MVPDs Find Margin of Victory in Broadband

Streaming shift could help operators weed out unprofitable video customers

Cable operators should embrace the coming shift from traditional MVPD distribution to streaming for the simple reason that it could help them remove what has been a thorn in their side for years: relatively unprofitable video customers.

While cash-flow margins were once in the 40%-plus range for video service when that was the only product in the cable arsenal, that measure of profitability has slipped to around 30% over the years, while broadband service has margins that hover near 90%.

Video subscribers have wildly different levels of profitability based on their level of service. Though cable operators don’t break out cash flow and margins for video, it is evident that overall cash-flow margins have grown as more and more operators have switched emphasis from video to broadband.

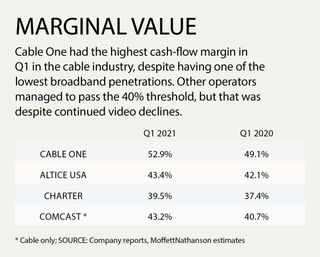

Cable One, the first publicly traded operator to make that shift way back in 2013, today has by far the biggest cash-

flow margins in the business: 52.9% in Q1. That’s nearly 10 percentage points higher than Comcast, which reported a profit margin of 43.2% in Q1 and has more than 75 times the number of video customers (19.4 million, compared to 252,000 for Cable One) and 35 times the broadband subscribers (31 million, compared to 880,000 for Cable One). According to its financial statements, in Q1, 74% of Cable One’s total residential customers didn’t take a video product.

Proof that de-emphasizing video has a margin impact is evident across the board. Comcast has grown its overall margins from 40.3% in Q1 2017 to 43.2% in Q1 2021; Charter Communications grew margins from 35.9% in Q1 2017 to 39.5% in Q1 2021; and Altice USA boosted cash-flow margins from 41% in Q1 2017 to 43.4% in Q1 2021.

Video’s Tough Economics

Cable operators have complained for years that they don’t make enough from video to put up with the hassle from programmers. And though no one has done a truly deep dive into the margin differences between super-premium and bare-bones basic video tiers, it seems pretty logical that the more video a customer buys and the longer they stay, the more profitable they become.

“The reality is that margins are what they are, programming has always been the biggest expense for distributors, impacting the margins,” FBN Securities analyst Robert Routh said. “Obviously, the people that sign up for the minimum, the margin is going to be different than those that sign up for every single channel and every single tier.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

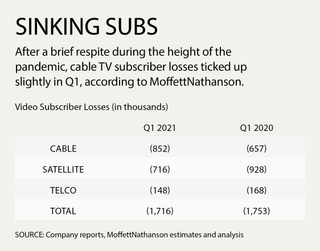

Core pay TV subscribers are continuing to shrink across the board. According to MoffettNathanson, the traditional pay TV industry (cable, satellite and telco TV providers) lost about 1.71 million subscribers in Q1, slightly better than the 1.75 million lost in Q1 2020.

At the J.P. Morgan virtual Technology, Media & Communications conference on May 25, Altice USA CEO Dexter Goei articulated what a lot of operators have been thinking for a long time: If consumers are moving to streaming anyway, embrace the shift and focus on delivering better broadband and participate in the streaming relationship, either via partnerships that allow easier access to streaming apps or helping content providers market, sell or bundle their streaming apps with other products.

“Larger players with a full package of offerings on the direct-to-consumer side are good for our business because it focuses our customers on instead of six, seven or eight different choices, on something a lot smaller that in many respects replaces a video consumer that is less and less valuable to us,” Goei said. “And it allows us to focus primarily on our broadband product, allows us to be a partner for content on a direct-to-consumer basis as opposed to a partner on a linear basis, and I think will dramatically improve the economic trends of our business from a cash-flow standpoint.”

In the meantime, Goei said, operators should focus on profitable video customers — those who buy top-tier premium packages — and place less emphasis on video subscribers who change providers every few years based on price.

“Those are the ones that are shifting toward the direct-to-consumer offerings and that’s good for us,” Goei said. “It’s beneficial to our economics, it makes our priorities very clear in terms of where we focus our capital allocation and our efforts.

“People getting larger on the consolidation front in the media space is good because it will allow our consumers to focus on those [types] of offerings and allows them the alternative outside the fat bundle model for cable, because that business model historically is unsustainable,” he said. “We are continuing to get skinnier and skinnier economics on the video, which also takes a large part of our capital allocation and efforts internally to focus on, and that’s something we’re seeing a shift in, which is good for our business.”

Video profit margins have eroded in the past decade as consumers have increasingly cut the cord and prices for programming have risen steadily. At the same time, operators are increasingly embracing direct-to-consumer packages as a means to provide broadband customers with access to programming without having to deal with the hassles of actual carriage.

Goei pointed out the irony inherent in the streaming video revolution’s potential to boost traditional linear TV profitability. But the idea that direct-to-consumer offerings could play into the prevailing wisdom that distributors should place less emphasis on middle-of-the-road video customers has been around for a while.

More Nets, More Fees

Most analysts agree that the initial impact of the WarnerMedia-Discovery union will be on the traditional linear business. With more networks — the combined company will control about 30 channels, including TNT, TBS, CNN, Food Network, Discovery Channel and HGTV — the new Warner Bros. Discovery could push for much higher-affiliate fees as carriage renewal time approaches. MoffettNathanson media analyst Michael Nathanson has estimated that Discovery accounts for 16% of viewership but just 6% of affiliate revenue. WarnerMedia has fared better, at 12% of viewership and 14% of total fees, according to Nathanson, but together they could attract 29% of viewership and 20% of affiliate fees.

But the analyst also pointed out that Warner Bros. Discovery has a unique set of assets and the largest chunk of national viewing share in the industry. Other programmers aren’t that lucky.

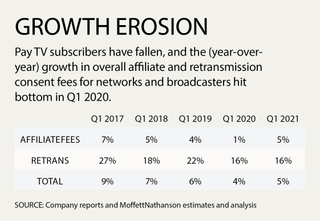

Overall, MoffettNathanson has estimated that increases in cable-network affiliate fees will slow from 18% growth in 2020 to 10% in 2021, 9% in 2022 and 2023 and 8% in 2024 and 2025.

“There are pressures that are building up and down the value chain,” Moffett wrote in a May 27 report on cord-cutting. “Media companies are being forced to respond to shortfalls in their legacy businesses and celebratory valuations of their new ones by shifting content to DTC platforms ever faster. Distributors face renewal negotiations with increasingly weaker networks.”

That changing dynamic was not lost on Goei, who said streaming offerings will play a big role in every linear network carriage negotiation. He added that access to DTC offerings is part of every discussion, and particularly smaller programmers want relationships where distributors will help push the streaming product.

“That becomes one of the front and center discussions in every single one of our renewals,” Goei said. “Either because it’s something we want to do or something they want to do or it’s collectively something we both want to do. I think that’s going to become the norm. It’s part of the package, to the extent that the linear packages are less of a focus, then the direct-to-consumer package becomes more of a focus, and vice versa depending on what side of the aisle you’re on.”

Carriage Changes Coming

Goei added that he expects a big change in the next two to three years in the way distributors and content providers negotiate.

“It’s not sustainable to continue to see price increases every year with viewership falling,” Goei said. “Not only do subscriber counts fall on the video side, but overall viewership and ratings of the content providers fall as well, at least from a linear standpoint. They may be seeing and catching those types of viewerships on the direct-to-consumer offerings they have, but in terms of linear TV watching, that continues to be effective. You can’t fight the trend. You have to accept it and figure out how to adapt from a business model standpoint.”

Mike Farrell is senior content producer, finance for Multichannel News/B+C, covering finance, operations and M&A at cable operators and networks across the industry. He joined Multichannel News in September 1998 and has written about major deals and top players in the business ever since. He also writes the On The Money blog, offering deeper dives into a wide variety of topics including, retransmission consent, regional sports networks,and streaming video. In 2015 he won the Jesse H. Neal Award for Best Profile, an in-depth look at the Syfy Network’s Sharknado franchise and its impact on the industry.