-

Food Network is Battling BuzzFeed’s Tasty in Competitive Social Video Space

When Discovery announced that it was acquiring Scripps Networks Interactive earlier this week for $14.6 billion, a lot of the coverage naturally focused on how the combined companies will have more leverage in their pay-TV carriage negotiations and also how significant cost-savings and synergies will result.

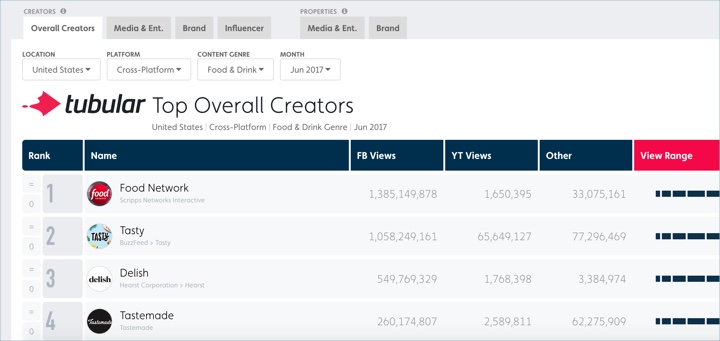

While all of that is true, the inescapable reality is that because pay-TV subscriptions as a whole are shrinking, Discovery’s best case scenario is that it can get a larger piece of a smaller pie. A far more interesting angle, to me at least, is how the company can accelerate its online and social video initiatives. A prime place to start would be by looking at the success that Scripps’ Food Network is having in 2017, as it as slightly surpassed BuzzFeed’s well-publicized Tasty, in the hotly competitive social video food space.According to Tubular Labs, which tracks video consumption across different platforms, Food Network drove approximately 1.4 billion views of its videos across Facebook, YouTube and other social platforms in June, 2017 in the U.S., compared with Tasty’s approximately 1.2 billion. As recently as December, 2016, Tasty was the clear leader, with over 1.3 billion views, dwarfing Food Network’s 595 million. But Food crept up on Tasty in Q1 and by April, it was on top for the first time, with just over a billion social views, compared to Tasty’s 956 million.

The big driver for Food Network is Facebook views, which zoomed from 570 million last December to almost 1.4 million in June, representing almost 98% of its total platform views. Clearly Food Network has mastered how to drive Facebook views in a relatively short period in 2017. Oddly, Food Network has 23.5 million Facebook followers whereas Tasty has nearly 88 million. According to Tubular, Food Network has 4,617 videos on Facebook, with 2.3 million views per video while Tasty has 1,549 videos on Facebook with 21.4 million views per video. (It’s also worth noting that for Q4 ’16 Tasty delivered 85 million Facebook video engagements vs. 33 million for Food Network).

One important area that Food Network still really lags Tasty is in YouTube views. In June Food Network gained just 1.5 million views, as compared with Tasty’s 65.6 million .

While Tasty specializes in the overhead shot format, with text overlays and accelerated play, Food Network’s most popular videos still incorporate traditional, on-air host-driven explanations and multi-angle shots of the food prep (though there are some overhead videos too). Perusing some of Food Network’s videos, they feel far more leisurely than Tasty’s sometimes manic-feeling ones, which likely reflect Tasty’s audience focus which skews younger and is more attention-constrained.

One way or the other, it certainly seems as if Food Network has figured out the formula for success on Facebook, and is using it to battle Tasty, at least in the U.S. (note Tasty has various international versions as well, while Food Network’s social video efforts seem earlier stage). Regardless, as analysts continue to focus more on the Discovery-Scripps deal in traditional pay-TV terms, it’s also worth considering Food Network’s success in social video and how it might be emulated across the combined company.Categories: Cable Networks, Social Media

Topics: BuzzFeed, Food Network, Tasty, Tubular Labs