-

IAB: 59% of Ad Buyers Plan to Spend More on Connected TV in Second Half of 2020

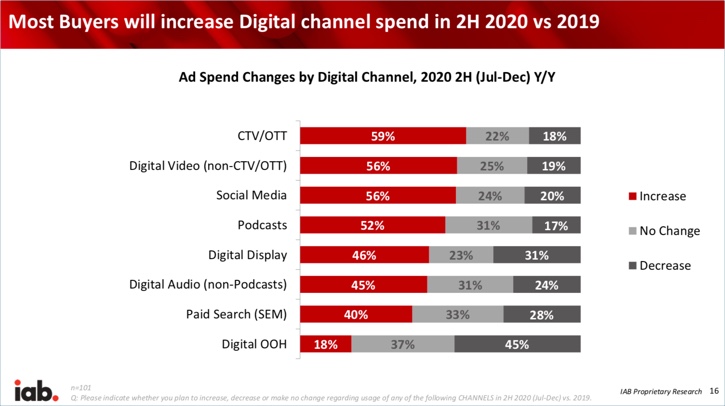

Heading into the NewFronts next week, the IAB has released its third survey of ad buyers since the pandemic began, finding, among other things, that 59% of respondents plan to spend more on Connected TV and OTT in the second half of 2020. Another 22% said they aren’t planning any change and 18% said they plan to decrease spending.

Ad buyers were more bullish on CTV/OTT than any other digital channel though 56% said they plan to spend more on digital video that isn’t on CTV, with 25% saying no change and 19% saying they’ll decrease spending.Respondents said they plan to increase CTV/OTT spending by 25% in Q3 and 27% in Q4. Only Q4 spending on social media (up 32%) was forecast to increase faster.

Interest in CTV/OTT is up considerably compared to the IAB’s prior ad buyer survey, released at the end of March. In that survey, 35% of respondents said they intended to increase their CTV/OTT spending in the remainder of Q1 and for Q2, with 50% planning no change. That survey was fielded just after the pandemic’s initial outbreak.

Since then, with sheltering at home guidelines in place, use of CTV/OTT has surged, with multiple data points pointing to an acceleration in adoption. For example, Leichtman Research Group found that 80% of U.S. TV households now have at least one CTV and the mean ownership in CTV households is over 4 CTVs. LRG estimates over 400 million CTV are deployed in the U.S. alone. The increase in CTVs and a proliferation of ad-supported services helped drive up CTV ad impressions 36% in the last week of May, according to Innovid.

While second half 2020 CTV/OTT ad spending plans are strong, just 22% of survey respondents said they plan to increase spending on linear TV, with 24% planning no change, and 54% planning to decrease. Linear TV spending is forecast to be flat in Q3, and down 6% in Q4. Yesterday GroupM forecast that total TV advertising will drop 7% in 2020.

Overall IAB found that 51% of ad buyers plan to spend less in 2020 than in 2019, with 26% planning to spend more and 23% planning to spend about the same. 49% of buyers are confident or very confident in the stability of their budget for the rest of 2020, which drops to 41% in 2021. 72% completely or partially agree that the 2020 NewFronts are more important to their business than a year ago. 49% would like to see the TV upfront and digital NewFronts merge, mainly for the benefit of cross-screen measurement and consumer insights and trends.

The survey included 148 media planners, media buyers and brands. The full report can be accessed here.Categories: Advertising

Topics: IAB