-

Connected TV Media Buys: Survey Says, "Get Ready"

Wednesday, May 7, 2014, 11:14 PM ETPosted by:Connected TV is still in its adolescence as an advertising channel, but a survey conducted this month by video ad solution provider Mixpo suggests that's all about to change. Mixpo surveyed 130 media buyers and planners and found very strong interest in including connected TV on media plans - and soon. Some are taking action now, trying to get out in front of a rapidly maturing channel.

"Connected TV" (sometimes referred to as "Smart TV") is essentially internet content brought to the "big screen in the living room." The Mixpo survey defined it as programming, including video advertisements, streamed through OTT devices connected to the internet (Roku, Apple TV, Xbox, Amazon Fire).It's still early in the game. There are some compelling reasons why over half of the 130 respondents say that connected TV isn't part of their media plan at present. As one of the 130 respondents put it, "[There is] not a lot of inventory, poor scale."

Other reasons included:

"Not top of mind, nor have we seen data to support the inclusion."

"Haven’t had the client/campaign opportunity yet."

"Simply haven’t considered it yet."

There's strong evidence that the scale and inventory problems will resolve themselves in the very near future. According to recent research by The Diffusion Group, the number of broadband households with at least one connected OTT device in the home reached 63% as of January 2014, up 19% from January of 2013 when there was 53% penetration. Those homes with connected devices own 1.6 of them on average.

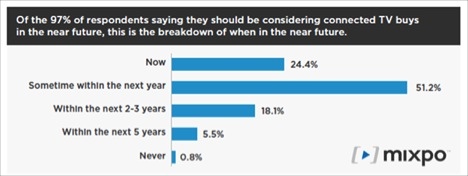

Stats like this paint a pretty clear picture of a channel that will be a big deal. The answer to the "when" question seems to be this year: 97% of the media buyers and planners believe that they should be considering connected TV buys in the near future, and for 75% of those respondents, that means the next 0-12 months.

18% of the respondents actually purchase connected TV inventory today, a relatively high number given the emergent state of the connected TV ad ecosystem. Those who do purchase inventory generally acquire it from networks like YuMe and TubeMogul or directly from content providers, especially Hulu.

Of the survey respondents who don't currently buy connected TV inventory, 65% said they "weren't sure how to go about purchasing," indicating that the education gap is actually bigger than the inventory gap.

According to NPD, "over 200 million connected TVs and attached content devices are expected in U.S. homes by 2015." And while market growth seems virtually assured, there are several hurdles that the industry needs to get over before video advertising on connected TV can hit scale:

1. Lack of integrated inventory: The adoption of connected TV devices is very high but marketers do not have access to this inventory. In most cases opportunities to buy and run creative on the available inventory are highly fragmented.

2. Lack of standards: Connected TV ecosystems don't have strong standards like online video. Existing IAB standards for online video do not perform as-is for the connected TV ecosystem.

3. Fragmentation: Connected TV devices have diverse technical capabilities which make it harder to compare campaign performance across all devices.

4. Limited Analytics: When it comes to analytics, CTV falls somewhere between online video and linear TV, which makes it hard to get consistent data on performance across the ecosystem of platforms.

Video advertising on connected TV will happen, meaning the channel will evolve - quickly -and the sale and purchase of connected TV inventory will fully blossom. All that remains is for the industry and the infrastructure to catch up to the market opportunity, and all evidence suggests that will start to happen sooner than later.Categories: Advertising, Devices

Topics: Mixpo