-

VideoNuze Report Podcast #42 - December 4, 2009

Daisy Whitney and I are pleased to present the 42nd edition of the VideoNuze Report podcast, for December 4, 2009.

Today's sole topic is of course the big news of the week, Comcast's acquisition of NBCU. Daisy and I chat about the winners/losers/unknowns that I detailed in my post yesterday. There are a lot of aspects to the Comcast-NBCU deal and the new entity will have wide-ranging implications for the media industry. Listen in to learn more.

Click here to listen to the podcast (15 minutes, 24 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings, Podcasts

Topics: Comcast, GE, Hulu, NBCU, Podcast

-

Comcast-NBCU: The Winners, Losers and Unknowns

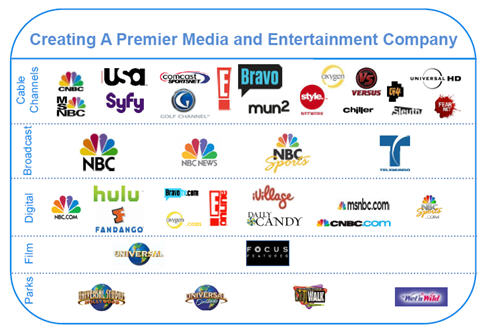

With Comcast's acquisition of NBCU finally official this morning (technically, it's not an acquisition, but rather the creation of a JV in which Comcast holds 51% and GE 49%, until GE inevitably begins unwinding its position), it's time to assess the winners, losers and unknowns from the deal, the biggest the media industry has seen in a long while. I listened to the Comcast investor call this morning with Brian Roberts, Steve Burke and Michael Angelakis and reviewed their presentation.

Here's how my list shakes out, based on current information:

Winners:

1. Comcast - the biggest winner in the deal is Comcast itself, which has pulled off the second most significant media deal of the decade (the first was its acquisition in 2002 of AT&T Broadband, which made Comcast by far the largest cable operator in the U.S.), for a relatively small amount of upfront cash. Comcast has long sought to become a major player in cable networks, but to date has been able to assemble an interesting, but mostly second tier group of networks (only one, E! has distribution to more than 90 million U.S. homes).

The deal moves Comcast into the elite group of top 5 cable channel owners, alongside Disney, Viacom, Time Warner and News Corp, with pro-forma 2010 annual revenues of $18.2 billion and operating cash flow of $3 billion. It also provides Comcast with a huge hedge on its traditional cable/broadband/voice businesses, as the JV, on a pro-forma basis would be 35% of Comcast's overall 2010 revenue of $52.1 billion, though importantly only 18% of its cash flow of $16.5 billion. On the investor call, Roberts emphasized that the deal should not be seen as the company diminishing its enthusiasm for the traditional cable business, but given the downward recent trends in fundamentals (vividly shown in slides from my "Comcast's Digital Transformation Continues" post 3 weeks ago), the conclusion that Comcast will be relying on its content business for future growth is inescapable.

2. Cable networks' paid business model/TV Everywhere - With Comcast's executives' platitudes about cable networks being "the best part of the media business," the fact that cable networks will contribute 80%+ of the JV's cash flow and the ongoing travails of the ad-supported broadcast TV business, the deal puts an exclamation mark on the primacy of the dual-revenue stream cable network model and Comcast's commitment to defending it (see "The Cable Industry Closes Ranks" for more on this.)

The deal can also be seen as cementing the paid business model for online access to cable networks' programs. Comcast is committed to having online distribution of TV programs emulate the cable model, where access is only given to those consumers who pay for a multichannel subscription service. Much as they may resist acknowledging it, Hollywood and the larger creative community must see Comcast as doing them a huge service by preserving the consumer-paid model, helping the video industry avoid the financial fate of newspapers, broadcasters and music. To be sure, some consumers will cut the cord and be satisfied with what they can get for free online, however it is unlikely to be a large number any time soon. As for aspiring over-the-top providers, they'll need to look outside the cable network ecosystem to generate competitive advantage.

3. Jeff Zucker - The current head of NBCU will migrate into the role of CEO of the JV, greatly expanding his portfolio and influence. Zucker has fought the good fight to preserve the NBC network's status, rotating in new creative heads, shifting Leno to primetime, backing Hulu, etc, but the reality, as he pointed out earlier this year, is that NBCU in his mind has long since become a cable programming company. I've been a Zucker fan since seeing him speak at NATPE in '08 when he laid out a sober assessment of the broadcast business. Through solid acquisitions and execution, Zucker has proved himself to be far more than the wonderboy of "Today" - he's going to fit in well at Comcast and be a great addition to its executive team.

Losers:

1. NBC broadcast network and the JV's 10 owned and operated stations - While Comcast executives said they "don't anticipate any need or desire to divest any businesses" and "take seriously their responsibility" to the iconic NBC brand, the reality is that with the broadcast business contributing just 10% of the JV's pro-forma annual cash flow, the network, and especially the stations, are not just in the back seat of the JV, they're in the third row. Though broadcast contributes 38% of the JV's pro-forma revenue and the deal is being struck near the bottom of the advertising recession, it's hard to see things improving much. Exceptions are the sports division (more on that below), the TV production arm and possibly the news division. The only thing saving the stations is retrans and Comcast's need to appease regulators to get the deal done and keep the regulators at bay thereafter.

2. Other cable operators, telcos and satellite operators - It's never good news when one of your main competitors owns the rights to a good chunk of the key ingredients in your product, yet that's the reality for all other cable operators, telcos and satellite operators. Sure Comcast must be disciplined about throwing its weight around too much, but if these distributors cried when NBCU (and other big network owners) forced bundling and drove fee increases, they haven't seen anything until Comcast runs the renewal processes. With 6 channels having 90+ million homes under agreement plus many others in the JV's portfolio, Comcast is in a very strong negotiating position. As the world moves online, the threat that Comcast eventually says to hell with other distributors and goes over the top itself (a scenario I described here), other distributors have even bigger problems ahead.

3. GE - Yes GE gets about $15 billion in cash and a graceful exit from NBCU, but 20 years since incongruously acquiring NBC, the question burns even brighter, what was GE doing in the entertainment business in the first place? Hasta la vista GE, time to focus on manufacturing turbines and unraveling the woes at GE Capital.

Unknowns:

1. Do content and distribution go together any better this time around - With the disastrous results of AOL-Time Warner still fresh in the mind, it's fair to ask whether vertical integration will work any better this time around. Sensitive to the issue and no doubt anticipating questions on it, Roberts said on the call that this is "a different time and a different deal" and, pointing to News Corp-DirecTV, noted that sometimes vertical integration does work. In addition, he highlighted that the deal's financials are not predicated on achieving any elusive synergies. Still, aside from the obvious benefits of getting bigger in cable networks, the primary reasons cited for Comcast pursuing the deal still have synergy at their core: a slide that clearly says that "Distribution Benefits Content" and "Content Benefits Distribution." As always there are plenty of opportunities to pursue in theory; the challenge is executing on them given the rampant conflicts and turf battles that inevitably ensue.

2. Hulu's future - the online aggregator was literally not mentioned once in the Comcast presentation and its logo only appears on just one of the 36 slides in the deck, yet its presence is hard to underestimate. Hulu is the embodiment of the free, ad-supported premium video model that Comcast is so fiercely committed to combating. So how does it fare when one of its controlling partners soon will be Comcast? In response to a question, Steve Burke said he sees "broadcast content going to Hulu" and that "Hulu and TV Everywhere are complementary products." He also tersely dismissed the much-rumored idea of a Hulu subscription offering. It's impossible to know what becomes of Hulu, but with such divergent interests among the owners, it wouldn't surprise me if Hulu is unwound at some point post closing.

3. ESPN's role - With the JV's NBC Sports assets, plus Comcast's Versus, regional sports networks and Golf Channel, the new JV is primed to play a bigger role in national sports. While Fox Sports and TNT have skirmished for high-profile rights deals with ESPN, the new JV has a much stronger hand to play. It's fair to wonder whether Comcast, which likely sends Disney a check for $70-80 million each month to carry ESPN to its 24 million subscribers, won't at some point say, "hey we can do some of this ourselves" and move to become a bona fide ESPN competitor. In fact, ESPN figures into a far larger Comcast vs. Disney story line in the media industry going forward. The two companies are incredibly dependent on each other, and yet are poised to become even tougher rivals. Expect to hear much more about this one.

4. Consumers - last but not least, what does the deal mean for consumers? Likely very little initially, but over time almost certainly an acceleration of digitally-delivered on-demand premium content - but at a price. Comcast has the best delivery infrastructure, with the JV, soon premier content assets and a persistent, if sometimes incomplete (as with VOD, for example) commitment to shape the digital future. I expect that will mean lots of experimentation with windows, multiplatform distribution and co-promotion across brands. Washington will scrutinize the deal thoroughly, but with continued public service assurances from Comcast, will eventually bless it. Then it will be vigilant for anything that smacks of anti-competitiveness. Consumers should buckle up, the next stage of their media experience is about to begin.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings

Topics: Comcast, GE, Hulu, NBCU

Posts for 'GE'

|