-

May '09 VideoNuze Recap - 3 Key Themes

Following are 3 key themes from VideoNuze in May:

1. Hulu Moves to Center Stage

Already on a roll, Hulu gained lots of mind share in May. After YouTube it is clearly the most-buzzed about video site - not a bad accomplishment for a site that just celebrated its one year anniversary.

The month began with the announcement that Disney would invest in Hulu, at last making available ABC and other programs in Hulu's ever-growing portal. Hulu gained stature during the month as the statistic from comScore released in late April - that Hulu was now the #3 most-popular video site, with 380 million video views in March - was repeatedly recirculated. (Hulu was separately disputing data released from Nielsen showing a far-smaller audience.)

In addition to the Disney content, Hulu also announced its first live event, tonight's concert from the Dave Matthews Band. Capping the month was last week's Hulu Labs announcement, showcasing the desktop app that moves Hulu one step closer to being TV-ready.

Hulu's growth and top-notch user experience continue to set the pace in the online video world. Still, as I noted in my post about the Disney deal, what's still unproven is the Hulu business model and how it plans to navigate the convergence of broadband and TV. The spin coming from its owners is that financial progress is being made, yet Hulu's per program viewed revenues continue to be a fraction of those derived from on-air viewership. Sooner than later, I predict the Hulu growth story is going to start to give way to the Hulu financial story, which may yet include subscriptions.

2. Susan Boyle Shows Power and Conundrum of Viral Video

It was hard to miss the Susan Boyle phenomenon in May. As of last Thursday (before the finale of "Britain's Got Talent" in which she placed second) her original video had generated over 235 million views, according to tracking firm Visible Measures. Ms. Boyle's sensational performance has mainstreamed the term "viral video." The idea that you can become a worldwide personality is truly a broadband-only invention.

Yet 3 1/2 years after SNL's "Lazy Sunday" video became the first bona fide big media YouTube hit (despite NBC's efforts), the process for copyright holders and distributors to monetize these viral wonders remains immature. The NY Times described the interplay over the Boyle viral videos between YouTube, Fremantle, ITV and others, and why those hundreds of millions of views are still under-monetized. But with broadband distribution's increasing importance, this won't last; viral monetization rights are inevitably going to become a key part of the upfront negotiating mix.

3. Mobile video growth

Mobile video continued to get a lot of attention from content providers, service providers and handset makers in May, with initiatives from NBC, NBA, E!, Samsung, Sling, among others (a full listing of mobile video news is here). The mobile video ecosystem is responding to data indicating surging consumer acceptance, primarily driven by the iPhone. In May Nielsen released a report indicating mobile user growth from Feb '07 to Feb '09 was 74%, and that iPhone users are 6 times more likely to consume mobile video. The crush of new smartphones coming in the 2nd half of '09 promises that mobile video usage is going to continue growing rapidly. Limelight's acquisition of mobile ad insertion company Kiptronic is likely the tip of the deal iceberg as companies position themselves for mobile.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Mobile Video, Video Sharing

Topics: Disney, Hulu, iPhone, Kiptronic, Limelight, NBC, YouTube

-

VideoNuze Report Podcast #17 - May 22, 2009

Below is the 17th edition of the VideoNuze Report podcast, for May 22, 2009.

This week Daisy takes on 2 topics: how book publishers are (finally!) embracing video to promote their authors and titles, and also what NBC's local media division is doing to roll out new web sites to support its ten owned stations. They're adding lots of original content (including from 3rd parties), video, social media features and more community emphasis. No surprise syndication is a real push. Local stations have been really hammered by the recession and also by the shift to broadband distribution, so it's good to see NBC being aggressive.

Separate but related NBC.com is my focus on this week's podcast. Specifically, I add more detail to my post this week about how NBC.com is leveraging its existing online/broadband infrastructure to support its mobile video efforts by using Kiptronic, a mobile video ad insertion company.

Coincidentally, Kiptronic was just acquired by Limelight, further validating that mobile video is a rising priority for many video providers. I've been digging into mobile video and though it's still well behind the broadband adoption curve, the iPhone and other video-ready mobile devices are creating a lot of momentum. (Recall that mobile video taking off was one of my 5 predictions for '09)

For those of you celebrating the long Memorial Day weekend, and the official start of summer, enjoy! I'll see you on Tuesday.

Click here to listen to the podcast (13 minutes, 21 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, CDNs, Deals & Financings, Mobile Video, Podcasts

Topics: Kiptronic, Limelight, NBC.com, Podcast

-

Limelight Acquires Kiptronic; Positions Itself for Mobile Video Growth

This morning Limelight announced it has acquired Kiptronic for cash and stock. Just yesterday I wrote about how Kiptronic is helping NBC.com insert ads into its mobile video streams by plugging into NBC.com's existing work flow and DART ad infrastructure.

While NBC.com is on the leading edge of blending its broadband and mobile video infrastructures, based on my conversations with other video content providers, I suggested this is going to be a significant future

trend. David Hatfield, Limelight's SVP of Products, Marketing and Sales, who I spoke to earlier today about the Kiptronic deal, echoed that sentiment.

trend. David Hatfield, Limelight's SVP of Products, Marketing and Sales, who I spoke to earlier today about the Kiptronic deal, echoed that sentiment. While mobile video is still in the early stages, David said that for "all of its customers, mobile and Internet-connected devices are top-of-mind" and that they are looking to partners like Limelight to cost-effectively address new 3 screen opportunities, as well as challenges like audience fragmentation.

David explained that having worked with Kiptronic for 3+ years, they shared a common vision of the importance of blending broadband/online infrastructure to support the mobile/Internet-connected device world. Both companies also emphasize open video ecosystems, and Limelight intends to continue supporting other CDNs that Kiptronic has been working with. As I said yesterday, the iPhone has been responsible for driving a lot of today's mobile video usage, but with other smartphones and devices coming on strong, mobile viewership is poised to broaden and intensify. With Kiptronic under its tent, Limelight will be better positioned to serve its customers' mobile needs, and augment its core CDN services.

Categories: CDNs, Deals & Financings, Mobile Video

-

NBC.com Bolsters Mobile Video Ad Model with Kiptronic's Help

While broadband video consumption continues to surge, mobile video usage is also now showing strong signs of growth, mainly due to the iPhone's popularity. In fact Nielsen just reported last week that iPhone users are 6 times as likely to watch mobile video as are other mobile subscribers. And for Q4 '08, it reported that 11.2M people watched mobile video, with 51% stating they're new to the medium, viewing for less than 6 months. This is still small compared with the 150M or so people (U.S.) watching broadband video each month, but with an onslaught of new or upgraded video-capable smartphones hitting the market, mobile video is poised to grow rapidly.

All of this is very good news for content providers, for whom this "3rd screen" (after TV and PC) opens up all kinds of new opportunities. Many have been participating to date in carrier-provided (e.g. VCast, FLO TV) and other (e.g. MobiTV) subscription services that have achieved solid growth. But with still advertising the primary business model for many content providers, they've been eager make ad-supported video available to growing base of mobile video users as well.

NBC for example has been pursuing ad-supported mobile video, and last summer, made a big mobile push with its Summer Olympics coverage. Still, as Stephen Andrade, NBC.com's SVP and GM and Robert Angelo director web/mobile, told me recently, inserting ads in its mobile-distributed video has been painfully laborious and grossly underoptimized. To address these issues, NBC recently struck a deal with Kiptronic, an ad serving firm that specialized in non web-based content.

Stephen and Robert explained that their overarching goal with NBC.com video is to "publish once, distribute everywhere" - a goal I often hear from other video content providers as well. However mobile-distributed video was siloed and not fully incorporated into its online/broadband work flows. This was especially problematic on the ad side, where mobile inventory wasn't exposed in DART, on which NBC has standardized its ads. As a result a lot of mobile inventory was unsold, and even when it was sold, advertisers were required to jump through a bunch of new hoops to get their ads to NBC, which itself then "hand-stitched" the ads to its mobile-distributed video.

After looking at multiple solutions to address these issues, NBC chose Kiptronic's kipMobile. Stephen and Robert said the key was kipMobile's flexibility in plugging into NBC's existing content management system

and work flow. Now when an NBC producer uploads video, upon preset instructions kipMobile transcodes the HD source file into relevant mobile formats and transfers them to Akamai (NBC's CDN). When a mobile user calls for a video, kipMobile determines which format is best-suited for that particular device, dynamically grabs appropriate ads from DART and combines the two into a file which Akamai then serves to the user.

and work flow. Now when an NBC producer uploads video, upon preset instructions kipMobile transcodes the HD source file into relevant mobile formats and transfers them to Akamai (NBC's CDN). When a mobile user calls for a video, kipMobile determines which format is best-suited for that particular device, dynamically grabs appropriate ads from DART and combines the two into a file which Akamai then serves to the user. Beyond dramatically simplifying NBC's work flow, Stephen and Robert are also excited about the new revenue potential, given NBC's booming mobile usage (Q1 '09 video streams jumped to 9.6M from 2.5M in Q1 '08 with mobile page views increasing from 32M to 96M in the same period). Looking deeper into the usage patterns, NBC sees more than half the mobile video usage occurring at home, as users increasingly look at their mobile device as an alternative screen when the TV isn't available. While 75% of NBC mobile usage is iPhone-based today, they're seeing strong adoption by non iPhone devices. Though still early, geo-identification is creating yet another ad opportunity unique to mobile.

NBC and many other content providers are going to be riding the wave of surging mobile video consumption. kipMobile and other monetization solutions will become increasingly important as these content providers seek to unify their online/broadband and mobile work flows and to fully monetize their views.

What do you think? Post a comment now.(Updated May 21st: Things move fast - Limelight just announced it has acquired Kiptronic.)Categories: Advertising, Broadcasters, Mobile Video, Technology

-

Kiptronic Accelerates Video Ad Insertion with DART and Atlas Integrations

Kiptronic, a dynamic ad insertion service provider for broadband-delivered video and audio has announced integrations with the two dominant ad management systems, DoubleClick's DART for Publisher and Microsoft's Atlas Ad Manager. This allows Kiptronic customers to traffic their ads from within these familiar ad management consoles beyond browser/PC-based environments.

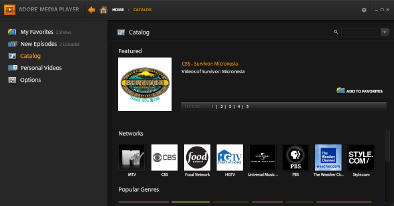

Kiptronic plays an important role delivering ads against video that's increasingly consumed outside the

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam.

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam. While more viewership is obviously a plus for content providers, this new heterogeneity creates headaches for ad operations staff tasked with running the correct ads wherever the video is consumed. Kiptronic's secret sauce is inserting both in-browser and also in these disparate environments after recognizing their specific attributes. I'm only aware of one other company in this space, which is Volo Media, but as I understand it, they only insert in downloaded video.

Last week Bill Loewenthal, Kiptronic's President and CEO, and Jonathan Cobb, the company's founder and CTO briefed me on the new integrations as a follow up to a background call Bill and I had about a month ago. Kiptronic's customers are mainly premium content providers such as divisions of Fox, CBS, Time Warner and Sony BMG who place a high value on control and who have their own sales teams.

Kiptronic's key mantra has been enabling ad insertion to all these new environments without requiring any changes to customers' publishing processes. However, to date Kiptronic had required customers to use its proprietary management tool to insert their ads. For customers who use DART and Atlas, these new integrations now eliminate this step, likely boosting Kiptronic's appeal.

The whole concept of video consumption outside the PC/browser domain is a fascinating topic that content providers need to be mindful of. In the next couple of months Kiptronic is going to make data available showing the breakdown of all the places its ads are served. It's a pretty accurate data set given Kiptronic's role. Bill gave me a preview and it is definitely eye-opening. I'll be sharing the info as soon as it's available.

What do you think? Post a comment.

Categories: Advertising, Technology

Topics: Atlas, DoubleClick, Kiptronic, Microsoft

-

Why Adobe Media Player Could Matter

Yesterday brought the public release of Adobe Media Player 1.0, first announced almost a year ago. AMP enters a very crowded space of other media players including its own Flash player, plus Windows Media Player, RealPlayer, QuickTime, SilverLight and others.

At a time when the broadband video industry in general and mainstream users in particular crave

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:AMP offers 2 things that, in my opinion, the market still needs. First, a widely used downloadable app that specializes in delivering on FREE video content. Before some of you jump up and say, "Will, what about iTunes?" keep in mind that iTunes offers primarily a PAID video catalog (though to be sure there are some free video podcasts). Second, and related, AMP' provides a download environment in which advertising can be properly inserted, measured and reported on.

These are important because together they open up an entirely new consumer use case for broadband video: offline, free, ad-supported viewing. I've been saying for a while that an odd dichotomy has taken root in the broadband industry, particularly for network programs: users can get either free, ad-supported streamed video at lots of places (provided they're online) OR they can get paid, downloaded video (iTunes model) which allows offline viewing. But this has meant that someone who wants to watch a show offline, but isn't willing to pay for the pleasure of doing so is out of luck (one exception is NBC Direct). Having media stored locally in AMP would allow the offline, free use case I'm describing. This would open up a boatload of premium ad inventory that advertisers savor.

If that's AMP's opportunity, then the question is how well are they executing on it? Though it's never fair to judge a version 1.0 on its first day, my experience with AMP shows there's room for improvement. First is the currently thin content selection that needs to be massively built out to be appealing and competitive. Second is an inconsistent user experience in which some shows are downloadable, yet many are not (e.g. CSI, Hawaii Five-O, Melrose Place). Third are getting the basics right. In my case, when I did download some episodes successfully (blip.tv's "DadLabs" and "Goodnight Burbank") they didn't show up in my download section at all. Ugh. I'm hopeful that Adobe will be able to address all of these.

On the ad side, I think there will be plenty of enthusiasm from ad technology firms to integrate with AMP as Adobe proves it can drive millions of AMP downloads (in fact Kiptronic announced its integration yesterday and other will surely follow). Plus, advertisers should be expected to get on board.

It should be noted however, that even for a mighty brand like Adobe, winning the hearts and minds of users to download and use AMP isn't a trivial undertaking. I have some personal experience with this from my early days consulting at Maven Networks, which offered an eerily similar download app as AMP when the company started up. Though that was in the Mesozoic broadband era of 2003 and Maven was an unknown entity, the company never got much traction with its download app and eventually transitioned over to a streaming model. Since then I've come to believe that premium content must drive the download process, not vice-versa. One successful example of this is ABC.com using its shows to drive millions of downloads of the Move Networks player.

Net, net, AMP is a timely product that could well matter. How well Adobe executes on its vision will determine to what extent it does.

Categories: Advertising, Broadcasters, Downloads, Technology

Topics: ABC, Adobe, Adobe Media Player, Kiptronic, Maven Networks

Posts for 'Kiptronic'

|