-

Netflix To Lose U.S. Subscribers in Q3, First Loss In Over 4 Years

Netflix revised its guidance for Q3 this morning, now forecasting that it will end the quarter with 24 million U.S. subscribers. That's 1 million less than the 25 million it previously forecast as the mid-point for Q3 subscribers (despite the loss, Netflix is maintaining its financial guidance for the quarter). Since Netflix ended Q2 with 24.59 million U.S. subscribers, it is now expecting to lose 590K subscribers in Q3, the first time the company has contracted since Q2 '07 when it lost 55K subscribers.

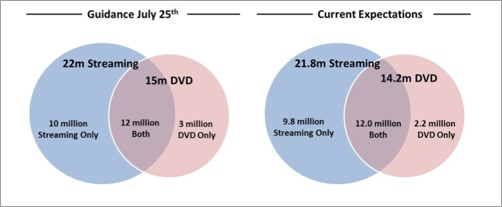

The expected Q3 loss brings to a screeching halt the torrid growth Netflix experienced over the 6 most recent quarters, when it doubled in size, adding over 12 million subscribers in the U.S. The Q3 reversal can be traced to the controversial decision Netflix ham-handedly announced in July to split its DVD and streaming businesses, therefore resulting in steep monthly price increases for a large number of its existing subscribers. As seen in the chart below that Netflix released this morning, the primary driver of the 1 million downward revision from July 25th is on the DVD-only side, which is now forecast at 2.2 million subscribers vs. the 3 million expected. The 200K balance is from streaming-only subscribers. This split is a good news-bad news story for Netflix.

On the one hand, the good news here is that Netflix, which is proactively trying to evolve itself into a streaming company, has been able to keep pretty close to its streaming forecast for Q3. A miss of 200K is only 2% off the 10 million streaming subscribers it expected at the end of Q3. It should be noted however, that the Q3 forecast anticipated virtually no net U.S. subscriber growth. Assuming, as I did in my Q3 analysis, that gross subscriber additions would stay on track, that meant that churn would jump by 2.5-3 million subscribers in Q3. However, since Netflix will only disclose gross additions when it reports Q3 results in a few weeks, it's unclear whether today's revision represents lower additions, even higher than expected churn, or both.

The DVD-only subscriber collapse isn't that surprising in the context of Netflix's near-total focus on streaming. With the pricing change Netflix also reorganized itself to make the DVD side almost feel like a standalone division. However, it's not clear what marketing muscle is being put behind DVDs; a quick visit to Netflix.com shows an emphasis on streaming only (Netflix said in Q2 that 75% of additions were streaming only). Given the tough choices many Netflix subscribers faced with the price increase, many of them who didn't want to accept paying more opted for streaming-only over DVD.

And that leads to the biggest concern of the Q3 revision - having diminished DVDs' role, Netflix has staked its future firmly to streaming, thereby throwing itself into a far more competitive, and dynamic landscape. Consumers will evaluate Netflix's streaming content more carefully against other choices from Hulu, Amazon, iTunes, pay-TV operators' VOD and TV Everywhere offerings and free online choices like network web sites/apps, YouTube, web-only content and others. Things could get even tougher for Netflix if Hulu ends up with Google, which could wage a fierce battle of attrition against Netflix, or even Amazon, which might look to give Hulu content away to support its forthcoming Kindle tablet.

As if that wasn't enough to worry about, Netflix will lose its marquee movies from Disney, when Netflix's Starz deal expires in February (the Sony movies were already pulled). Although there's always the chance that negotiations could be revived, as I explained recently, it would almost certainly require Netflix to create a premium tier, thereby breaking its "all-inclusive" pricing approach. Licensing new, high-value content has never been more challenging for Netflix in the U.S. - between pay-TV operators flexing their muscles with TV Everywhere and retransmission consent riches restricting experimentation, there's less good stuff to be had, regardless of Netflix's willingness to pay.

As I've suggested previously, all of this means Netflix is heading into a period of huge uncertainty. It's still a mystery to me why the company felt compelled to split its services and hike prices so quickly given the clear benefits of the DVD plus streaming value proposition that nobody else could offer. Even more puzzling was that the price increase offered zero new value as an offset. For 2 years, no company has epitomized the potential disruption of the video industry more than Netflix. Now the tide has turned and Netflix must confront its own challenges.Categories: Aggregators

Topics: Netflix