Video demand-side platform (DSP) TubeMogul posted Q3 revenue of $27.4 million, up 112% from $13 million during the same period last year. Total advertiser spend through its platform was $62.5 million, up from $25.7 million last year. TubeMogul stock was up 6% in late trading.

Video demand-side platform (DSP) TubeMogul posted Q3 revenue of $27.4 million, up 112% from $13 million during the same period last year. Total advertiser spend through its platform was $62.5 million, up from $25.7 million last year. TubeMogul stock was up 6% in late trading.

TubeMogul gained considerable business via its self-serve model “Platform Direct” used by brands and agencies. In Q3, 20% of Platform Direct spend came from brands TubeMogul has direct relationships with. This was up 7% YoY, said TubeMogul CEO Brett Wilson and includes tech manufacturer Lenovo and CPG upstart Hello Products.

Despite this trend, many clients aren’t actually bypassing the agency. “More often than not, they have their media agency of record or trading desk execute the buys on their behalf,” Wilson told AdExchanger.

For instance, TubeMogul client Mondelez International, continues to work with the agency MediaVest. Mondelez also entered into a deal with Google earlier in the quarter to enhance its video buys. Though TubeMogul remains its DSP, analysts wondered how this affects TubeMogul’s relationship. “This was a spend commitment Mondelez was making with Google as a publisher,” Wilson said. “We will be the pipes to facilitate any of their publisher buys, including Google.”

TubeMogul’s Platform Direct clients grew from 165 to 308 year-over-year. TubeMogul had stated in its first-ever earnings call last quarter that although a majority of clients’ first use its managed services, Platform Direct is expected to be the real “growth driver” in the business, and at least 25% of self-serve deployments were migrations from managed services.

Wilson did not mince words about competitor BrightRoll (just acquired by Yahoo for $640 million), which began as an ad network and recently rolled out the BrightRoll Exchange (BRX).

“Tod [Sacerdoti, BrightRoll’s founder] built a great company and he should be proud,” Wilson said. “We primarily competed with BrightRoll on Platform Services [since BrightRoll has a video DSP]. To the extent that Yahoo does make more of their inventory available programmatically through BRX, we should be a recipient of that as well. We bid and buy through BRX every day.”

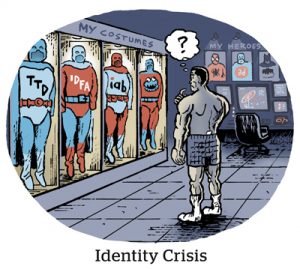

Analysts asked whether Yahoo’s intent to purchase BrightRoll significantly changed the video ads landscape, and Wilson said the deal reaffirms TubeMogul’s focus on brand advertisers over selling media.

“When you have media companies or Internet publishers that also sell ad tech, it’s like using your real estate agent to buy a home who’s also selling that home,” he claimed. “Given Yahoo’s network sales model, they’ll probably focus on the ad network side of BrightRoll’s business. … Yahoo is good at a lot of things, but selling software is probably not one of them. We think it’s a positive trend for us. It reinforces the significance of our positioning. We’re not trying to sell you media and technology.”

BMO Capital Markets equity research analyst Dan Salmon asked about TubeMogul’s recent deal with Comcast publisher video ad server FreeWheel (see AdExchanger exclusive) and whether that indicates TubeMogul’s deeper entrance into the TV space, given FreeWheel’s tight connections to linear TV companies. Wilson said this was translating the concept of “upfront buys” common in the broadcast world to reserved inventory common in digital.

“ABC and Channel 4 were some of the first publishers to go on the record to say they were joining the pilot, and it’s really about bringing benefits of software and digital targeting to advertising in the largest segment – TV,” Wilson said. The effort is early, he added, but will be a key focus.

Analysts were also curious about TubeMogul’s positioning, given the number of video ad acquisitions that occurred since summer alone: Facebook/LiveRail, Ooyala/Videoplaza, RTL Group/SpotXchange and Yahoo/BrightRoll. The acquisitions have not materially impacted TubeMogul, claimed Wilson, who said TubeMogul has a “great relationship” with RTL now via SpotX and Facebook via LiveRail.

“We may see more inventory access over time (as a result of that consolidation,) but from an advertiser’s perspective, there are definitely fewer choices out there on the buy side if you value independence and (agnosticism),” he added.

TubeMogul’s focus moving forward is increasing mobile, which accounted for 9% of total spend in Q3, double its contribution in Q2. TubeMogul’s also expanding its international footprint with the appointment of Mauricio Leon as Commercial Director, Europe. Leon’s background was in agencies, spending time at ZenithOptimedia and Starcom MediaVest. Additionally, TubeMogul snagged Vindico’s Jes Santoro as EVP of enterprise sales.

“We have only hired a single digit number of (salespeople) each quarter, since we primarily look at this as an enterprise sale and it requires someone who is a little more sophisticated and whom you can put in front of a CEO or CFO, VP of media,” Wilson told AdExchanger. He said five new senior Tubemogulers have joined the company from “direct competitors” in the last few months. The company now has 372 employees.