-

Movielink-Target Download Promotion Makes No Sense to Me

Yesterday I received the below email from Movielink promoting a "Steal of a Deal" offer with Target. Here's how it works: I purchase an Ocean's Thirteen DVD at a Target store and I receive a code that then entitles me to download Ocean's Thirteen from Movielink.

Maybe I'm missing something (and please let me know if I am), but this promotion makes no sense to me and instead seems to possibly undermine the value of the Movielink service.

As with all marketing and promotional efforts, the starting point must always be "What's our objective?" So what is Movielink's objective here?

To expose people to the Movielink brand and service? That wouldn't make sense since I only received the email because I was on their email list in the first place.

To demonstrate there's consumer appetite for downloading the same that was just bought on DVD? That seems like a silly and sort of pointless thing to prove in the first place if you believe the ultimate opportunity for digital downloads is to be a DVD substitute, not a compliment.

To expose people to the breadth of Movielink's service? That's worthy, but the offer is limited to downloading the same title that was purchased, so the user isn't incented to browse and see the full breadth of the Movielink catalog.

Maybe there's another objective, but if so I don't see it. Instead I think the campaign ends up detracting from Movielink by confusing the user and not creating any really new distinctive value. Think about it - if you're a consumer that just bought the Ocean's Thirteen DVD, what new value is the download providing you? (Let me know if you can think of anything, I can't)

Movielink could have enhanced this campaign to greater effect in lots of different ways. Ideas: Open the download choice to anything in the catalog. Or make the download easily giftable to a friend to virally increase Movielink's awareness. Or create a rewards-style program that gives DVD purchasers credits toward subsequent downloads. And so on.

I'm not trying to pick on Movielink's marketers, I see this kind of thing all the time. Murky objectives coupled with confusing/underwhelming offers. For broadband video to succeed - either in paid or ad-supported, marketers must be extremely thoughtful and precise about what they're trying to incent their target audiences to do, and how that specific action helps build the business.

Categories: Brand Marketing, Downloads, Partnerships

-

Exclusive Brightcove Update with Jeremy Allaire

Yesterday I did an hour-long briefing with Jeremy Allaire, Brightcove's CEO/founder at their Cambridge offices.

Background

If I were to make a list of the 5 questions I've been asked most frequently over the last two years, "What do you think about Brightcove?" would easily be on the list. Certainly a lot of the attention Brightcove has generated relates to its fund-raising leadership. Through three rounds, the company has raised $82 million, including the monster $59.5 million C round closed in January 2007.

By my count the only pure-play, private broadband video company that has raised more is Hulu, which raised $100M in one round from Providence Equity. But Hulu's probably not a fair comparison given that NBC and News Corp are the company's primary owners and are contributing exclusive content. (btw, if anyone has a different take on who's raised more, please leave a comment)

So this briefing was a great opportunity to get a first-hand update and also channel many of the follow-on questions I've been asked about Brightcove. (Full disclaimer, Brightcove is a VideoNuze sponsor.) Jeremy also shared some new stats with me that haven't been disclosed before.

Positioning

Brightcove's positioning has shifted around in the 18 months since its official launch causing many industry tongues to wag.

Jeremy explained that in the summer of 2007 the company did a candid assessment of its competitive standing across areas in which it was involved. While his original vision included a consumer-facing destination site (named Brightcove TV), this assessment concluded that with YouTube's dominance, Brightcove's goal to be number 1 in that business was unlikely to ever materialize. Further, the potential for conflict with its own media customers had become real. So though Brightcove TV had 8 million unique visitors in August, 2007 according to comScore (making it the number 5 player in that space), Brightcove decided to de-emphasize it and reduce investment spending on it to zero. As a result, Brightcove TV now functions mainly as a showcase site.

The company narrowed its focus to its broadband media publishing and management platform, which Jeremy says is now used by 4,000 professional publishers (sample list here), which Brightcove thinks makes it number 1 among its competitors. These publishers operate 7,000 web sites with an estimated combined reach of 120 million unique visitors per month.

The platform business model includes an annual software licensing fee with upside revenue based on the customers' usage. Jeremy denied that the company is taking ad revenue shares in lieu of platform fees, a rumor that has persistently circulated in the market. Brightcove has also continued to build out a professional support team serving the gamut of design, support, integration and customization required by customers.

Broadband Video Market and Advertising

From Jeremy's vantage point the major media companies Brightcove is serving are aggressively focused on building out their direct-to-consumer broadband video destinations, and only recently have they begun also considering syndication. Brightcove's customers' business models skew overwhelmingly in favor of advertising support, with only negligible interest being shown in Brightcove's commerce capabilities.

On this point Jeremy and I have been in agreement for a long time - the macro factors driving ad-supported broadband businesses are very strong, while those driving paid downloads continue to be challenged. The key catalysts for paid models will be mass connections from broadband to TVs, better portability and improved competitiveness with the DVD platform. In the longer-term all of these will no doubt fall into place, however, for as far as the eye can see, broadband is going to remain an ad-dominated industry.

The follow-up question of course is, what kind of advertising will predominate? Brightcove supports a range of options and Jeremy said that recently interest in overlays is running very high, though 15 second pre and mid-rolls are still used by 99% of its customers today. There's a lot of planning or rolling out of overlays coming shortly by Brightcove customers. People.com was shown as an example of a hybrid pre/mid-roll and overlay model that Jeremy thinks will become more prevalent.

Syndication

Brightcove is also starting to see heightened interest in syndication, and the company offers a set of tools to support it. One example Jeremy showed which I haven't followed is Sony BMG's "MusicBox" service, which offers an array of syndication options. Sony BMG demonstrates that for sites serious about syndication, it's about far more than moving video files around to third parties. Of course the goals of syndication are still to proliferate the content and brand to drive new revenues from far-flung corners of the Internet, but the mechanisms for optimizing this can be quite involved. There's integration of players, advertising, widgets and more. I've been very bullish on syndication for a while, and the actions by Hulu and CBS's Audience Network to distribute their content show real signs of life in the syndication model.

Going Forward

Not surprisingly, Jeremy's extremely bullish on broadband's future growth and sees opportunities galore to grow Brightcove's revenues by deepening its penetration of existing customers, driving more international business, especially in Asia, and expanding its fledgling presence in the enterprise/government sectors, where there's also been a lot of recent interest.

Regarding competition, Jeremy says Brightcove still sees internal development as an alternative being considered by some major media companies, though to a lesser and lesser extent recently. He also volunteered that both Maven and thePlatform are two companies Brightcove sees most often competing for deals. When asked what differentiates Brightcove, Jeremy cites product quality, ease-of-use, customer/market leadership, quality of its people and R&D. On this last point, he believes Brightcove's relatively deep pockets have helped it maintain a far more aggressive R&D budget, which grew by 300% this year.

Key upcoming priorities include launching "Brightcove Show", its new HD initiative, "Aftermix", its mash-up feature, which just finished up its beta test, multimedia capabilities (photos and audio) and enabling a slew of social/sharing features.

I couldn't resist asking Jeremy about Brightcove's last round valuation rumored to be north of $200 million. I've heard much skepticism in the market that the Brightcove's platform-centric strategy does not justify this lofty figure.

Jeremy's response is that based on the company's current revenue and recent growth trajectory, it has "grown into" its valuation and that its multiple is comparable to others he's aware of. His main objective is building a "significant global business" and if that's accomplished then there will be numerous options open for what ultimately happens with the company. He wouldn't comment on M&A, IPO or other potential exits, only saying that he feels no pressure from his investors to liquify their positions any time soon.

To achieve his global ambition, Jeremy says he's focused primarily on what actions Brightcove needs to make to dramatically scale the business, which he thinks can drive a real premium for Brightcove's valuation. To the extent that broadband remains mainly an ad-supported business, I think Jeremy correctly understands that scale - in customers, streams, usage, geographic reach, etc. - are absolutely central to success. When asked the classic "what keeps him up at night?", he cites as his chief source of insomnia the challenge of building out every part of the organization to support his goal of massive scale.

As Brightcove continues to evolve and grow, one thing is for certain - all eyes in the broadband industry will be watching its progress.

Categories: Technology

Topics: Brightcove, CBS, Hulu, Maven, Providence Equity, Sony BMG, thePlatform

-

Broadband Video's Not For Media Companies Only

While the majority of my focus is on media companies' use of broadband video, a presentation by executives of Wachovia Bank last week at the VeriSign customers' meeting served as a reminder that broadband is being used successfully by non-media companies as well.

Wachovia, which is America's third largest bank by deposits, is making strong use of broadband, particularly as an internal communications vehicle, now turning out 800 individual video "programs" per year. These include, "Take 5," a five minute daily broadcast on their internal "V-Net" network, continuous video pumped into all of their branches, customer podcasts and support for live shots of their analysts from Wachovia's trading floors when interviewed on business news broadcasts.

All of this is managed by an impressive staff of 18 full-time staffers, 10 full-time contractors and 20-30 freelancers. They're managing a state-of-the-art digital production facility in Charlotte that is likely comparable to anything found in the broadcast industry. The company has also deployed 80,000 desktops using VeriSign's Kontiki commercial P2P platform, which it says is highly reliable and scalable.

Patty Perkins, a Wachovia VP who's been the key evangelist for video's growth, noted in her presentation that senior executives video consider video a critical mechanism in keeping the bank's far-flung employee base informed and up-to-date. In fact, Patty said that in internal surveys, the Take 5 program is consistently cited as the number 1 driver of employees feeling more connected to the bank and its goals.

Patty and many of the others in Wachovia's enterprise video group are broadcast veterans. This got me to thinking, maybe with there's a new revenue opportunity for broadcast professionals to help enterprises understand how to leverage broadband for internal communications. If Wachovia's any example, there may be a lot of upside.

Categories: Broadcasters, Enterprises

Topics: Wachovia

-

Net Neutrality in 2008? Let's Hope Not.

Network or "net" neutrality, a confusing legislative concept being promoted by large online and content players, may be the hottest broadband video topic in 2008, at least according to Jeff Richards, VP of VeriSign's Digital Content Services, who makes his case at his blog Demand Insights.

I had the pleasure of informally debating net neutrality's merits with Jeff (who's officially neutral on the subject by the way) over cocktails at a VeriSign customer event I just spoke at. Jeff is persuasive about why net neutrality is such a hot button issue, and that its resolution - one way or another - has broad repercussions across the technology, content and Internet industries.

First, a primer for those not familiar with net neutrality. To date the Internet has functioned as a level playing field of sorts. Anyone putting up a web site could be confident in the knowledge that broadband ISPs would neither favor nor disadvantage one player's access to users over another's.

Big online content and technology companies now want to codify this tradition in legislation commonly referred to as net neutrality. Big broadband ISPs (i.e. cable operators and telcos) regard this as needless regulatory meddling, a classic "solution in search of a problem" that would unnecessarily limit their future business dealings and influence their investment decisions.

Interest in net neutrality legislation has waxed and waned, as lobbyists for the pro-net neutrality side (content and technology firms) try to convince legislators that this really is an important issue for constituents and that this isn't just a "rich vs. richer" debate that should be left to the industry's participants to figure out, while anti-net neutrality lobbyists (cable and telco firms) argue the opposite point of view.

So what might precipitate the resurgence of interest in passing net neutrality legislation? In two words, broadband video.

As Jeff points out, the massive adoption of broadband video, which still disproportionately comes from illegal video file-sharing networks, is motivating ISPs to reevaluate current policies. Stoking this reevaluation is the awakening that the really big money is now being made by legitimate companies like Google (current market cap $200+ billion) which ride freely over ISPs' networks. As such, ISPs are wondering whether the balance of economics has gotten out of whack and if they can get a bigger share of the pie.

Some ISPs are now blocking or "shaping" certain types of traffic. The most recent example that came to light was Comcast, who the AP recently found is blocking BitTorrent's traffic in the Bay Area. Comcast's vague response, coupled with ill-thought out earlier remarks from telco executives about their own business intentions, have inflamed conspiracy theorists' worst fears about what kind of world could result absent immediate net neutrality action.

Yet for me, preemptive net neutrality legislation can only be justified if you buy into one or both of the following two assumptions.

First, that any new premium tier of service ISPs may want to sell to certain preferred providers (e.g. Google is search engine of choice, so its results somehow load faster) must, by definition, mean that some other provider is disadvantaged as a result. But this presupposes a zero-sum ISP network, which is not true. To enable a high quality-of-service ("QOS") tier for preferred partners does not technically necessitate a degrading other non-preferred services. Not to mention degrading other services would be a foolish, provocative thing for ISPs to do.

The second assumption is that regardless of whether ISPs create QOS-enabled premium tiers, they cannot be trusted not to block or harmfully shape traffic, whether it's legitimate or not. While there have been random acts of blocking by smaller ISPs, this does not seem to be a rampant problem right now. And it's important to distinguish between blocking legitimate vs. illegitimate traffic. For instance, when Comcast blocks illegitimate P2P file-sharing traffic then to me that's a good thing. It frees up network resources for the rest of us who are paying to use the network for legitimate purposes. I'm not going to cry for some 15 year-old kid who can't speedily download a pirated copy of the latest Hollywood thriller, nor should you.

While the pro-net neutrality folks obviously believe ISPs will be bad actors, to my mind, even if you make the above assumptions, this does not form the basis for preemptive net neutrality action now. Sure it's tempting to believe that cable and telco companies, still with plenty of monopolistic DNA flowing through their corporate veins, would indeed act unfairly, for now it is most appropriate to give them the benefit of the doubt.

Washington's laissez-faire attitude toward Internet regulation has been one of the key reasons for the Internet's continued innovation and growth. Attacking broadband video and the Internet, which are among the last few bastions of economic growth left in America is unwise, particularly given the fact that the "law of unintended consequences" is virtually synonymous with all recent telecommunications regulation. Preemptively impose network neutrality and who knows what the actual result will be.

So for now net neutrality regulation should stay on the backburner. When and if it's appropriate, it can be re-prioritized. Instead, I'd prefer keeping Washington's focus on cleaning up a separate, larger and far more pressing problem caused by another rush to preemptive government action (hint, it starts with an "I" and ends with a "Q").

Categories: Broadband ISPs, P2P, Regulation

Topics: BitTorrent, Comcast, VeriSign

-

Google's Android: Striving for Broadband's Openness

Google's announcement on Monday of its "Android" mobile operating platform is another example of open platforms' appeal and underscores why broadband video has grown so quickly and is so compelling.

For those who missed the news, on Monday Google announced its Android mobile platform and the Open Handset Alliance, with 33 other companies, aiming to accelerate innovation and application development for mobile devices. In essence the goal is to develop a widely-deployed open platform,

comparable to the Internet itself. Mobile video would certainly be a key beneficiary if Android succeeds.

comparable to the Internet itself. Mobile video would certainly be a key beneficiary if Android succeeds.This push to openness in mobile can be seen as an attempt to emulate what's unfolded in the broadband video industry over the last 5 years. The result of broadband's openness has been nothing short of staggering, Whether it's video found at YouTube, iTunes, Hulu, NYTimes.com, MLB.com, Cosmopolitan.com or countless others, the torrent of video that's been unleashed, the shift in consumer behavior that's ensued and the capital that's been invested in this sector are all the direct result of broadband's open pipe.

In fact, as I have said innumerable times, the reason why broadband video delivery is the single most disruptive influence on the traditional video industry is precisely BECAUSE it offers an open platform for producers to send video directly to their target audiences. As such, it eliminates the requirement for video producers to land a deal with a traditional gatekeeper to the home such as a broadcast or cable TV network, or a cable TV, satellite or telco service provider.

In short, the ability for producers to connect directly with their audiences strikes at the heart of the traditional video distribution value chain, threatening a permanent re-ordering of the economics of the video business. It enables all kinds of players who have been shut out of the video game to now jump in.

And while broadband video is admittedly still in its embryonic stage from a revenue standpoint, its long-term appeal portends vulnerability for those who cling too long to the traditional closed, walled-garden model. The Internet has shown us all the power of open over closed models, of interoperability over proprietary approaches, and of often chaotic, but user-centric growth over top-down control.

Broadband's ecosystem is experiencing a rapid "layer-cake" effect where new technologies and applications are being built on top of preceding ones. The result is a vibrant, entrepreneurial culture in the broadband sector. If Android succeeds the same will be true in the mobile video sector as well.

Categories: Mobile Video, Partnerships

Topics: Android, Cosmopolitan, Google, Hulu, iTunes, MLB.com, NYTimes.com, Open Handset Alliance, YouTube

-

HD Broadband Video Rollouts Will Be Driven by Advertising Model Growth and ROI

Last week's unveiling of HDWeb from Akamai (disclaimer: a VideoNuze sponsor), coupled with Limelight's recent announcement of its LimelightHD service offering, further raise the visibility and near-term prospect of higher-quality video streaming.

Underlining this was the impressive array of support in the two press releases from customers willing to be quoted expressing their interest in HD. I read all this as putting to rest any doubts about whether content providers are interested in offering HD. Supporting Akamai's release were MTV, NBA, Gannett, while supporting Limelight's release were Fox

Interactive, Brightcove, Adobe, Silverlight and Rajshri.com (India's #1 broadband portal).

Interactive, Brightcove, Adobe, Silverlight and Rajshri.com (India's #1 broadband portal). Content providers I talk to are enthusiastic about pushing the quality bar, though a key issue is cost of delivery and potential ROI. Obviously to push out HD-quality streams means higher bandwidth and storage needs, the 2 key drivers of CDN charges. To support higher costs, improved revenue potential is required. And this is why HD rollouts are dependent on broadband video advertising prospects.

With ad support the primary business model for broadband video, I think a chicken-and-egg dynamic between ads and HD is going to play out. The better the ad revenue prospects, the more willing content providers will be to invest in HD. This is a reminder of why further maturing of broadband video ad models and supporting technologies are so important. So while the paid download model will also continue to grow, if you really want to get a handle on HD's prospects, keep an eye on the broadband video ad business. Continued traction will govern how much HD we'll all be seeing.

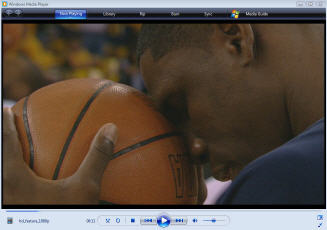

In the mean time, HDWeb from Akamai provides an enticing glimpse of an online HD future. I had no problem accessing its content over my standard Comcast broadband connection. The video quality is unlike anything I've yet seen online. If you get a chance, take a look at the NBA highlights clip (screen shot below). The clarity is mind-boggling.

Can Akamai actually deliver this at scale? At the recent Akamai analyst day I attended, Chief Scientist/co-founder Tom Leighton said their network roadmap is to have 100TB of capacity by 2010, which could theoretically support 50 million concurrent 2MB streams. We're a long way from that usage level, but Akamai seems to be squarely focused on making HD a reality. And they're not alone, along with Limelight there are numerous other HD CDN initiatives underway. All this means that the video quality bar will inevitably rise.

Categories: Advertising, CDNs, HD

Topics: Akamai, HDWeb, Limelight

-

UGC Video Ads Becoming More Viable

Announcements from both ScanScout and Digitalsmiths continue to show that ads against UGC video may become more viable. There has been much skepticism about whether the vast trove of UGC video will be monetizable. Concerns about UGC monetization have been partly behind the recent emphasis by traditionally UGC-centric sites like YouTube, Metacafe, Veoh and others to move up the video quality food chain by offering branded or independent video.

Last week ScanScout announced trademark approval for its "Brand Protector" technology which is aimed at

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

Today Digitalsmiths also introduced "AdIQ", which brings the concept of "conquest ads" to the broadband video advertising world. For those unfamiliar with conquest ads, this is when a brand in the same category as a competitor buys inventory where a competitor is somehow mentioned or identified in the content itself. Here's a pretty good explanation from iMedia.

So for example, say Reebok is mentioned or identified in a video scene and say Nike wants to buy an overlay ad to play at that moment. Conversely, AdIQ allows Nike to ensure that its ad never runs against Reebok (or other competitors') content mentions. This is pretty cool stuff. But how about the media buyer who gets the responsibility to administer all this? I haven't seen the implementation, but I hope Digitalsmiths has made it simple to set up and monitor these campaigns!

Categories: Advertising, Technology, UGC

Topics: Digitalsmiths, ScanScout

-

NFL Demonstrates Syndication is Not Right for Everyone

As many of you know, in general I'm a big-time advocate of syndication as a strategy to permeate broadband video into all the "nooks and crannies" of the Internet. Many content providers have embraced this path, most recently Hulu and CBS (with its Audience Network). The purpose of syndication is to ensure that content reaches users where they currently visit, as opposed to requiring them to come to a new destination. That "destination-centric" approach was of course the way the traditional media industry worked.

But the NFL shows that syndication isn't right for everyone. In instances where there is genuinely unique content, it can make sense to pursue a pure destination strategy.

To illustrate, yesterday I missed part of the Patriots-Colts game. Though I did catch the end, I was eager to see the big plays. During the parts of the game I saw there were several promos for video available at NFL.com. So post-game I started pinging the NFL's site and it turned out that within about 1 1/2 hours of the end of the game, there was a 5:13 edited montage posted. It included most of the big plays and was available exclusively at NFL.com.

The NFL caused a kerfuffle earlier this year when it issued highly restrictive rules governing use of and monetization of its game video. But having had this experience, I think they made the right call. When you have must-see content and own all the rights, I think it is indeed better to pursue a destination strategy. You get all the views. You get all the monetization. You get all the site loyalty and cross-promotion opportunities. You get everyone linking to you. And you have the exclusive archive.

It's rare to own something as valuable as NFL game video. But if your video does have similar attributes, then I would encourage considering destination over syndication. If you go this route though, being highly proactive to serve users' interests, as the NFL is doing, is essential to success.

Categories: Sports