-

Specific Media Achieves 240% Gain in Reach One Year After BBE Deal

Specific Media, which acquired online video ad network and technology provider BBE one year ago, has since achieved an approximately 240% gain in its video reach, to approximately 80 million viewers in October. Specific, which runs one of the largest display ad networks, has combined both companies' strengths in order to expand its footprint. Matt Wasserlauf, EVP of platforms and services at Specific and formerly head of BBE, explained to me last week that the video ad network has grown significantly by leveraging Specific's thousands of publisher relationships.

in its video reach, to approximately 80 million viewers in October. Specific, which runs one of the largest display ad networks, has combined both companies' strengths in order to expand its footprint. Matt Wasserlauf, EVP of platforms and services at Specific and formerly head of BBE, explained to me last week that the video ad network has grown significantly by leveraging Specific's thousands of publisher relationships.

Categories: Advertising

Topics: BBE, Specific Media

-

Interview With BBE's Matt Wasserlauf On Its Acquisition By Specific Media

Yesterday, BBE, one of the earliest online video ad networks, announced it has been acquired by Specific Media, a large display ad network. I caught up with BBE's CEO and founder Matt Wasserlauf to learn more about the deal. An edited transcript follows.

with BBE's CEO and founder Matt Wasserlauf to learn more about the deal. An edited transcript follows.

VideoNuze: Why did you decide to be acquired now?

Matt Wasserlauf: The market needs some consolidation, there are a lot of companies trying to do similar things and most important customers need a one-stop solution. They need to be able to buy reach against all display - banners, rich media and video.

VideoNuze: Why Specific Media?

MW: They're the leader in targeting and that's where video is going next. We've done a great job delivering reach and brand metrics, but many of our customers are getting savvier about video and are looking to reach specific audiences. The targeting that Specific Media brings to BBE is going to create the leader in video targeting.

Categories: Advertising, Deals & Financings

Topics: BBE, Specific Media

-

VINDICO Gets MRC Accredited

VINDICO, the recently created video ad server division of BBE, is announcing this morning that it has been accredited by the Media Ratings Council (MRC). For those not familiar, the MRC is an independent industry association that works to ensure audience measurement is valid, reliable and effective. VINDICO believes it is the first demand-side video ad server to be accredited by MRC (there may others, I'm not sure; I know that FreeWheel was accredited about 6 months ago).

works to ensure audience measurement is valid, reliable and effective. VINDICO believes it is the first demand-side video ad server to be accredited by MRC (there may others, I'm not sure; I know that FreeWheel was accredited about 6 months ago).

Matt Timothy, VINDICO's president, told me yesterday that the accreditation is a big step forward for both the company, and the online video ad industry. Matt explained that with online video advertising still relatively early-stage, there's been a "Wild West" dynamic with different ad servers and measurement approaches. That friction constrains advertiser spending in the new medium. MRC gives VINDICO new credibility with the agencies and advertisers it serves that the audience data it shares is up to MRC's stringent standards.

With the rise of online video advertising, Matt also sees 2 trends developing: the shift from estimated ad measurement (common in TV advertising) to actual ad measurement and agencies/advertisers taking control of the actual ad delivery process (which in TV advertising is handled by the TV networks and stations). VINDICO is betting on both of these trends; it targets agencies and advertisers with its ad-server technology. Matt pointed to recent wins with VivaKi and Universal McCann as evidence that its approach is working.

What do you think? Post a comment now (no sign-in required).Categories: Advertising, Technology

-

SpotXchange to Partner with Quantcast for Demographic Targeting and GRP Pricing

Performance-based video ad network SpotXchange will announce this week a new partnership with audience profiling firm Quantcast that will allow SpotXchange to offer demographic targeting across its entire network as well as Gross Ratings Points (GRP) based campaigns, the standard for TV media buying. As Bryon Evje,

SpotXchange's EVP told me last week, being able to translate campaigns into a "cost-per-point" model for its clients means SpotXchange will be more appealing to traditional TV media buyers evaluating online video ad opportunities. SpotXchange's goal is of course to lure over ad dollars traditionally spent on TV.

SpotXchange's EVP told me last week, being able to translate campaigns into a "cost-per-point" model for its clients means SpotXchange will be more appealing to traditional TV media buyers evaluating online video ad opportunities. SpotXchange's goal is of course to lure over ad dollars traditionally spent on TV.If a SpotXchange advertiser is also a Quantcast client, then the advertiser will be able to proactively define a specific audience it wants to target and then buy just those ad placements from SpotXchange that fulfill its objective. SpotXchange can use Quantcast's data on particular segments to determine how many GRPs are available, and then by combining its own pricing, can calculate what it would cost a client to reach that audience on a per point basis.

SpotxChange can separately offer demographically-targeted ads by doing a real-time match against Quantcast's data, before an ad is served. If there isn't a targeted user available, then no ad would be served, reducing spending waste and enhancing the overall campaign's ROI.

Quantcast's demographic information is derived by tracking the behaviors of 220 million Internet users across thousands of web sites. I talked briefly with Quantcast's head of business development Winston Crawford who explained that the company's secret sauce is an "inference model" that takes the behavioral data and mathematically translates it into affinity levels.

From this Quantcast is able to build a "lookalike" model which allows advertisers to target those users who have similar affinities (and as a result a higher probably of converting) elsewhere on the web. In the case of SpotXchange, the lookalikes targeted would be users of sites in its publisher network. Quantcast already works with other video ad networks such as Tremor and BBE, along with many display ad networks.

Melding online video ad campaigns with traditional GRP measurement has gained momentum this year, as other video ad networks like Tremor, BBE and YuMe have announced their own initiatives. Combining a GRP approach with demographic targeting offered by firms like Quantcast is further evidence that the online video ad medium is continuing to mature. Despite the news today that CBS Interactive is phasing out its use of third-party ad networks, as video ad networks move to offering campaigns that can be evaluated along traditional TV criteria, this should in turn draw traditional TV ad dollars to online video. That would mean video ad networks' value would increase.

What do you think? Post a comment now.

Categories: Advertising, Analytics

Topics: BBE, Quantcast, SpotXchange, Tremor, YuMe

-

Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks

A monthly reminder that online video remains a work in progress is comScore's viewership data for online video ad networks. Even as someone who follows the industry closely, I find these reports confusing. The press

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service.

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service. comScore's traffic reports are extremely important for the online video industry's growth because they are a key source of data for advertisers, media buyers, agencies and others looking to tap into this new medium. Ad networks in particular are an important part of the online video ecosystem because they provide significant reach, targeting and delivery technology, all of which are required by prospective advertisers.

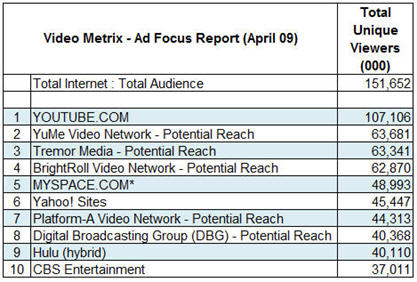

A key part of the current confusion is that each month comScore's Video Metrix Ad Focus report - which details the total audience of unique viewers for online properties and ad networks - combines both the actual audience of destination properties with the potential reach of video ad networks. For example, here's the top 10 for April:

As you can see, 5 of the top 10 listed are ad networks, whose measurement is potential, while the other 5 are actuals. "Potential" is supposed to represent the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However even the validity of this number is amorphous, because networks are only required to provide comScore proof of their relationships if the site accounts for more than 2% of all streaming or web activity.

Recognizing the need to provide more clarity, comScore has recently made available the option for networks to participate in a "hybrid" measurement approach, meant to track networks' actual viewership. To participate, networks need to place a 1x1 pixel, or "beacon" inside any video player where their ads appear. comScore takes the data reported by the beacons and combines it with its 2 million member panel of users whose behavior it tracks. It reconciles differences between the two through a "scaling" process that looks at the intensity of users' non-video behaviors.

To give a sense of the difference between potential and actual, comScore reports BrightRoll - which along with Nabbr are the only video ad networks to have implemented the beacons by April - as having 26M actual viewers vs. the 62M potential reported.

comScore's hybrid approach, which fits with its recently-announced "Media Metrix 360" service, is an important step forward in providing more clarity on how video ad networks are actually performing. Still, as Tania explained, even the hybrid approach has its own idiosyncrasies. For example, some publishers resist having a network's beacon incorporated into their video player, because they want to receive traffic credit themselves. Further, it is a voluntary program. Tania said that in addition to BrightRoll and Nabbr, other networks like BBE, YuMe and Tremor are all working through the implementation currently.

The actual numbers are important for buyers, so that ad networks' viewership can be assessed on an "apple to apples" basis with online properties, as well as non-video options. Tania said that media buyers tell comScore they value both potential and actual numbers. Though that sounds right to me, I think that for the online video medium to mature, buyers are going to put increasing emphasis on actual performance, particularly as it relates to existing media. That's why recent efforts from YuMe and Tremor to translate online video's impact into TV's gross rating points (GRP) paradigm are also important.

In short, comScore seems to be doing its part to improve reporting clarity. However, this isn't going to resolve itself overnight; the market will continue to experience reporting confusion for some time to come.

What do you think? Post a comment now.

Categories: Advertising

Topics: BBE, BrightRoll, comScore, Nabbr, Tremor Media, YuMe

Posts for 'BBE'

|