-

IAB: CTV to Benefit from Virus Ad Spending Shifts; Upfronts Could be Down by $4 Billion

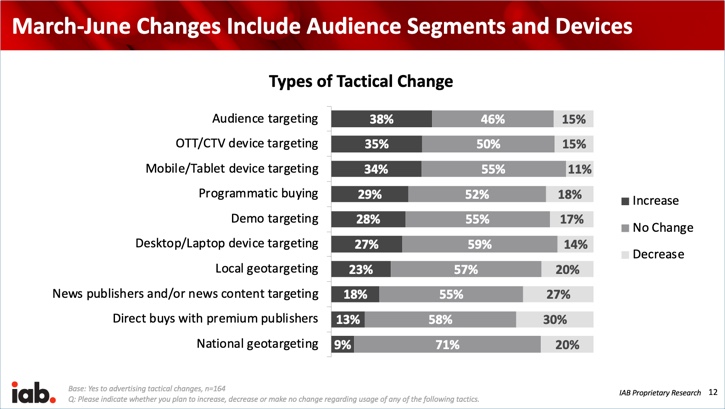

The IAB released new research on Friday afternoon indicating connected TV (CTV) and over-the-top (OTT) video are likely to benefit from ad spending shifts caused by the coronavirus. In a survey of approximately 400 agency and brand decision-makers, 35% of respondents said they anticipate increasing their use of OTT/CTV device targeting, second only to audience targeting (38%), with mobile/tablet (34%) in third place.

Supporting the IAB research, last Friday Beachfront said it has seen a 105% increase in average daily CTV ad requests in March vs. February. Founder Frank Sinton noted that typically only big sports events drive these kinds of bumps in usage. There have been many other reports of surging CTV/OTT usage since stay-at-home guidelines have been implemented.

More broadly, the IAB’s research found the buy side pulling back spending plans in March/April in traditional media (-43%) and digital media (-38%) with a slight improvement in May/June in both (traditional media -35% and digital media -28%). The more positive news is that 67% of respondents said ad spending changes for second half of 2020 are still to be determined. Of the 25% saying they anticipate change in H2 spending due the virus, 75% expect spending to increase in Q3 and 88% expect it to increase in Q4.

Importantly the IAB found that 73% of ad buyers believe the virus will have an impact on their TV upfront ad commitment, with an average 20% reduction. In recent years the upfront has accounted for about $20 billion in commitments across broadcast and cable networks, so a 20% contraction would mean about $4 billion of ad spending moving out of the upfront. That’s no surprise because a key pillar of spending - live sports - is currently suspended and unclear when it will resume.

Of course, then the big question is where does that approximately $4 billion or more go: does it get deferred to the spot market? Get reallocated to AVOD (e.g. YouTube, Roku, Pluto, etc.)? Get saved to help shore up advertisers’ cash positions? Or all of the above?

How quickly the virus is contained, and the economy reopens are the likely the biggest determinants in answering this question.

(Note the IAB and Beachfront data are included in VideoNuze’s Coronavirus Video Research Hub, along with tons of other industry data. Please send me your data and I’ll post it.)Categories: Advertising, Virus

Topics: Beachfront Media, IAB