-

Verizon's Latest Discount Illustrates Why Intel Media Faces a Tough Road Ahead in Pay-TV

Several weeks ago, after watching Intel Media chief Erik Huggers interviewed at the D: Dive Into Media Conference, I expressed skepticism that the company's marketing plan for its forthcoming pay-TV service would work. Huggers explained that Intel would emphasize a breakthrough, high-quality video experience, rather than a "value approach" where consumers could possibly save money by switching to Intel.

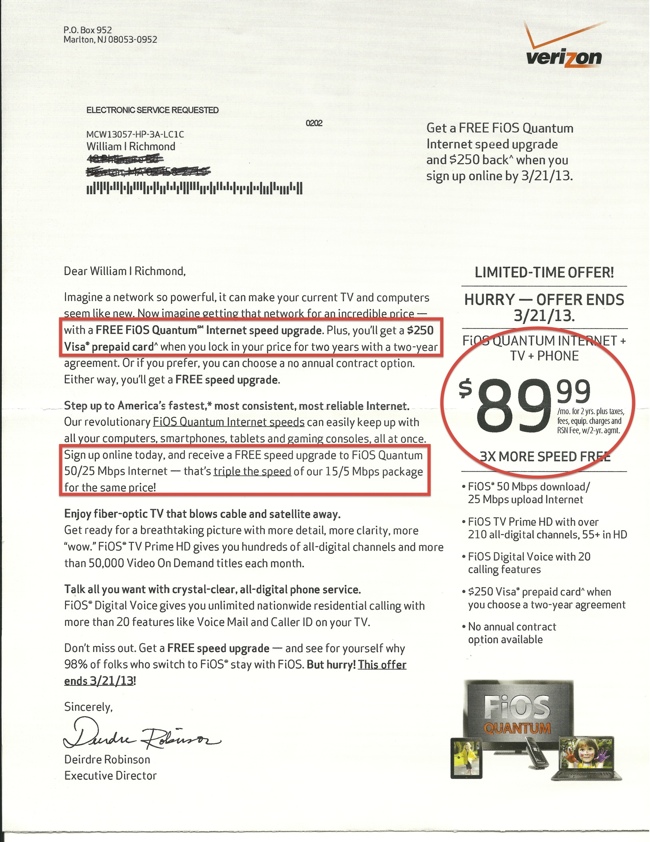

While I agree with Huggers that there's a lot left to be desired in today's pay-TV experience, the reality is that the industry's big players have set the tone for how consumers make their decisions to switch providers: price first, features second. The latest evidence of this was another Verizon mailer that arrived at my house last week (see below), offering a 2-year, $89.99/month bundle of video/broadband/voice and a $250 Visa card. Verizon will also bump the broadband speed to 50/25 mbps as a bonus. Verizon's latest offer one-ups Comcast's current in-market offer to non-subscribers, of $89.99/mo plus $100 Visa card. And so it goes in all U.S. markets where pay-TV competition exits today. With penetration rates above 90% of homes, it's a share-shifting game in which the key players recognize that bargain pricing is both the easiest way to attract the consumer's attention, and likeliest way to get them to act. Look at any other saturated consumer product category (e.g. soda, credit cards, shampoo, etc.) and you'll see the exact same dynamic: price first, features second.

Verizon's latest offer one-ups Comcast's current in-market offer to non-subscribers, of $89.99/mo plus $100 Visa card. And so it goes in all U.S. markets where pay-TV competition exits today. With penetration rates above 90% of homes, it's a share-shifting game in which the key players recognize that bargain pricing is both the easiest way to attract the consumer's attention, and likeliest way to get them to act. Look at any other saturated consumer product category (e.g. soda, credit cards, shampoo, etc.) and you'll see the exact same dynamic: price first, features second.

But from Huggers' remarks, it appears Intel believes it can buck the norm and succeed with a features first, price second approach. Anything is possible, but I think that's extremely unlikely: when consumers have been taught to shop on price, getting them to do otherwise is nearly impossible.

Intel has at least 2 other challenges as well: the main suppliers of TV programming are resistant to real innovation in bundling (see Cablevision's spat with Viacom for more on that), which severely limits Intel's ability to truly present innovative programming packages to viewers. And Intel will also require interested consumers to buy special purpose devices in order to receive the Intel video service. At a time when households are awash in connected gaming consoles, Rokus, Smart TVs, Blu-ray players, etc. Intel's decision to put another adoption barrier in the consumer's way - in order to deliver more features - will be quite burdensome.

Pay-TV is a service crying out for real innovation. While TV Everywhere holds the promise of extending today's pay-TV service to additional devices, it does nothing to innovate the packaging and pricing of the underlying service. I don't expect the industry itself to change that anytime soon. More likely it will be the outsiders delivering low-cost services - whether Netflix, Aereo, Amazon, Redbox, Google or others - that are the candidates disrupting the market. Intel should take note of this and plan accordingly.Categories: Cable TV Operators, Startups, Telcos

Topics: Comcast, Intel Media, Verizon