of similarly formatted videos, on topics such as technology, society, money and green. I tweeted how cool I thought the videos were and 20 minutes later, Chris Savage at Wistia sent me an email saying he saw my tweet. He said

he knows the Common Craft founders and offered an introduction. Shortly thereafter I found myself talking to Lee LeFever, half of the Common Craft team. (as an aside, talk about the power of Twitter to connect people!).

he knows the Common Craft founders and offered an introduction. Shortly thereafter I found myself talking to Lee LeFever, half of the Common Craft team. (as an aside, talk about the power of Twitter to connect people!).The whole Common Craft story is well-laid out here, but the abbreviated version is that Lee's on-the-job experience prompted him to write blog posts explaining RSS and Wikis in "plain English." On a hunch, he and his wife Sachi turned the RSS post into a short video, sort of stumbling onto the idea of the paper cutouts (which they call "paperworks") and narration. When it was posted in April, 2007, it was promoted on Digg and got tons of views. Next they turned the wikis post into a successful video and Lee discovered his knack for productizing explanation (to date Lee says their videos have racked up 10M+ views and have been translated into 50+ languages).

Given the Common Craft team's lack of video experience, their videos might get thrown into the "user generated" category. But the quality and power of their videos instantly blurs the distinction between what is UGC and what is "premium." Lee explained to me that it was in fact their lack of formal video training that freed them to do things that "professionals' likely wouldn't have done, allowing them to create their own authentic style.

The capper to the Common Craft story is that not only have the LeFevers figured out how to make quality video, they've figured out an effective way to promote and monetize it. Eschewing the custom video path (which they started to gain traction with), they've instead focused on licensing their videos for training and educational purposes. Lee says they're already generating $15K/mo in license fees. The key is still using YouTube and their own site to offer full length free viewing, with prompts to transact. They've also leveraged their reach by creating something called the "Explainer Network" which provides referrals to a handful of custom video companies.

I'm drawn to the Common Craft story because it is a business model completely rooted in the broadband video economy. The LeFevers demonstrate that broadband really does enable "amateurs" to found successful video businesses that in the past would have been prohibitively costly and untenable. I have no doubt we'll see plenty more success stories like Common Craft's in the years to come, as broadband becomes an ever more pervasive part of our economy.

What do you think? Post a comment now.

Categories: Indie Video

Topics: Common Craft, Twitter

-

Watch Liberty's John Malone at the D7 Conference

If you have a spare 10 minutes, have a look at this interview Walt Mossberg did with John Malone yesterday at the D7: All Things Digital conference. Malone, who's now chairman of Liberty Media/Liberty Global, was the head of cable giant TCI for many years. Nobody on planet earth knows more about how the cable TV business works than Malone, and his responses to Mossberg's questions about how premium TV programming will or won't shift to online and a la carte availability are well worth listening to.

Categories: Cable Networks, Cable TV Operators, People

Topics: John Malone, Liberty

-

Ooyala Launches Updated Video Player as It Prepares for Strobe Entry

Today Ooyala is officially releasing its updated video player, named "Swift," with a lighter-weight, more modular design intended to deliver faster loading/playback for users and improved integration of advanced features for its content provider customers. Sean Knapp, one of Ooyala's 3 co-founders, and head of

technology shared more details of the new player with me last week, and also provided a perspective on the coming entry of Adobe's Strobe video player framework, which will undoubtedly impact all of the video player/content management companies.

technology shared more details of the new player with me last week, and also provided a perspective on the coming entry of Adobe's Strobe video player framework, which will undoubtedly impact all of the video player/content management companies.A key focus of the Swift's development has been modularizing its code, so that only what's required for that particular user experience is downloaded to the user. Faster response times and better playback are critical drivers in the user experience, as we've all no doubt endured the wait for a video, only to end up clicking away. It's no surprise that Ooyala - with a cadre of people from Google, where cutting milliseconds from the time to deliver search results is an obsession - should be focusing on response times.

Playback quality is another focus of the new player, with improved bandwidth detection that supports Ooyala's adaptive bit rate ("ABR") or "dynamic video" delivery. ABR/dynamic video has become a competitive battleground lately, with companies like Move Networks (an ABR pioneer), Microsoft, Adobe, Brightcove and others all touting ABR delivery.

ABR delivery detects on a moment-to-moment basis the user's available bandwidth and computer processing capability so that an appropriately encoded video file can be dynamically delivered. Sean said that via an HTTP delivery workaround it created over a year ago, Ooyala has been able to offer ABR in Flash, thereby preceding Flash Media Server 3.5 (FMS 3.5 was released last November as the first Flash server to support dynamic streaming; it has only recently been deployed by CDNs).

Sean explained that the new player's design approach aligns with the coming entry of Adobe's "Strobe" video player framework later this year, which he welcomes. From his perspective, Strobe has the potential to address a lot of the core video functions that Ooyala and other video player companies have had to develop themselves. If successful, Strobe will provide a standardized foundation layer ("getting us out of the muck" as Sean happily said) that would free up Ooyala to focus on supporting higher value components such as advanced monetization (e.g. micro-payments, subscriptions). Ooyala has not yet announced support for Strobe, but it plans to.

This is basically how Adobe itself would like Strobe to be perceived. In a recent conversation with Sumner Paine, Strobe's product manager, he explained to me that Strobe's tools and frameworks are intended to accelerate the development of custom Flash players, to better support content providers' specific objectives (and of course reinforce the Flash value proposition).

Key to Strobe are third party plug-ins from the growing video ecosystem meant to replace the duplicative process of each video player company having to integrate with each third party. Sumner sees video player companies with freed-up resources being able to move up the stack, for example, to provide tighter integrations with customers' content management systems.

Strobe's Q3 entry is going to be another milestone in the ongoing maturation of the broadband video industry. Adobe is trying to create additional industry scalability and drive further customization while defending its turf against Silverlight and other potential entrants. If Strobe is successful, the bevy of video players on the market will need to find new ways to innovate to differentiate themselves, such as Ooyala's trying to do here with Swift. With so many moving parts this is going to be a closely watched space.

What do you think? Post a comment now.

Categories: Technology

-

Video Behavior Changes Suggest "Evolution," Not "Revolution" For Now

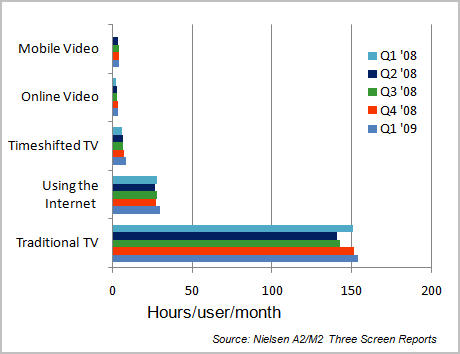

Last week's latest Nielsen A2/M2 Three Screen Report confirmed what I've been saying for a while: when it comes to characterizing changes in consumers' overall video behaviors, "evolution" is a better descriptor than "revolution." To be sure there are certain age segments and behaviors where change is happening very fast. But the overall Nielsen tracking data suggests that until a significant catalyst comes along, major market changes will play out quite gradually.

I've been tracking Nielsen's periodic releases of its Three Screen reports since last year, and the graph below captures the data during this period.

No surprise, time spent watching online video experienced the biggest year-to-year jump (53%) to 3 hours/month. That's solid growth, but even at this rate, it would be a long time before online video viewing takes a significant overall share of the video market. Part of the reason is that time spent on traditional TV just keeps on increasing, nudging up almost 3 hours in the last year to almost 153 1/2 hours/month. That trend has to keep a lot of TV executives smiling.

Still, industry participants have to be watching younger viewers, where adoption of alternate viewing platforms is on the leading edge. For example, 18-34 year olds consume 70% more online video (5 hours, 7 minutes per month) than average, 12-17 years consume 85% more mobile video (6 hours, 30 minutes per month) than average and 25-34 year olds consume 109% more timeshifted TV (12 hours, 12 minutes per month) than average. All of these segments are most coveted by advertisers and their more-rapidly shifting behaviors are clearly (and correctly) driving major media to experiment with new broadband and mobile models.

The "x factor" that would scramble these trends is the introduction of significant market catalyst, like the iPhone, which has ignited mobile video market. In online video viewing specifically, a market catalyst would be a convergence device or enabler that would allow seamless broadband connectivity to TVs. I've talked about this a lot on VideoNuze, and there are many different approaches underway. When one begins experiencing serious adoption, as the iPhone has, I expect Nielsen Three Screen Data will reflect it.

Until then we can expect broadband, mobile and timeshifting to have a significant, yet gradual impact on the overall market.

What do you think? Post a comment now.

Categories:

Topics: Nielsen

-

VideoNuze Report Podcast #17 - May 22, 2009

Below is the 17th edition of the VideoNuze Report podcast, for May 22, 2009.

This week Daisy takes on 2 topics: how book publishers are (finally!) embracing video to promote their authors and titles, and also what NBC's local media division is doing to roll out new web sites to support its ten owned stations. They're adding lots of original content (including from 3rd parties), video, social media features and more community emphasis. No surprise syndication is a real push. Local stations have been really hammered by the recession and also by the shift to broadband distribution, so it's good to see NBC being aggressive.

Separate but related NBC.com is my focus on this week's podcast. Specifically, I add more detail to my post this week about how NBC.com is leveraging its existing online/broadband infrastructure to support its mobile video efforts by using Kiptronic, a mobile video ad insertion company.

Coincidentally, Kiptronic was just acquired by Limelight, further validating that mobile video is a rising priority for many video providers. I've been digging into mobile video and though it's still well behind the broadband adoption curve, the iPhone and other video-ready mobile devices are creating a lot of momentum. (Recall that mobile video taking off was one of my 5 predictions for '09)

For those of you celebrating the long Memorial Day weekend, and the official start of summer, enjoy! I'll see you on Tuesday.

Click here to listen to the podcast (13 minutes, 21 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, CDNs, Deals & Financings, Mobile Video, Podcasts

Topics: Kiptronic, Limelight, NBC.com, Podcast

-

Limelight Acquires Kiptronic; Positions Itself for Mobile Video Growth

This morning Limelight announced it has acquired Kiptronic for cash and stock. Just yesterday I wrote about how Kiptronic is helping NBC.com insert ads into its mobile video streams by plugging into NBC.com's existing work flow and DART ad infrastructure.

While NBC.com is on the leading edge of blending its broadband and mobile video infrastructures, based on my conversations with other video content providers, I suggested this is going to be a significant future

trend. David Hatfield, Limelight's SVP of Products, Marketing and Sales, who I spoke to earlier today about the Kiptronic deal, echoed that sentiment.

trend. David Hatfield, Limelight's SVP of Products, Marketing and Sales, who I spoke to earlier today about the Kiptronic deal, echoed that sentiment. While mobile video is still in the early stages, David said that for "all of its customers, mobile and Internet-connected devices are top-of-mind" and that they are looking to partners like Limelight to cost-effectively address new 3 screen opportunities, as well as challenges like audience fragmentation.

David explained that having worked with Kiptronic for 3+ years, they shared a common vision of the importance of blending broadband/online infrastructure to support the mobile/Internet-connected device world. Both companies also emphasize open video ecosystems, and Limelight intends to continue supporting other CDNs that Kiptronic has been working with. As I said yesterday, the iPhone has been responsible for driving a lot of today's mobile video usage, but with other smartphones and devices coming on strong, mobile viewership is poised to broaden and intensify. With Kiptronic under its tent, Limelight will be better positioned to serve its customers' mobile needs, and augment its core CDN services.

Categories: CDNs, Deals & Financings, Mobile Video

-

Origin Digital's New Business TV Solution is Like Hulu-for-the-Enterprise

Switching gears a bit, lately it has become apparent to me that broadband video is not just proliferating for consumers, it is also beginning to change how businesses communicate with their constituencies. As people spend more of their time watching video at sites like YouTube, Hulu and others, it was probably inevitable that businesses would embrace video as well. This is the context for Origin Digital's new business TV solution, which can be thought of as a "Hulu-for-the-Enterprise" solution. Origin's Darcy Lorincz recently walked me through their strategy and showed me a demo at NAB.

Origin has been managing large scale corporate video events for 10+ years, and was recently acquired by Accenture. With the business TV solution it is leveraging that experience and its relationships to present a one stop solution for companies to communicate their messages. The solution is a hosted white-label video content management system, player, customizable UI/template and social media features, rolled into one. In a sense the business TV solution turns enterprises into video publishers presenting TV-like experiences.

Origin's goals are to help companies improve on how key messages and information are communicated to constituencies and save on face-to-face meetings and travel budget. Darcy explained how Accenture itself has used the business TV solution to build 11 internal "channels." The most active is for human resources, a crucial function in a professional services firm with offices worldwide.

In the HR channel I saw, supporting written materials are still available (with some neat zooming options) and they are arranged alongside relevant videos. Topics include HR policies and procedures, training classes offered, company updates, etc. The business TV solution can also integrate with existing ERP and SAP resources. Other channel examples are executive communications, marketing, sales, investor relations, etc. Users can save specific videos, create playlists, embed, download, share and comment.

Of course, to make use of something like this presupposes that the company has a library of video assets, and/or is ready to commit to shooting ongoing video. Darcy said feedback it has received suggests that a lot of big companies already have lots of video; the problem is there's been no easy way to organize and present it. Further, with the cost of producing high-quality video becoming cheaper and more available through companies like TurnHere and StudioNow, this will become less of any issue over time. Still, it's a paradigm change that will take time to adjust to.

Interestingly, Origin's is just one of many business-focused initiatives hitting my radar. Brightcove told me recently that they've set up a group focused on non-media (i.e. business/government/education) sectors which is getting traction. KickApps has also shared with me they've seen an uptick in corporate communications interest, with an emphasis on social media/interactivity (Alcatel Lucent's Network Cafe is an example). Lastly, a consumer-oriented video platform company recently explained to me confidentially that they're planning a full shift of their model to support business video.

If you happen to be going to next week's All Things D conference, Origin will be demo'ing its business TV solution. If not, there's a pretty good overview video here. Between it and all of these other business-focused initiatives, there could be a lot of Hulu-like activity coming soon.

What do you think? Post a comment now.

Categories: Business Apps

Topics: Accenture, Brightcove, Business TV, KickApps, Origin Digital