In London, Dauman Lays Out Viacom Global Strategy

With the U.S. ad market questionable and cord cutting fomenting a Chicken Little attitude toward the future of pay TV revenue, media company execs are seeking comfort in their growing international businesses.

Among the major media companies, Viacom has been most impacted by these trends, because of its young-skewing tech-savvy viewing base and a programming mix that does not include must-have sports.

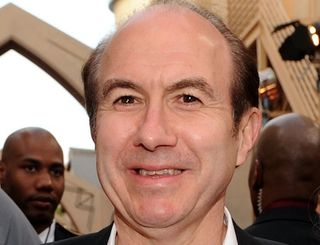

On Wednesday, Viacom CEO Philippe Dauman was in London, where the company expanded its business by buying broadcaster Channel 5. In a speech to the Royal Television Society in Cambridge, Dauman laid out Viacom’s global media strategy.

That strategy has three prongs, Dauman said.

• Continually increase our investment in outstanding creative content -- and deliver it to consumers . . . When they want it . . . wherever they want it;

• Continue to build international scale and capabilities;

• Apply technology-driven innovation to both expand distribution and pioneer new advertising platforms.

Talking about prong three, Dauman noted that Viacom’s programming is already carried by a variety of distributors, from cable and satellite to digital distributors like Netflix, Amazon and Hulu.

“And that doesn’t include short-form content that we provide to digital media apps such as Snapchat, YouTube, Instagram, Vine and others. These partnerships require not only technological sophistication, but also organizational agility and speed,” he said.

“And then there’s the burgeoning mobile market. We were one of the first to sign a programming deal with Verizon, the largest wireless carrier in the states and just last week, we announced the international launch of Viacom Play Plex, a suite of mobile TV apps that will allow our distribution partners in all 180 countries we serve to engage consumers with our content on their smartphones and tablets." Dauman said that on the advertising front, technology and the power of data is revolutionizing how the company interacts with advertisers and connects them with the millennial audiences that flock to Viacom networks like MTV and Comedy Central.

Those audiences are largely unmeasured by traditional rating mechanisms, he said.

Dauman talked about Viacom Vantage, the company’s new ad tool. “By integrating proprietary and third-party data on more than 100 million U.S. individuals, we provide advertisers with a much clearer picture of exactly who they are reaching so they can customize their message to reach that precise audience,” he said. “We also have a number of other innovative ad solution products that fully leverage the 650 million social media fans who follow our portfolio of brands."

Dauman warned that the changes affecting the U.S. market would eventually impact the rest of the world.

“While some of the specific implications may be less relevant here in the U.K.—with its strong public service broadcasting culture—the trend is clear. The revenue models that are being challenged in the U.S. will also come under increasing pressure here as the digital revolution continues to transform viewing habits,” he said.

“It is also clear that the way forward is inevitably up. Audiences the world over are hungry for the high quality content we all produce. Digital technologies provide us—and our advertisers—with a way to connect more immersively and directly with our audiences that is unprecedented and extremely valuable,” he said.

"So, the primary challenge before us—and one that we at Viacom are addressing head on—is to craft new, more accurate methods to measure and monetize that audience engagement with our content…across all platforms,” he said. “It is an issue that we as an industry need to address collectively and—while it may take time—I have every confidence that we will find a solution.”

Dauman on Friday is speaking at Goldman Sachs Communacopia conference. It will be interesting to see if he addresses the same issues with the U.S. investment community.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.