-

Inside the Netflix-Starz Play Licensing Deal

This past Wednesday, Starz, the Liberty Media-owned premium cable network, licensed its "Starz Play" broadband service to Netflix. The three year deal makes all of Starz's 2,500 movies, TV shows and concerts available to Netflix subscribers using its Watch Instantly streaming video feature. Very coincidentally I happened to be at Starz yesterday for an unrelated Liberty meeting, and had a chance to speak to Starz CEO Bob Clasen, who I've known for a while, to learn more.

On the surface the deal is an eye-opener as it gives a non-cable/telco/satellite operator access to Starz's

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors.

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors. Then there is the value-add/no extra cost nature of Netflix's Watch Instantly feature. That there is no extra charge to subscribers for Starz's premium content (as there typically is when subscribing to Starz through cable for example) raises the question of whether Starz might have given better pricing to Netflix to get this deal done than it has to its other distributors.

But Bob is quick to point out that in reality, the Netflix deal is a continuation of Starz's ongoing push into broadband delivery begun several years ago with its original RealNetworks deal and continued recently with Vongo. To Starz, Netflix is another "affiliate" or distributor, which, given its tiny current online footprint does not pose meaningful competition to incumbent distributors. With only about 17 million out of a total 100 million+ U.S. homes subscribing to Starz, broadband partnerships are seen as a sizable growth opportunity by the company.

Further, Starz has been aggressively pitching online deals to cable operators and telcos for a while now, though only the latter has bit so far (Verizon's FiOS is an announced customer). Cable operators seem interested in the online rights, but have been reluctant to pay extra for them as Starz requires.

Bob also noted that Starz's wholesale pricing was protected in its Netflix deal, and that for obvious reasons of not hurting its own profitability, Starz has strong incentives to preserve incumbent deal terms in all of its new platform deals.

To me, all of this adds up to at least a few things. First is that Netflix must be paying up in a big way to

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.And while I agree that Starz Play on Netflix doesn't represent real competition to cable, telco and satellite outlets today, it's hard not to see it as a signal that traditional distributors are losing their hegemony in premium video distribution. (for another example of this, see Comedy Central's licensing of Daily Show and Colbert to Hulu). As I've said for a while, over the long term, the inevitability of broadband all the way to the TV portends significant disruption to current distribution models. I see Netflix at the forefront of this disruptive process.

What do you think? Post a comment now.

Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Telcos

Topics: CBS, Comedy Central, Disney, Liberty Media, Netflix, Starz, Verizon

-

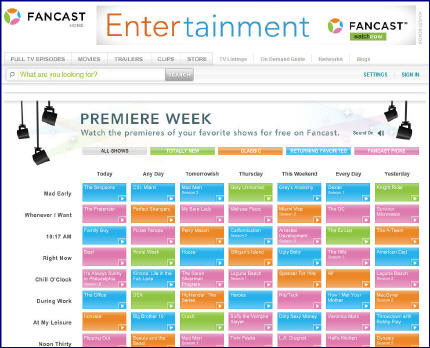

Comcast's Fancast Becomes Hub for Premieres; But Where's Project Infinity?

Here's a clever move from Comcast's Fancast broadband portal to create new value for users and generate excitement in the broadband market: this week it is running "Premiere Week," an aggregation of 168 premiere TV episodes. The episodes span series premieres ("Desperate Housewives," "Dexter," "The Office"), season premieres ("Fringe," "Sons of Anarchy," "Crash") and classic pilots ("Dynasty," "The A-Team," "Miami Vice"). It's great fun and a visitor could get lost on the site for hours, as I nearly did.

These are the kinds of promotions that Comcast should be all over. Given its extensive reach and programming muscle, the company has definite - though not insurmountable - advantages over other aggregators to pull this kind of promotion together.

The competition for aggregating premium programming continues to intensify. Business models are all over the board as are approaches for getting video all the way to the TV. For example, last week Amazon launched its pay-per-use VOD initiative which includes a page of info for how to watch using TiVo, Sony Bravia Internet Video Link, Xbox 360, etc. Then yesterday, Netflix announced that it will incorporate about 2,500 of Starz's movies, TV shows and concerts in its Watch Instantly feature, along with a feed of its linear channel. Still other moves are forthcoming.

Comcast's real lever though is unifying its currently siloed worlds of digital TV, broadband Internet access and Fancast. When converged they're a blockbuster; companies like Netflix, Amazon and others cannot replicate this combination. In particular, Comcast, and other cable operators are ideally positioned to bridge broadband all the way to the TV. That's the last big hurdle to unlock broadband's ultimate value. Whether they'll do so is an open question.

Earlier this year Comcast CEO Brian Roberts unveiled the company's "Project Infinity" which suggested Comcast was looking to unify its various video offerings and bring broadband to its subscribers' TV. It seemed like a promising move, though there was no timeline disclosed. Now, nearly 9 months later I can't find any updates on the status of Project Infinity. It would be great for the company to publicly release a progress report or sense of upcoming milestones.

Promotions like "Premiere Week" are a positive step from Comcast, but real competitive advantage for the company lies in launching services which are truly impossible for others to match.

What do you think? Post a comment.

Categories: Aggregators, Cable TV Operators, Portals

Topics: Amazon, Comcast, Fancast, Netflix, Starz, TiVo

-

May '08 VideoNuze Recap - 3 Key Topics

Looking back over two dozen posts in May and countless industry news items, I have synthesized 3 key topics below. I'll have more on all of these in the coming months.

1. Broadband-delivered movies inch forward - breakthroughs still far out

In May there was incremental progress in the holy grail-like pursuit of broadband-delivered movies. Apple established day-and-date deals with the major studios for iTunes. Netlix and Roku announced a new lightweight box for delivering Netlix's "Watch Now" catalog of 10,000 titles to TVs. Bell Canada launched its Bell Video Store, complete with day-and-date Paramount releases, with others to come soon. And Starz announced a deal with Verizon to market "Starz Play" a newly branded version of its Vongo broadband subscription and video-on-demand service.

Taken together, these deals suggest that studios are warming to the broadband opportunity. This is certainly influenced by slowing DVD sales. Yet as I explained in "iTunes Film Deals Not a Game Changer" and "Online Move Delivery Advances, Big Hurdles Still Loom" broadband movies are still bedeviled by a lack of mass PC-TV connectivity, no real portability, well-defined consumer behavior around DVDs and the studios' well-entrenched, window-driven business model. Despite May's progress, major breakthroughs in the broadband movie business are still way out on the horizon.

2. Broadcast TV networks are embracing broadband delivery - but leading to what?

Unlike the film studios, the broadcast TV networks are plowing headlong into broadband delivery, yet it's not at all clear where this leads. In "Does Broadband Video Help or Hurt Broadcast TV Networks" and "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks?" I laid out an initial analysis about broadband's pluses and minuses for networks. I'll have more on this in the coming weeks, including more in-depth financial analysis.

On the plus side, in "2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow," "Sunday Morning Talk Shows Need Broadband Refresh" and "Today Show Interview with McClellan Showcases Broadband's Power," I illustrated some opportunities broadband is creating. On the other hand, "Bebo Pursues Distinctive Original Programming Model" and "More Questions than Answers at Digital Hollywood" explained how exciting new programming approaches are taking hold, challenging traditional TV production models. Broadcasters are in the eye of the broadband storm.

3. Advertising's evolution fueled by innovation and resources

Last, but hardly least, I continued on one of my favorite topics: the impact broadband video is having on the advertising industry. Over the last 10 years the Internet, with its targetability, interactivity and measurability has caused major shifts in marketers' thinking. With broadband further extending these capabilities to video, the traditional TV ad business is now ripe for budget-shifting. We'll be exploring a lot of this at a panel I'm moderating at Advertising 2.0 this Thursday.

In "Tremor, Adap.tv Introduce New Ad Platforms" and "All Eyes on Cable Industry's 'Project Canoe'" (from Mugs Buckley), key players' innovations were described along with how the cable industry plans to compete. Content providers are being presented with more and more options for monetizing their video, a trend which will only accelerate. Yet as I wrote in "Key Themes from My 2 Panel Discussions Last Week," many issues remain, and with so many content start-ups reliant on ads, there may be some disappointment looming when people realize the ad market is not as mature as they had hoped.

That's it for May. Lots more coming in June. Please stay tuned.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, Devices, Downloads, FIlms, Studios, Video Sharing

Topics: Adap.TV, Apple, Bell Canada, Canoe, iTunes, Netflix, Paramount, Roku, Starz, Tremor, Verizon, Vongo

-

Akimbo, Vongo Expose Risks for Broadband Pioneers

The last few days' news about Akimbo and Starz's Vongo service, two of the earliest players in broadband video delivery, shows how risky the broadband video market can be for pioneers.

Akimbo - which has closed its doors after raising approximately $50 million since 2003 - demonstrates that

misjudging the key characteristics of an early market can be devastating. Akimbo's faulty assumptions included:

misjudging the key characteristics of an early market can be devastating. Akimbo's faulty assumptions included:- Anticipating that consumers would be willing to buy a broadband-only set-top box, despite overwhelming research to the contrary.

- Expecting that consumers would be willing to pay yet another monthly subscription fee, although broadband's value proposition was still in its infancy and consumers were already complaining about the high cost of cable/satellite subscription services.

- Building its initial content strategy using a pure "Long Tail" approach of aggregating lots of niche programmers, not grasping that Long Tail models only succeed when "head" content - in this case from broadcasters and cable networks - is also included.

As these misjudgments became obvious, the box was dropped, select cable programming was added to the content lineup, pricing was changed and management was overhauled. Ultimately in February '08, the whole company strategy was blown up, as Akimbo unsuccessfully tried to get a toehold in the already over-crowded white-label content management/publishing business. But once a startup is in a deep hole, it's almost impossible to climb out.

Meanwhile, Starz's announcement yesterday with Verizon, of its first "wholesale deal" for broadband delivery of its programming, shows additional risks for early players. Yesterday I caught up with Bob Greene, EVP of Advanced Services at Starz, for whom I did some consulting work several years ago on Vongo's predecessor service, Starz Ticket.

Starz launched Vongo in early '06 as a broadband-only subscription and download-to-own service, featuring programming it had under contract, plus other categories it later added. Vongo went to market direct-to-consumer and through device partners like HP, Samsung, Toshiba, Creative and Archos, but Vongo's growth has been modest as the broadband subscription category has yet to really take off.

Starz launched Vongo in early '06 as a broadband-only subscription and download-to-own service, featuring programming it had under contract, plus other categories it later added. Vongo went to market direct-to-consumer and through device partners like HP, Samsung, Toshiba, Creative and Archos, but Vongo's growth has been modest as the broadband subscription category has yet to really take off.Vongo's larger goal was getting deals done with existing service providers like cable, telco, and broadband ISPs. But this aspiration ran into the buzzsaw of incumbents' intransigence, illustrating that reliance on ecosystem partners, who often have divergent motivations, can be very risky. In this case, Vongo's would be distributors perceived Vongo as less as an opportunity to grow the market and tap new consumer behaviors, and more as a potential long-term end-run, with immediate threats to profit margins and cash flow contribution.

Cable operators have been saying "no thanks" to distributing Vongo, concluding it had more downside risk to existing Starz linear subscriptions and Video on Demand than it had upside broadband potential. The Verizon deal may reverse things; Bob says more deals are in the offing. Time will tell. In the meantime, with Vongo's direct marketing efforts set to be further de-emphasized, Starz's broadband fate is falling squarely into the hands of reluctant incumbent service providers.

Akimbo and Starz show that to succeed, it's essential to make correct fundamental assumptions about a market's early growth have a keen understanding of ecosystem partners' motivations and concerns. Missteps on any of these can have disastrous implications.

What do you think the lessons are from Akimbo and Starz's Vongo? Post a comment!

Categories: Cable Networks, Cable TV Operators, Devices, Startups, Telcos

Topics: Akimbo, Starz, Verizon

-

Online Movie Delivery Advances, Big Hurdles Still Loom

Online movie delivery is back in the news, but dramatic change is still well down the road in this space as usability, rights issues and incumbent business models/consumer behaviors pose formidable hurdles.

Yesterday Netflix announced a $99 appliance with Roku, enabling the company's "Watch Instantly" streaming service on TVs. That news follows Apple's deals with a number of big studios in early May obtaining "day-and-date" access to current titles. And today brings news that Bell Canada, that country's largest telco, is formally launching its Bell Video Store, also providing day-and-date delivery, of Paramount titles to start (and soon others), plus portable viewing on Archos devices.

Netflix, which I last wrote about here, took a shot across the bow of Apple TV and Vudu by introducing the

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.However, Watch Instantly has older titles and amounts to less than 10% of Netflix's total catalog. I don't see that changing much; Watch Instantly runs smack into studios' incumbent windowing approach and deals with HBO, Showtime and Starz for premium TV. Netflix's model is built on the home video window, so new online delivery rights must be obtained which will be a tough road. However, with Paramount, MGM, Lionsgate and others splintering from Showtime recently to set up their own premium channel, it's possible that some studios' rights may loosen up, but of course at a price.

Still, I don't see the Netflix/Roku box breaking 10% penetration of Netflix's sub base any time soon, barring a box giveaway. Enlarging the value proposition by licensing the Roku technology for inclusion in other devices (e.g. Blu-ray) could also help drive adoption.

Meanwhile, today Bell Canada is announcing the formal launch of its Bell Video Store. In beta since late '07,

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.By using ExtendMedia's platform, Bell is also enabling downloads-to-own directly to Archos portable devices. With a couple million satellite homes and fiber IPTV fiber-based deployments continuing, there are multiple three screen options looming for Bell. Yet for now these are limited. Michael confirmed Bell has no plans to offer a branded movie appliance a la Netflix/Roku, meaning it will dependent on XBoxes and other PC-TV bridge devices.

Renewed progress and experimentation are welcome in this space, but lots of hard work remains for online movie delivery to become mainstream.

What do you think of the online movie delivery space? Post a comment now!

Categories: Aggregators, Cable Networks, Devices, Downloads, FIlms, Studios

Topics: Apple, Bell Canada, HBO, Netflix, Paramount, Roku, Showtime, Starz, VUDU

-

HBO Wakes Up to Broadband

HBO's deal with Apple to include its programs in the iTunes store has received widespread coverage in the last couple of days, particularly because it includes differentiated pricing for the first time.

Indeed, while it's a big story that Apple's Steve Jobs has finally consented to deviate from his "one price for all" approach - which NBC couldn't attain last fall - there is another angle on this announcement: the possibility that, at long last, HBO has woken up to broadband video's potential.

HBO's absence from the broadband scene has been noticeable. As the most profitable and acclaimed TV

network, I've long thought that HBO had significant upside in pursuing broadband initiatives. Instead it has badly lagged Showtime and Starz, its two principal rivals in the premium network space, as well as other networks.

network, I've long thought that HBO had significant upside in pursuing broadband initiatives. Instead it has badly lagged Showtime and Starz, its two principal rivals in the premium network space, as well as other networks. Showtime in particular has been quite innovative in both creating broadband-only extras for its programs, plus enticing user-involvement opportunities. For its part, Starz has been aggressive in pursuing Vongo, its broadband-subscription service, which continues to make inroads with numerous device partnerships.

Yet HBO has seemed contentedly disinterested in broadband. Between its hefty subscription fees and healthy DVD business, broadband has likely been seen as just a gnat buzzing about. HBO's lack of broadband interest is evident on its web site which has just a smattering of video clips and highlights, and it is fairly static, with little-to-nothing enticing for the broadband user.

In reality, broadband could have likely been adding real value to HBO's business. With the proper incentives, HBO's creative production partners could have easily come up with broadband extras that would have appealed to the diehard fans of its programs. In addition to their sheer programming value, these would have helped drive more fan loyalty and stickiness between seasons. That would help address HBO's churn rate during its off-season periods.

While HBO's iTunes relationship is a step forward, it's a small one. Contrast its approach to soon-to-be-corporate-sibling Bebo's programming model (which I wrote about yesterday), with its intense focus on community engagement and the different philosophies are evident. Of course HBO is a programming powerhouse and there's no arguing with its success. But for it to fully embrace broadband's opportunities, it would benefit from looking at what Bebo and others are currently doing.

Categories: Aggregators, Cable Networks, Indie Video, Video Sharing

Topics: Apple, HBO, iTunes, Showtime, Starz, Vongo

-

HBO, Showtime, Starz: 3 Different Broadband Strategies

The unveiling of HBO's broadband video strategy provides fresh evidence that the 3 major premium cable channels - HBO, Showtime and Starz - are pursuing 3 very different paths in navigating the broadband world.

These 3 channels have traditionally been tight-knit partners with cable operators who leveraged these channels' brands and programming relentlessly in marketing campaigns to gain new revenues and subscribers. But operators' high margin digital services (e.g broadband access, phone, HD, VOD DVR) have lately become the primary focus of cable marketers' finite promotional power. Somewhat mitigating this shift has been powerful original programming, especially from HBO (The Sopranos, Sex and the City, etc.) that has often made these "must have" channels for audiences, helping build powerful consumer brands in the process.

Broadband delivery further scrambles the relationship between these 3 premium channels and their cable operator brethren. For the first time, the premium channels can promote their services, and even deliver them directly to consumers, all without cable operators' involvement. This newfound flexibility has led to 3 very different strategies that I would categorize as "Be bold" (Starz), "Be incremental" (Showtime) and "Be aligned" (HBO).

"Be bold" - Starz has pursued the boldest broadband strategy, launching Vongo, a pure broadband-delivered subscription service several years ago. Starz has invested heavily in making Vongo a top-notch user experience, including hundreds of hours of additional content specifically for the service. Starz has marketed Vongo

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.Starz has sought cable operator partnerships as well, I believe correctly arguing that Vongo can be priced and packaged in a way that provides new value for subscribers as well as cable operators. These efforts have been stymied to date as reluctant operators perceive Vongo as possibly opening the door for Starz and others to gain direct access to subscribers, while also creating possible confusion around operators' budding VOD services.

"Be incremental" - Showtime has focused its broadband efforts on new revenue opportunities such as selling episodes through aggregators like iTunes, and also offering innovative new programming and features that capitalize on broadband's ability to directly interface with audiences. Two perfect examples of the latter are the "Dexter" parallel webisode series and season finale producers' video I have previously written about.

Showtime's goal is to create valuable exposure for its programming to non-subscribers on the bet that actual sampling is the best way to drive new subscriptions (in the past sampling was limited to cable operators' offering "preview weekends"). Showtime's "be incremental" approach studiously avoids creating conflicts with its cable operator partners, while not limiting the network's ability to harness broadband's potential.

"Be aligned" - HBO's belated entry into the broadband world is intended to support its cable partners by offering access to HBO Broadband to only those viewers who are both existing HBO subscribers AND cable broadband subscribers. This "value add" positioning is comparable in some ways to Netflix's "Watch Instantly" approach. They are both focused on giving existing subscribers more, not creating a distinct

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners.

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners. Three premium channels, three distinct broadband strategies. Further evidence that we currently live in a world of vast experimentation, with market participants focused on different goals and different ways of achieving them. I expect plenty more of this to come, as all players gather data about what works and what doesn't.

What do you think? Post a comment and let us all know!

Categories: Aggregators, Cable Networks, Cable TV Operators

Topics: HBO, Showtime, Starz, Vongo

Posts for 'Starz'

Previous |