Netflix recently revealed that it has plans to launch in Singapore next year, but already a number of ambitious video streaming services have sprouted up in Southeast Asia — a region that is home to more than 500 million people — aiming to dethrone the U.S. company before it even arrives.

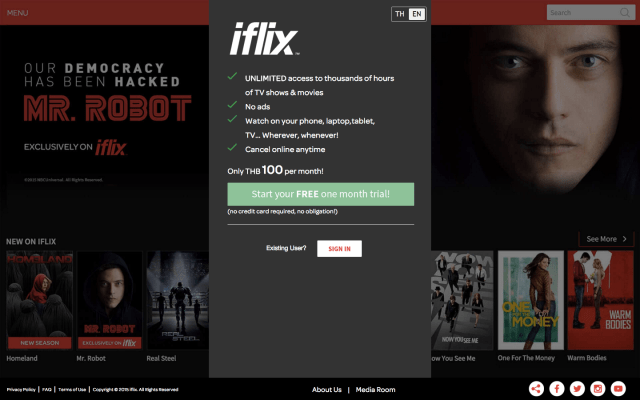

One such upstart is iFlix, a service available in Malaysia, Philippines and Thailand, which is currently talking to investors with a view to raising up to $150 million in fresh funding to fuel a major global expansion. Ambitious indeed.

A pitch deck to investors dated November 2015, obtained by TechCrunch, states that iFlix — which is owned co-founded by Malaysia-based group Catcha Group and raised $30 million in April — is “looking to expand actively into other ASEAN markets as well as specific high-potential areas outside of ASEAN”.

iFlix declined to comment when we contacted it about these plans.

More specifically, the company plans to spend the money expanding its presence in Southeast Asia and moving into new markets in the wider Asian continent, the Middle East, Africa, and CIS (Eastern Europe). Further, iFlix claims it is in “ongoing distribution agreement dialogue” with operators across Asia, the Middle East, and Africa. The company has used telecom partnerships to gain reach in its existing markets, to date, so that would represent a continuation of that strategy.

All in all, it’s a hugely ambitious plan for a service that has only been commercially available for five months.

So how is iFlix, which is chiefly rivaled by Singtel-backed HOOQ, doing so far?

It’s hard to say.

iFlix recently proclaimed that it crossed “one million members” — but TechCrunch understands that by “members” the company is actually referring to activations. I.e. anyone who has ever registered on the service.

That’s a fairly misleading metric given that iFlix — like HOOQ — is offering users month-long free trials of its service before they have to pay. iFlix hasn’t said how many of those million-plus registrations have converted to actual paying users but, given that subscription-based models are still in their early days in Southeast Asia (where people are not used to paying for digital goods), we can imagine that the number is not amazing.

[Update: iFlix doesn’t rely on credit cards to enable paying users. It offers carrier billing for payment, and recently struck a deal with Telecom Malaysia, which is offering iFlix’s service free for a year to its broadband customers. iFlix declined to disclose what happens to these customers once the 12-month deal lapses.)

Some metrics from the deck:

Since its launch in June 2015, iflix has been growing at ~9k user subscriptions per day, surpassing 665k activated accounts as of end-October

Overall average usage of ~1.5 hours / active viewer / day

Over 18k hours of content in each market

(Note, again, that “activated accounts” doesn’t mean paying users since it just counts user registrations.)

Metrics aside, iFlix has some impressive backers.

Catcha is a pretty prolific investor, much like a Southeast Asia-made Rocket Internet. It has a tendency to build companies quickly, trumpeting impressive growth stats to help raise funding — just like iFlix, in this case — and push them to list publicly earlier than most others. Catcha did score a major win last month when News Corp agreed to buy iProperty, one of its portfolio, for $534 million — a record exit for Southeast Asia — and it’ll be interesting to see how that money is used.

Other iFlix backers include U.S.-based Evolution Media Capital, the investment arm of Creative Artists Agency, which co-owns the company alongside Catcha. Both organizations invested in iFlix’s $30 million funding round in addition to PLDT, the Philippines telecom firm that has close ties with Rocket Internet. In addition, PLDT has a $20 million “subscription contract” with iFlix, according to the investor pitch deck.

(The deck also states that iFlix raised a $10 million seed round, which, until now, went unreported in media.)

Raising $150 million — which, it should be pointed out, appears to be the ceiling for this round which could close at a lower number — is no easy task. Rocket Internet’s Southeast Asia-based companies, which are the best-backed in the region, each took years of development until they began swallowing such large funding checks, so it remains to be seen whether iFlix can close such a large and ambitious round.

Yet, the fact that it is trying — while Sony and Warner-backed HOOQ continues to expand its presence in Asia and hire aggressively — shows that Netflix won’t walk into Southeast Asia, and beyond, unopposed. But the bigger question is whether new players, who offer free trials in emerging markets where piracy leads subscriptions, can actually make money beyond simply raising it from investors.

So, sit back, grab your popcorn and prepare for The Streaming War Of 2016: Southeast Asia Edition.